Existing-home sales gained in October on a monthly basis as prices fell and cheaper homes predominated sales. Elevated inventory levels also declined.

Existing-home sales gained 10.1%, reflecting in large part an outsized seasonal adjustment. Sales were 23.5% above the 4.94 million-unit level in October 2008, when the collapse of Fannie, Lehman, AIG, Bank of America and Citigroup had paralyzed the nation.

Median existing-home price was $173,100 in October, down 7.1% from October 2008.

The biggest gains were found in the cheapest homes – especially condominiums and co-ops. Their sales surged 13.2% (seasonally adjusted) and were up an astonishing 40.8% above a year ago. Median prices for condos fell 10.4% below October 2008.

As expected, the prior month’s initial report was revised downward to annual pace of 5.54 million in September (originally reported as 5.57mm annualized). These revisions effectively eliminated the upside surprise of 220k sales last month.

It is noteworthy that the NAR claims the seasonally adjusted sales activity is at the highest level since February 2007 (6.55 million). CNN bought this nonsense hook line and sinker (Existing home sales at highest level since 2007) but it is not actually true without some accounting sleight of hand.

It is noteworthy that the NAR claims the seasonally adjusted sales activity is at the highest level since February 2007 (6.55 million). CNN bought this nonsense hook line and sinker (Existing home sales at highest level since 2007) but it is not actually true without some accounting sleight of hand.

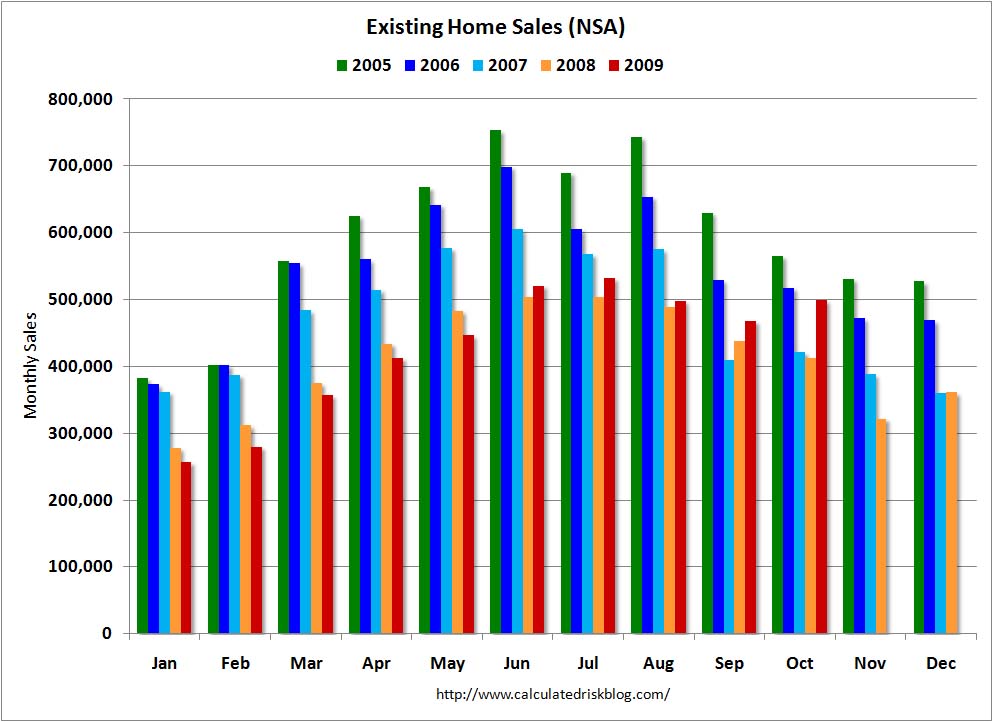

As the chart at right shows, the NSA data is quite unimpressive relative to the past few years.

Ultra low interest rates are helping sales somewhat. A 30-year, conventional, fixed-rate mortgage fell to 4.95% Last week, the 30-year rate dropped to 4.83%.

In addition to the low rates and the now extended first time homebuyers’ tax credit, a big spike in foreclosures is attracting bargain hunters. In parts of the country, some foreclosed units are selling for less than 50% of the peak 2005-06 price – especially on the low-end of the price scale. Foreclosure units have been selling briskly in California, Florida, Arizona, and Las Vegas.

Total housing inventory for sale fell 3.7% to 3.57 million existing homes, a 7.0-month supply at the current sales pace. This does not include a variety of so-called shadow inventory: REOs, rental units, vacation properties, and bank-owned strategic non-foreclosures.

>

Seasonal Adjustments Continue to Skew Data:

Mark Hanson notes the ongoing skew of Seasonal Adjustments, and the continuing spin of the NAR:

1) The month of October was thought to be the end of the stimulus, so it reflects a last minute dash to get in before the tax credit sunset

2) Rates fell sharply to below 5% in Sept/Oct 2009

3) Despite this, Oct YTD sales are DOWN a whopping 716k from 2007

4) NSA sales were up 31k sales MoM to 499k in Oct — the exact same as Aug

5) NSA sales were up 86k sales from Oct 2008 – but in Oct 2008 rates were high (pre Fed QE) and there was not stimuli of any kind

6) Median and Avg prices fell again – about 1.5% MoM and 6% YoY – price drop accelerated into shoulder season as price dumping and short sales picked up

7) Year to date Oct 2008 vs Oct 2009 – 2009 sales finally passed 2008 sales by only 61k houses.

So in a nutshell, prices keep falling month after month and 2009 has produced 61k more real sales over 2008.

>

chart courtesy Barron’s Econoday

>

Source:

Existing-Home Sales Record Another Big Gain, Inventories Continue to Shrink

National Association of Realtors, November 23, 2009

http://www.realtor.org/press_room/news_releases/2009/11/record_big

What's been said:

Discussions found on the web: