Time for a few charts looking at Sentiment.

Despite the huge run up in equity prices, sentiment, as measured by invested dollars and equity exposure, as well as surveys, is actually pretty middle of the road:

>

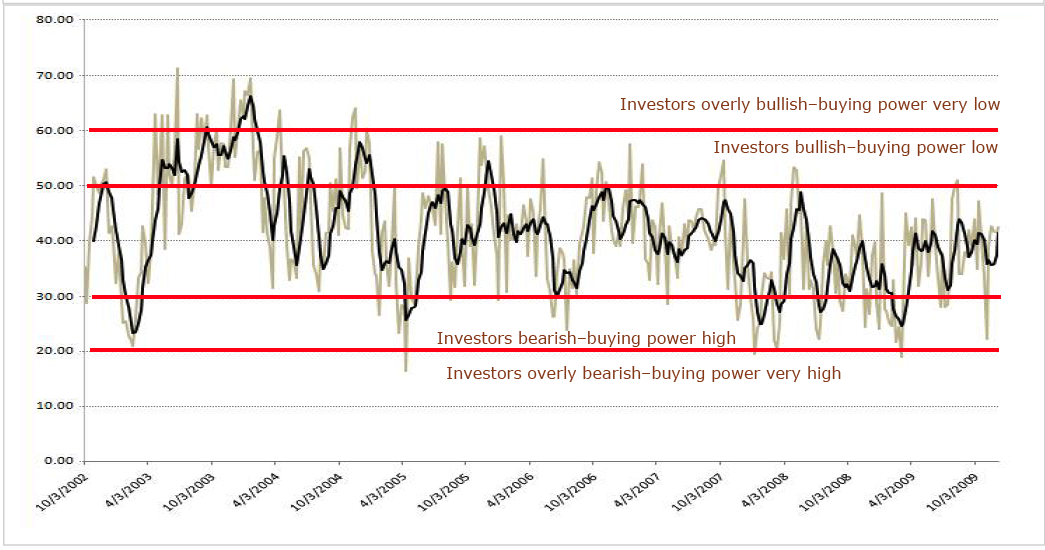

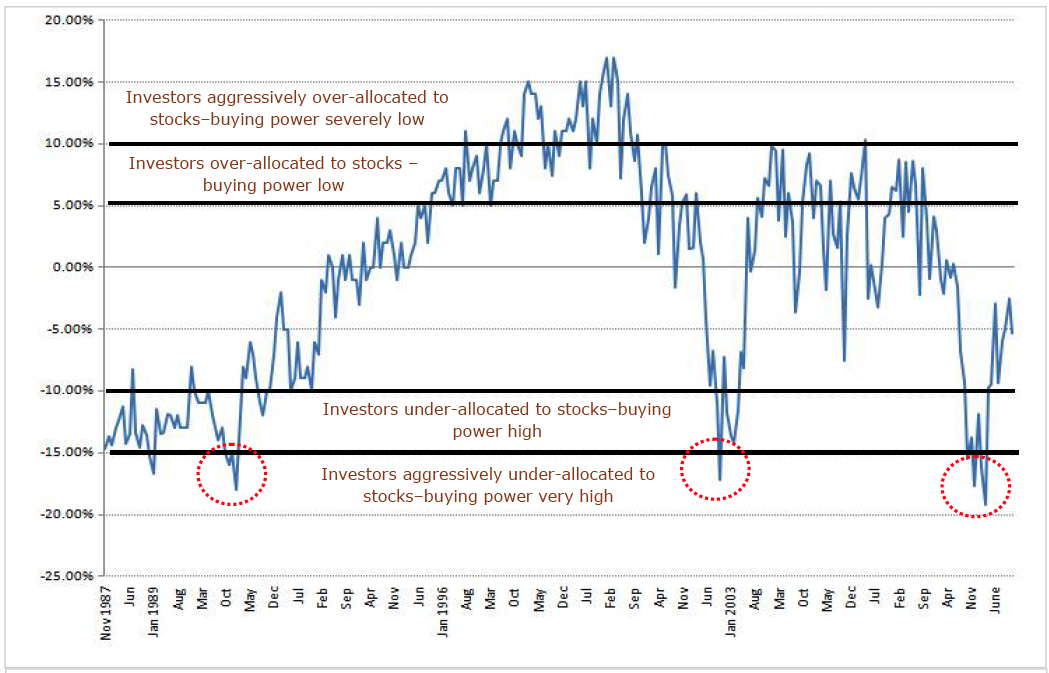

AAII Asset Allocation Deviation from the Mean

>

AAII Bullish Sentiment Survey

click for ginormous charts

All charts courtesy of Fusion Investments

>

This suggests that a reversal is not imminent, at least due to sentiment. But it also implies that the negativity that drove the early phases of the rally are no longer present either.

The easy money has been made . . . the sledding now gets more challenging . . .

What's been said:

Discussions found on the web: