~~~

HAPPY HOLIDAYS and HAPPY AND HEALTHY NEW YEAR!

ECONOMY

As first forecast last March, the U.S. economy was going to experience a V-shaped recovery that at first would be more statistically based. As discussed in the May letter:

“A dissection of the -6.1% decline in first quarter GDP will underscore why a turnaround in GDP is coming. The decline in residential construction subtracted -1.36% from GDP. However, single family housing starts have held steady for the last 4 months through April. With housing starts already down 80% from their peak three years ago, there is a good chance starts will continue to stabilize near 350,000, a very depressed level. By the time the fourth quarter arrives, the drag to GDP from residential construction could be near zero, and possibly a slight positive. Businesses slashed inventories a record $103.7 billion in the first quarter, which shaved -2.79% from GDP. Last week, 52 million Social Security recipients began receiving their $250 economic recovery checks. Along with other measures within the $787 billion fiscal stimulus plan, consumers will have more disposable income, which will lift demand in coming months. This will help align sales with production and inventories, so the large drag from inventories will be far less in the second half of 2009.

Business investment on new buildings and equipment plunged 38%, the most since 1947. This accounted for the bulk of the -4.68% non-residential investment subtracted from first quarter GDP. Although commercial real estate will remain weak in coming quarters, business investment has begun to stabilize. Even if business investment doesn’t pick up by the fourth quarter, the negative drag on GDP will be less.

The lone bright spot in the first quarter was a 2.2% increase in consumer spending, which added +1.5% to GDP. Although consumer spending will continue to be pressured by job losses and weak income growth, various aspects of the stimulus plan should help maintain consumer spending near first quarter levels.

This breakdown of first quarter GDP shows that most of the improvement by the fourth quarter will result because the extreme weakness in the first quarter will have flat lined, causing most of the GDP components to go from deeply negative toward zero. That may be better than the alternative, but it is no substitute for a healthy pick up in demand. It’s a bit like sitting down for a delicious five-course gourmet dinner, and only being served a plate of Cheetos.”

By the third quarter, most of the shifts had occurred, and various aspects of the fiscal stimulus were clearly evident in the 2.2% gain in GDP. Motor vehicle output added 1.45%, spurred by the Cash for Clunkers program. New homes sales were a net positive, aided by the $8,000 first time home buyers tax credit. A swing in inventories actually added .69%, and personal consumption contributed about 2%. Most of these factors, along with a gain in exports should help fourth quarter GDP to push 4%. But as I noted in the May letter, “The most important issue in the next 12 to 15 months is whether the rebound in the second half of 2009 and first half of 2010 will gain enough traction to launch a self sustaining economic recovery. The short answer is no one knows.”

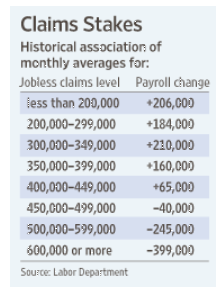

As we enter 2010, the largely statistical recovery to date should strengthen, and include more gains from inventory accumulation, fiscal stimulus, and an irregular improvement in job growth. The loss of only 11,000 jobs in November likely overstated the near term health of the labor market, but there were other positives signs. As noted last month, temporary employment changes are a good leading indicator. In November, temporary jobs increased 52,400, the fourth consecutive month of gains. The workweek rose to 33.2 hours from a record low of 33.0 hours, and overtime hours also increased. As noted previously, job growth of 125,000 is needed to reduce the ranks of unemployed workers, and could appear by the end of the first quarter. If this is to occur, the historical record suggests that the four week moving average of weekly jobless claims will have to fall and remain below 400,000. Hiring for the 2010 census will peak in April and May, when up to 800,000 workers are needed. The average census job will require 20 hours of work each week, pay between $10 and $25 an hour, but only last for six weeks. I suspect the Census Bureau will be swamped with applications. In addition, every economic statistic will look much better when compared to the extraordinary weakness in the first quarter of 2008.

As discussed in the September letter, there are a number of secular headwinds that will weigh on the economy for 3 to 5 years. Total debt as a percent of GDP has risen from $1.65 in 1982 to $3.70 in 2009. Household debt is now 97% of GDP, up from just 44% in 1982. The burden of total debt and household debt cannot be lessened with lower interest rates, since interest rates are already at generational lows. As this debt was being assumed over the last 25 years, annual GDP was higher than it otherwise would have been. Since consumers will not being able to increase their debt at the same pace, annual GDP growth will be slower, until the ratio of household debt is a good deal lower than it is today. My guess is that it will fall back to 90% or less, before consumer balance sheets will be healthy enough to support a new secular economic expansion. The savings rate was almost 10% in 1982. Although it has climbed to 3% to 4%, it is likely to rise further as consumers cut back on their spending. This task will be made more difficult, if the economy grows more slowly in coming years, since personal income will also grow more modestly. Another drag on growth will come in the form of higher federal taxes to lower the massive deficits that are being created by Congress. In addition, the overall level of regulation is going to increase, which will add to the cost of doing business in the U.S.

As discussed in the September letter, there are a number of secular headwinds that will weigh on the economy for 3 to 5 years. Total debt as a percent of GDP has risen from $1.65 in 1982 to $3.70 in 2009. Household debt is now 97% of GDP, up from just 44% in 1982. The burden of total debt and household debt cannot be lessened with lower interest rates, since interest rates are already at generational lows. As this debt was being assumed over the last 25 years, annual GDP was higher than it otherwise would have been. Since consumers will not being able to increase their debt at the same pace, annual GDP growth will be slower, until the ratio of household debt is a good deal lower than it is today. My guess is that it will fall back to 90% or less, before consumer balance sheets will be healthy enough to support a new secular economic expansion. The savings rate was almost 10% in 1982. Although it has climbed to 3% to 4%, it is likely to rise further as consumers cut back on their spending. This task will be made more difficult, if the economy grows more slowly in coming years, since personal income will also grow more modestly. Another drag on growth will come in the form of higher federal taxes to lower the massive deficits that are being created by Congress. In addition, the overall level of regulation is going to increase, which will add to the cost of doing business in the U.S.

There are also a number of cyclical headwinds that will weigh on growth in the next 2 years. Banks of all sizes have billion more in losses to work through. Commercial real estate has not bottomed, and this will affect many mid sized banks that were overly aggressive in their lending to regional commercial developers. Residential home prices are likely to decline further, as the foreclosure pipeline is still building. Although the labor market should continue to improve, the level of unemployed and underemployed workers will remain high for most of 2010, which will restrain consumer spending. This will force banks to keep lending standards high, and the volume of new lending lower than it needs to be to support a sustainable recovery. State spending has averaged 6% annually over the last 30 years. Revenues are down 11% as of September 30, which is forcing states to raise taxes and cut their spending. All of these factors should result in a sub par recovery that does not inspire corporations to substantially boost their business investment plans or their hiring. Each of these secular and cyclical headwinds are significant, but the combination of all of them interacting and reinforcing each other will be a formidable hurdle for the economy to make a smooth transition from the stimulus spurred V-shaped recovery, into a self sustaining recovery that can gains traction as 2010 unfolds.

In addition, by the end of the first quarter in 2010, the Federal Reserve will have phased out the majority of the special liquidity facilities that have been especially supportive of the credit market in general, and the mortgage security market specifically. The housing market will be hurt, if mortgage rates rise as I expect. If rates rise too much, the Fed may step in again. As noted in its post FOMC statement for the December 16 meeting, “The Federal Reserve is prepared to modify these plans if necessary to support financial stability and economic growth.”

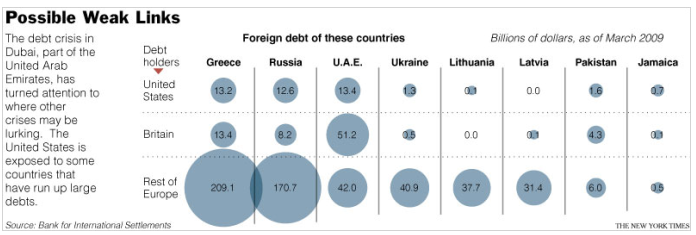

One of the safest predictions any prognosticator can make is that there will be surprises in the coming year. This wisdom is as valuable as the medicine man solemnly proclaiming in the dead of night that the sun will come up tomorrow and the direction of its ascent. But if delivered properly and the right back ground music it sounds good. My guess is that the U.S. economy will hit a soft patch by mid year, for all the reasons cited above. However, the biggest surprises are likely to come from overseas. Banks in Europe employed leverage of 40 to 1, versus the merely ridiculous 30 to 1 leverage of their U.S. counterparts. European banks have also been slower to acknowledge losses. As we all know, major banks in the U.S. were brought to their knees by sub prime mortgage loans and the overall decline in home prices. Most of the European banks were affected by the same malady. Where they differ is their large loan exposure to Eastern Europe, Russia, Dubai, and Greece. This exposure is their version of sub-prime lending, and it has the potential to be as unsettling.

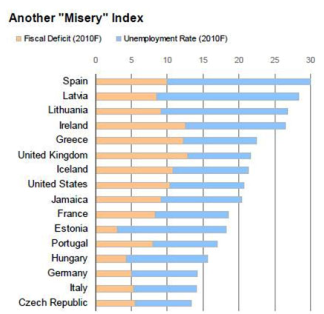

One way of measuring the level of financial stress is to combine a nation’s unemployment rate with its fiscal deficit as a percent of its GDP. The “Misery” index is quite high for a number of Eastern European countries, i.e., Latvia, Lithuania, Estonia, Hungary, and Bulgaria. It is also high for a number of the larger countries in the European union, i.e., Germany, France, Spain, Ireland, Italy and Greece. Economic stress has forced governments around the world to increase their budget deficit spending to offset weak private demand.

In the U.S., total debt is projected to rise from 63% of GDP in 2007, to 82% in 2010. In Germany, the ratio is expected to reach 77%, up from 60% in 2002. The deterioration in Britain has been even more severe, soaring from 40% in 2002 to 80% in 2010. The problem for Latvia, Lithuania, Estonia, Bulgaria and Hungary is that foreign debt exceeds 100% of their GDP. Although U.S. and British banks have some exposure to these problem countries, it is dwarfed by the exposure European banks possess. Last week, the European Central Bank raised its estimate of total crisis related loan losses by $93 billion to $796 billion. Banks have already booked about 65% of these losses, and have an additional $268 billion in losses to absorb by the end of 2010. The ECB said it expected to see much higher losses than previously forecast, mainly from exposure banks Eastern Europe and commercial real estate. On December 9, Fitch Ratings cut Greece’s sovereign debt rating. On December 19, Ewald Nowotny, who is an ECB governing council member and head of the Austrian central bank, said the ECB would not bail out debt-stricken member states, such as Greece, which must repair its public finances on its own. Greece will have a fiscal deficit of 12.7% of its GDP in 2009, far above the European Union mandated ceiling of 3%. If push comes to shove, it will be interesting if the ECB allows one of the countries in the EU to default. If we have learned any lesson in the last two years it is that in a global economy any misstep is very quickly spread throughout the global financial system.

In the U.S., total debt is projected to rise from 63% of GDP in 2007, to 82% in 2010. In Germany, the ratio is expected to reach 77%, up from 60% in 2002. The deterioration in Britain has been even more severe, soaring from 40% in 2002 to 80% in 2010. The problem for Latvia, Lithuania, Estonia, Bulgaria and Hungary is that foreign debt exceeds 100% of their GDP. Although U.S. and British banks have some exposure to these problem countries, it is dwarfed by the exposure European banks possess. Last week, the European Central Bank raised its estimate of total crisis related loan losses by $93 billion to $796 billion. Banks have already booked about 65% of these losses, and have an additional $268 billion in losses to absorb by the end of 2010. The ECB said it expected to see much higher losses than previously forecast, mainly from exposure banks Eastern Europe and commercial real estate. On December 9, Fitch Ratings cut Greece’s sovereign debt rating. On December 19, Ewald Nowotny, who is an ECB governing council member and head of the Austrian central bank, said the ECB would not bail out debt-stricken member states, such as Greece, which must repair its public finances on its own. Greece will have a fiscal deficit of 12.7% of its GDP in 2009, far above the European Union mandated ceiling of 3%. If push comes to shove, it will be interesting if the ECB allows one of the countries in the EU to default. If we have learned any lesson in the last two years it is that in a global economy any misstep is very quickly spread throughout the global financial system.

Another surprise from overseas will come from China, although I don’t know if it will happen in 2010 or 2011. One of the most widely accepted investment themes is that China will continue to grow far faster than every other country in the world for decades to come. While this is likely to be true, that doesn’t mean there won’t be a few speed bumps along the way. China, with $4 trillion in GDP, represents less than 10% of world GDP and derives 35% of its GDP from exports. After being prodded by the government, Chinese banks have increased lending by more than $1 trillion in 2009, or by more than 25% of GDP. In addition, the Chinese government launched a $585 billion economic stimulus package. Most of the stimulus and lending went into fueling a surge in their stock market, and commodities, property and land prices. Through October, the total floor space of housing sold rose 50% above year earlier levels. Some developers have warned that land prices in some cities have already risen so far that it will be hard to make money on future developments, without large price increases. Mr. Wang Shi, who founded China Vanke 25 years ago and is China’s biggest property developer, recently said, “In individual cities, and in some of the main cities, there is clearly a bubble. There’s no doubt about that. I’m very concerned.” In addition, some of the rampant lending was surely directed toward increasing export capacity, at a time when the world economy is awash in excess capacity. I have no doubt that there will be loan losses in the wake of their lending debauchery. Call me a cynic, but I don’t think Chinese bankers are much smarter than American bankers, or bankers anywhere else either. After all, boys will be boys, and bankers will be bankers. There will be loan losses, it’s only a question of when.

In 1999, Andrew Lawrence, research director at Dresdner Kleinwort, analyzed the timing of when the largest skyscrapers in the world were planned and erected, and their relationship with financial crisis’. The planning for the Singer and Metropolitan Life buildings preceded the Panic of 1907. The Great Depression was forewarned with the Chrysler and Empire State Building. The World Trade Center and the Sears Tower cast their long shadows on the stagflation in the 1970’s. The East Asian Crisis in 1997 was tagged by the Petronas Tower in Kuala Lumpur. The Burj, located in Dubai, set a new height record in August 2007, just before the current financial crisis. Interestingly, the next skyscraper is set to be completed in 2012. It will be called Shanghai World.

DOLLAR

Over the last 3 months, I thought the dollar was in the process of making an intermediate low, as sentiment toward the dollar was almost unanamously negative. Sentiment indicators can be very helpful, but they can also be early at times. In this case, the amount of price decline was fairly small (less than 3%), but I did not expect it to take two months before the trend reversed. Here is why the dollar may be embarking on a very large advance in 2010. The rally in 2008 in the dollar carried the dollar from 70.70 in March to its November high of 88.46, a gain of 17.76 points. The recent low of 74.17 on November 26 was obviously above the low in 2008, even though the media made it sound as if the dollar was collapsing to all time lows. This suggests there could be a rally of at least 17.76 points, carrying the dollar to 91.93. At a minimum, it should exceed the March 2009 high of 89.62. The initial rally from the low of 74.17 was sparked by the news of a possible debt default in Dubai. As I noted in a Special Update on December 8, the dollar broke out of the down trend channel it had been trapped in since August on December 4, after the release of the November jobs report. The better than expected jobs report led investors to conclude that the economy was doing better and lead the Fed to raise rates sooner, rather than later. As discussed last month, the dollar carry trade had become very crowded, as traders took the Fed’s intention to keep rates “exceptionally low for an extended period” as a green light to short the dollar and buy commodities. The technical breakout on December 4 from the down trend channel forced traders to begin to cover their short positions in the dollar, and sell their long positions in oil, gold, and commodities in general.

If the technical analysis of the dollar is correct, I think the fundamental reason for the dollar to rally above 89.62 will not occur because the economy is doing well, forcing the Fed to increase rates. The driver will be a resumption of the financial crisis that likely starts overseas, or fear of a double dip recession in the U.S. economy as growth slows in the second half of 2010. It would be ironic if the dollar has started to rally on perceptions of a better economy, but gains even more, when those perceptions are proven wrong.

