From today’s WSJ, comes this (amusing) article about the past decade: Its the worst equity performance in nearly 2 centuries.

From today’s WSJ, comes this (amusing) article about the past decade: Its the worst equity performance in nearly 2 centuries.

Why do I say amusing?

Because despite what many fools and asshats were claiming in the 1990s, stocks can only gain so much relative to earnings. Sure, other factors like population growth, economic expansion, productivity gains, all matter on the margins, but the bottom line is Earnings. But over the long haul, there is only so far you can run ahead of historical median rates of return.

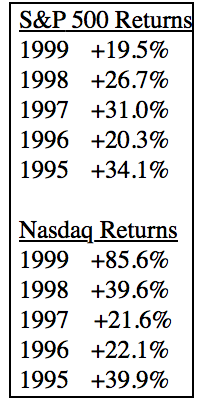

The current horrific decade lost half a percent each year on average versus average annual returns of about 10-12% over the past century. Why? This under-performance is payback for the massive gains in the salad days of the late 1990s. As the table at right shows, the gains were far above median.

There is only so far you can deviate from the historical mathematical norm before mean reversion rears its ugly head.

Here’s the WSJ:

“Even with the rebound this year, the U.S. stock market is on the verge of posting its worst performance for any calendar decade in nearly 200 years of American stock-market history.

Investors would have been better off investing in pretty much anything else, from bonds to gold or even just stuffing money under a mattress. Since the end of 1999, stocks traded on the New York Stock Exchange have lost an average of 0.5% a year thanks to the twin bear markets this decade.

In the process, the market has provided a lesson for ordinary Americans who used stocks as the primary way of saving for retirement.

Many investors were lured to stocks by the big bull market that began in the early 1980s and gained force through the 1990s. But coming out of the 1990s, the best calendar decade in history with a 17.6% average annual gain, stocks simply had gotten too expensive. Companies also pared dividends, cutting into investor returns. And in a time of absolute financial panic like 2008, stocks usually were the worst place to be.

With just two weeks to go in 2009, the declines since the end of 1999 make the last 10 years the worst calendar decade for stocks going all the way back to the 1820s, when reliable stock-market records began, according to data compiled by Yale University finance professor William Goetzmann.

It edges out the 0.2% decline stocks suffered during the Depression years of the 1930s, which up until now held the title of worst decade. And it is worse than other decades with financial panics, such as in 1907 and 1893.”

Repeat after me: There is no free lunch. A decade of out-performance will be p[aid back one way or another.

>

Source:

Stocks’ ‘Nightmare’ Decade

U.S. Market’s Performance Since End of 1999 is Worst in Almost 200 Years

TOM LAURICELLA

WSJ, DECEMBER 20, 2009, 4:33 P.M. ET

http://online.wsj.com/article/SB10001424052748704786204574607993448916718.html

What's been said:

Discussions found on the web: