St. Louis Fed member Bullard said over the weekend that he favors extending the Fed’s program of purchasing mortgage-backed securities beyond the 1st Q next year.

This adds many more months to the low rates for an ‘extended period of time.’ His comments have pummeled the US Greenback, and as the dollar fell, stock futures soared. Gold hit fresh record highs.

>

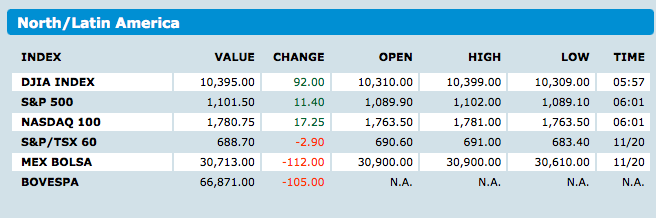

Source: Bloomberg

>

Source: The Chart Store

What's been said:

Discussions found on the web: