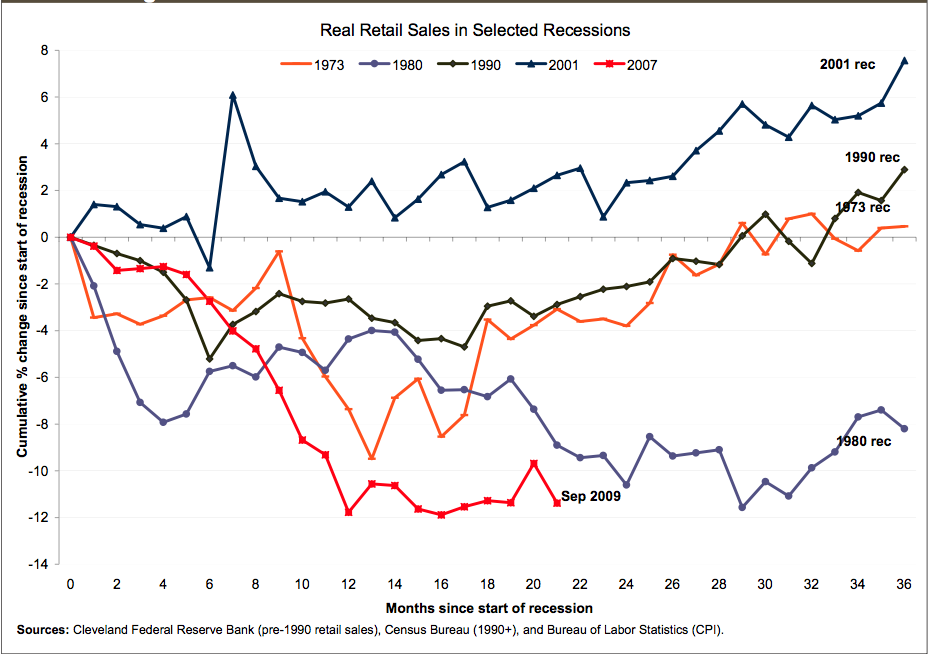

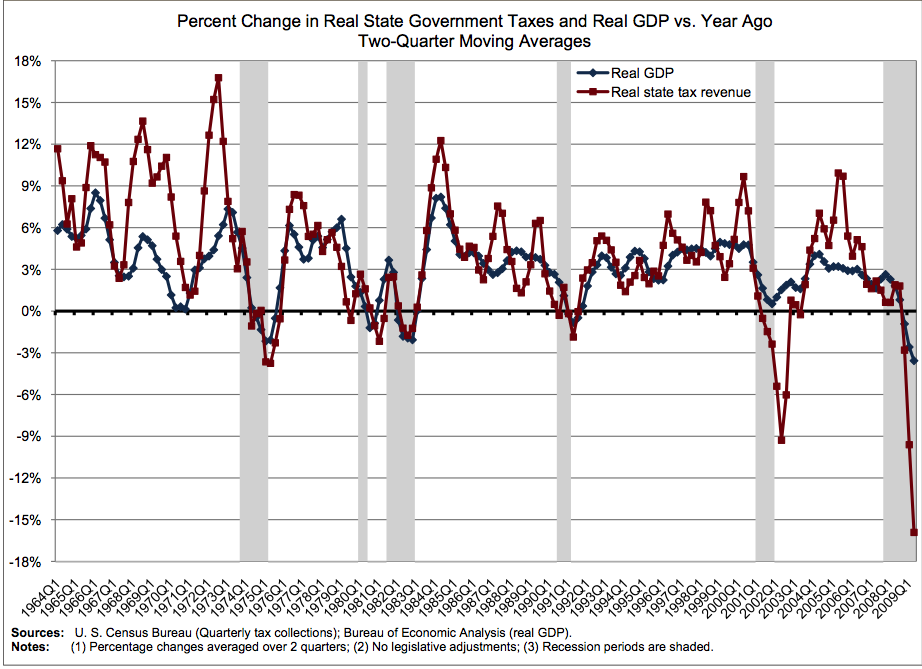

One last pair of charts, showing the impact of recessions on tax data, via the Rockefeller Institute of Government. These two shows the impact of recessions on general tax receipts, and on retail sales.

In both charts, the current contraction is the worst on record for the time periods (1973, 1964 forward)

>

Retail Sales: 5 Recessions

State Tax Revenues (1964- 2009)

>

Source:

State Tax Revenues Show Record Drop, For Second Consecutive Quarter

Lucy Dadayan and Donald J. Boyd

The Nelson A. Rockefeller Institute of Government

http://www.rockinst.org/pdf/government_finance/state_revenue_report/2009-10-15-SRR_77.pdf

What's been said:

Discussions found on the web: