One of the memes I’ve heard recently in the climate debate is that there is no scientific consensus — that there is actually...

One of the memes I’ve heard recently in the climate debate is that there is no scientific consensus — that there is actually...

Read More

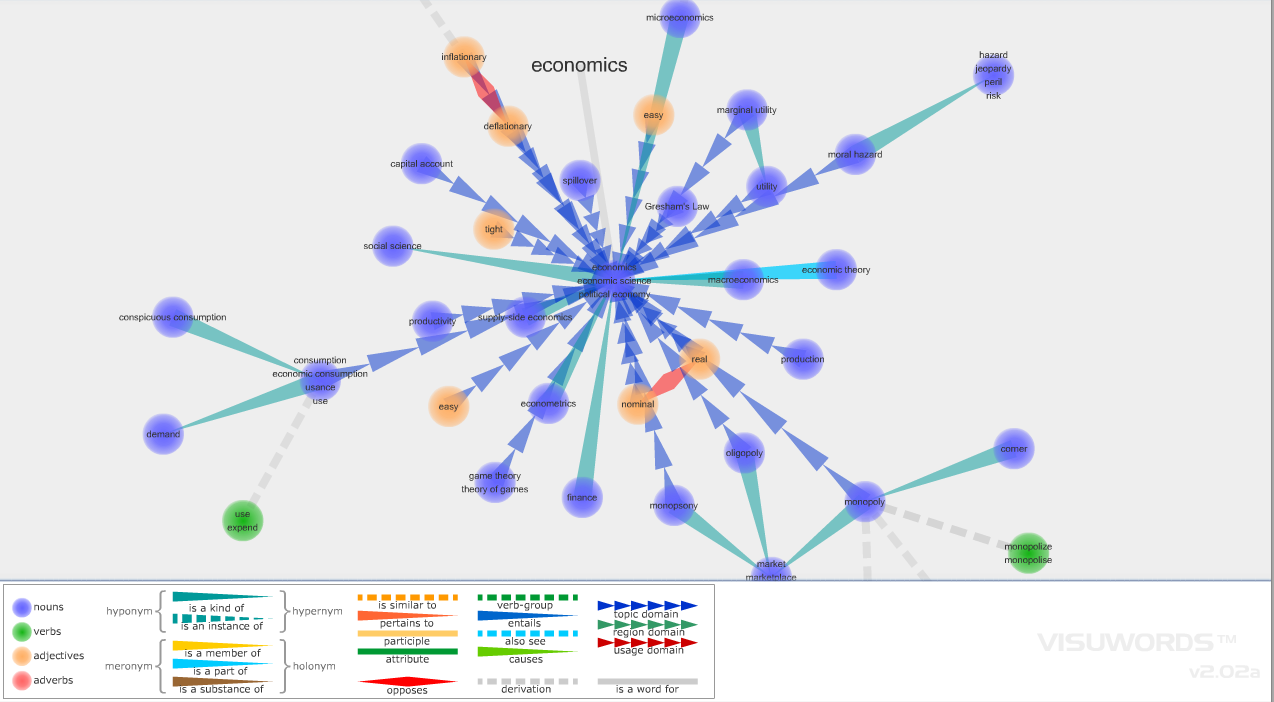

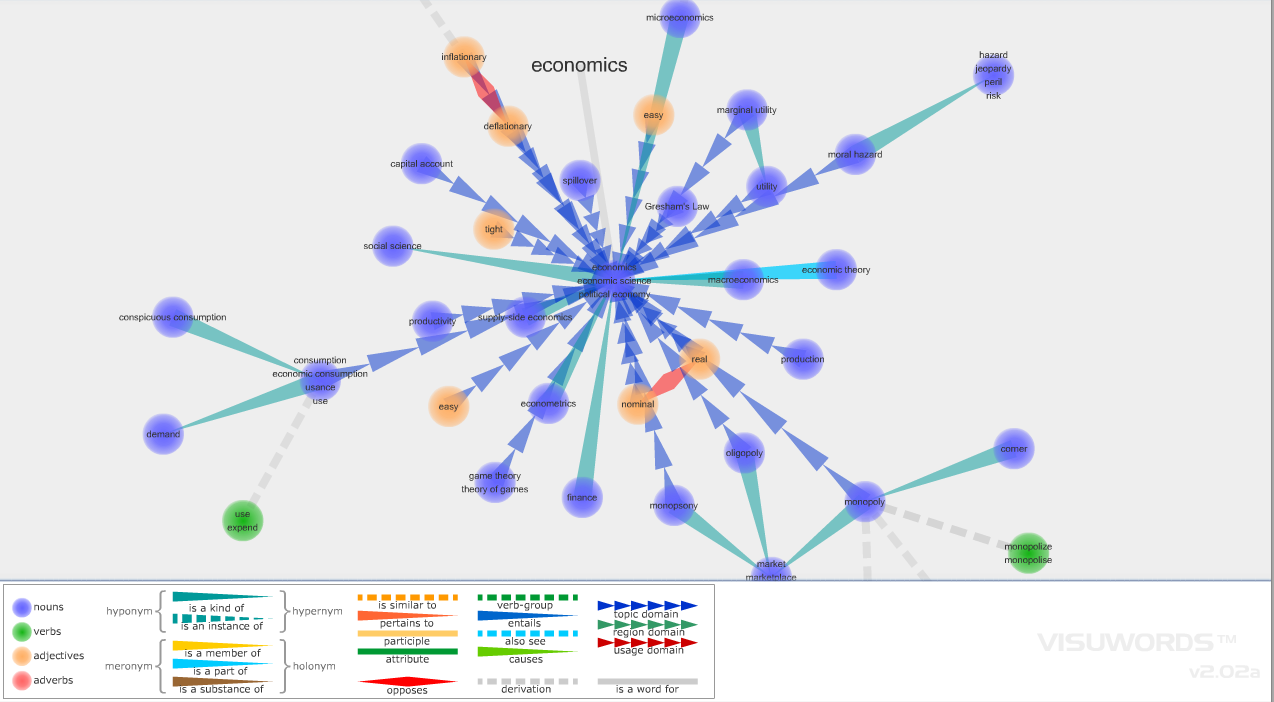

Visuwords is is a visualization tool based upon Princeton University’s WordNet. The online graphical database — part dictionary,...

Visuwords is is a visualization tool based upon Princeton University’s WordNet. The online graphical database — part dictionary,...

Read More

We won’t get the final numbers til after the close today, but here is what they look like going into the final session: • Nasdaq...

We won’t get the final numbers til after the close today, but here is what they look like going into the final session: • Nasdaq...

Read More

Seems appropriate: “I’m starting to get the sense that 2009 wants to finish me off before it dies of old age. A calendrical...

Read More

Interesting commentary in the UK on QE: “The truth is, though, that we have been living in an economic La La Land, induced by...

Read More

Economics Nobel laureate and Columbia University professor Joseph E. Stiglitz has what very well be the best year end piece I have seen...

Read More

We are on track to finish the yr with the trends that have been in place 3/4 of ’09, strong stocks and corporate debt, weak US$ and...

Read More

What Would Cause A 5.50% 10-Year Note Next Year? Bloomberg.com – Morgan Stanley Sees 5.5% Note as U.S. Faces Deficits If Morgan...

What Would Cause A 5.50% 10-Year Note Next Year? Bloomberg.com – Morgan Stanley Sees 5.5% Note as U.S. Faces Deficits If Morgan...

Read More

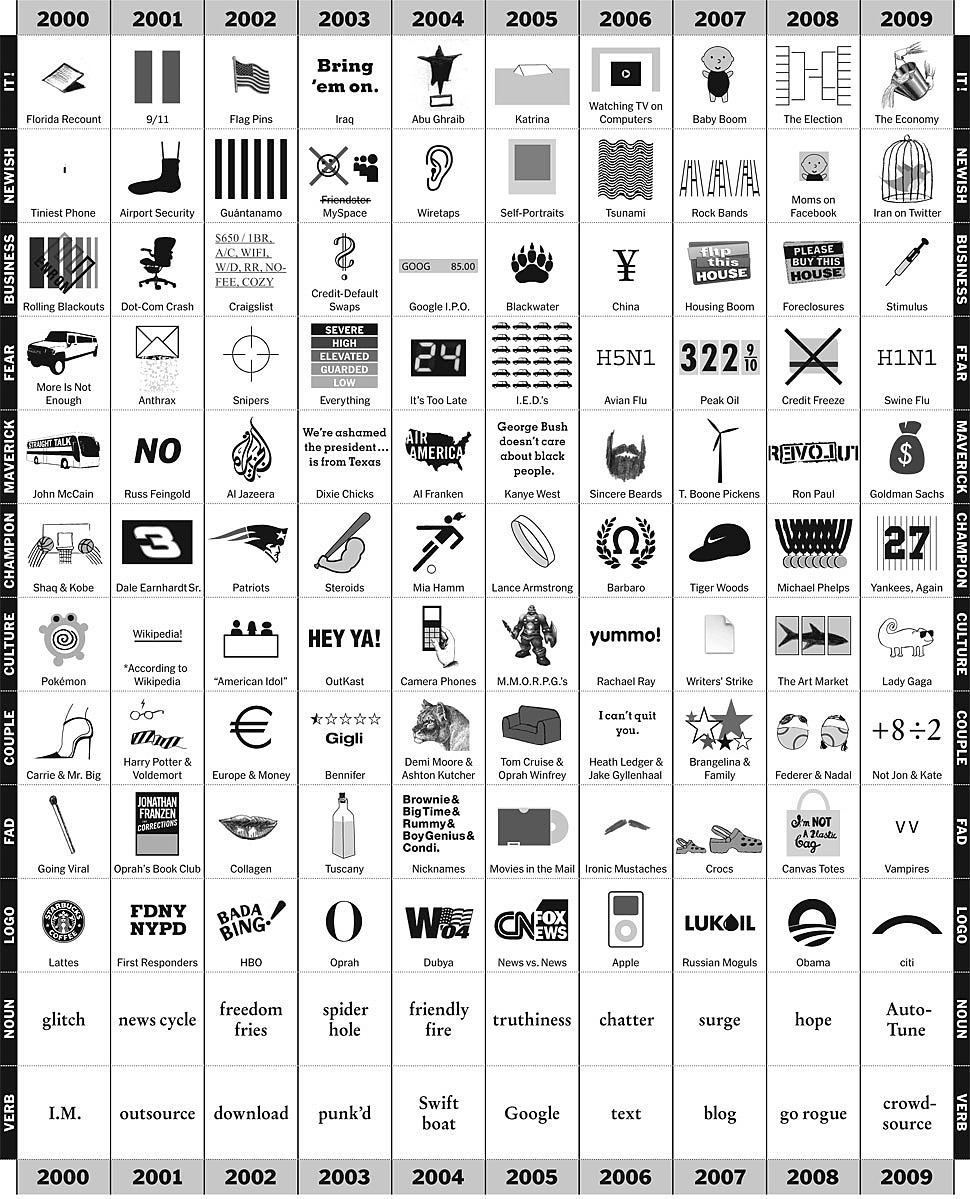

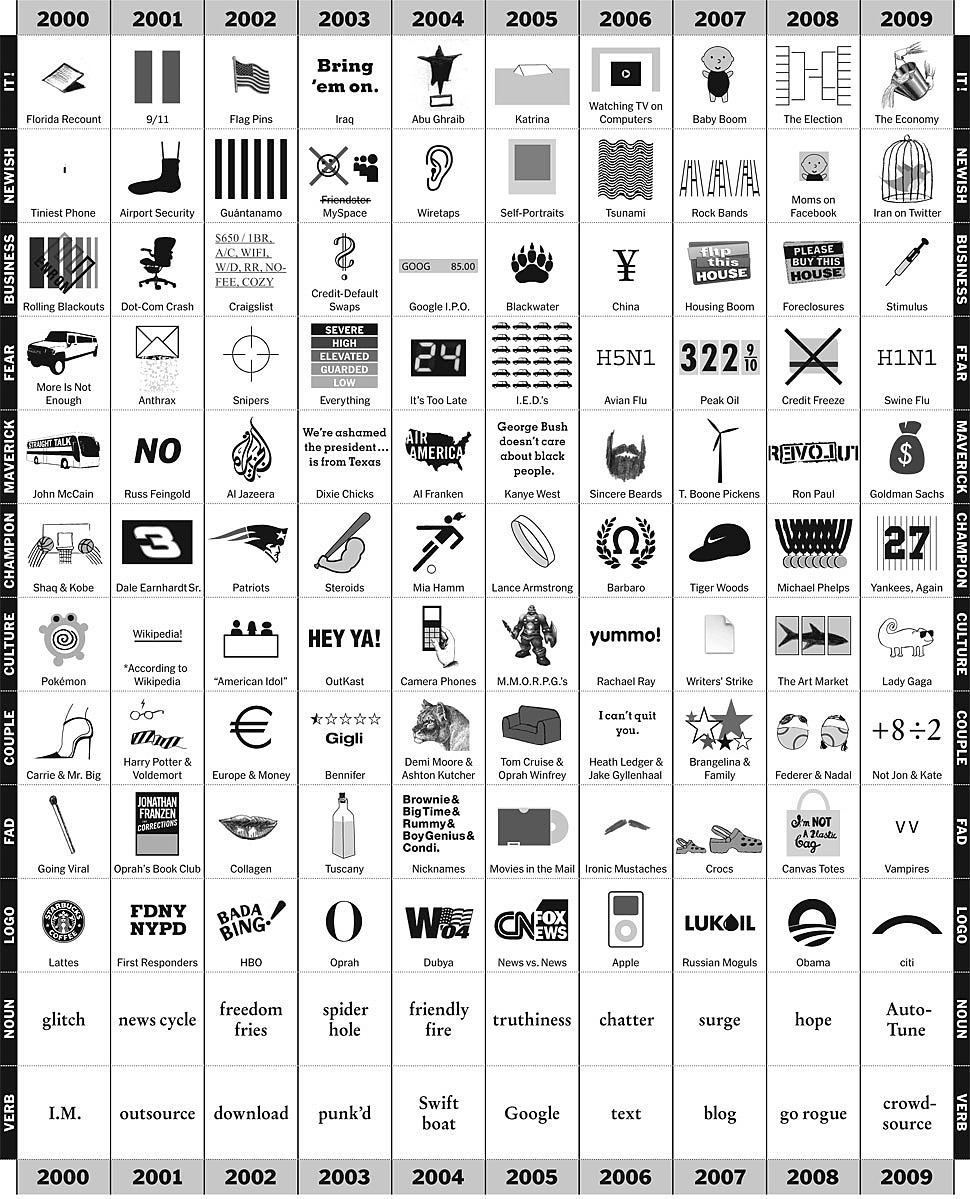

Here are the highlights of the year’s news stories, depicted visually: Click for large graphic Source: OP-CHART: Picturing the Past...

Here are the highlights of the year’s news stories, depicted visually: Click for large graphic Source: OP-CHART: Picturing the Past...

Read More

One of the memes I’ve heard recently in the climate debate is that there is no scientific consensus — that there is actually...

One of the memes I’ve heard recently in the climate debate is that there is no scientific consensus — that there is actually...

One of the memes I’ve heard recently in the climate debate is that there is no scientific consensus — that there is actually...

One of the memes I’ve heard recently in the climate debate is that there is no scientific consensus — that there is actually...