We are long the dollar futures from an adjusted price of 76.75, after rolling to the March 2010 contract. We are also long the dollar ETF UUP from an average price of $22.40. Raise the stop from 74.00 to 75.50 for all positions. If the March futures climb above 80.50 before year end, I will send out an update. If, as I expect, the December jobs report to be released on January 8 does not meet expectations, the dollar could be vulnerable to a correction

GOLD

I would rate my analysis of gold and gold stocks in 2009 as crummy, even if I added lipstick. The dollar took longer to bottom than I expected, which helped gold breakout in September, and I certainly did not anticipate the run from $1,000 to over $1,220 in November. However, in the November letter, I discussed the phenomena of parabolic price increases that have appeared as far back as 1604 with the Tulip Bulb Mania, and in 2000 in technology stocks. As I explained last month, “One of the more fascinating aspects of each mania is how similar the price pattern has been. In each case, a gradual price increase over a number of years accelerates, until the rise appreciates into an almost vertical trajectory. Like a pilot who takes off and then aims the nose of the plane toward the sky, until there isn’t enough lift under the wings and the plane stalls. At that point, the nose of the plane rolls over, and a harrowing descent toward earth begins. This flight pattern is evident in the wake of every investment mania.” In discussing how this applied to gold last month, I said, “Ten years ago, technology bulls knew all the reasons that justified their faith in the ‘New Paradigm’. Over the last few weeks, gold has made a series of new highs, and the percent of bulls has exceeded 90% for almost 3 weeks. In terms of market phenomena, this is a rare event.” In less than 3 weeks, gold has plunged $150.00, or more than 12%. The pressure on dollar shorts and gold longs to protect gains or limit losses could increase going into the end of the year. This is why the dollar could rally to above 80.50 and gold drop to $1,030 – $1,050 before year end. What is certain is that there will be a sizable counter trend rally in gold, once the dollar corrects. I just don’t know if it waits until early January to start.

We are short the gold ETF GLD from average price of $107.94, and long the gold short ETF DZZ from an average price of $14.88. Cover half of the GLD short if it drops below $103.50, and sell half of DZZ at the same time.

STOCKS

Last month I wrote, “Since peaking in mid October, the internal strength of the market continues to weaken. On October 14, 462 stocks made a new high. That dropped to 318 on November 16, and 190 on November 23, even as the DJIA has pushed almost 4% above its mid October high. The Russell 2000 has made a series of lower peaks, and is 5% below its October high. These statistics show that fewer stocks are participating in the advance, which is often a fairly reliable precursor of a market decline. A close below 1080 on the S&P should confirm that a short term top is in, with a decline to 1030 likely to follow. The only caveat is that seasonality is a positive going into year end.” In my Special Update on December 8, I noted the following. “On November 11, the S&P reached 1105.37. Since then, the S&P has traded in a fairly tight range between 1085 and 1,115, with a couple of very brief spikes to 1117 and 1119. The price pattern since November 11 appears to be forming a five point (a, b, c, d, e) expanding triangle. Today’s drop below Friday’s low of 1096 could be providing the finishing touch to wave e of the expanding triangle. Unless the S&P closes below 1080, which has been my expectation, the completion of the triangle implies that the market will rally above the resistance around 1115. This rally would have the potential to reach 1145 to 1165. If this rally develops, it is likely to represent the end of the rally from the March low. The bottom line is that the market is at an important juncture.

The Russell 2000, which has been consistently underperforming the DJIA and S&P since mid October, has been gaining in relative strength. This shift appears to have coincided with the improving tone in the dollar. A weak dollar helps companies with international exposure, since the 500 companies in the S&P garner 45% of their sales from overseas. The combination of a stronger dollar and the better than expected jobs report on Friday has led to a swing toward domestic oriented companies that are in the Russell 2000. If the triangle interpretation is correct, the Russell will likely outperform, if the S&P moves above 1115.” The S&P has moved above 1,115, and the Russell 2000 has outperformed, by gaining 3.5%, versus a gain of 2.0% for the S&P since December 8. For many months, the dollar and the stock market have moved inversely. The better than expected employment report started the rally in the dollar, and has enabled stocks to grind higher on the expectation of better earnings, despite dollar strength.

The technical weakness noted in November suggested the market would, for the first time since the March low, be vulnerable to a decline that would be signaled, if the S&P dropped below 1,080. That signal was not given, and the technical pattern in the price of the S&P now suggests that the S&P will rally to 1,135 to 1,165. My expectation was that the S&P would subsequently rally to new highs, after a drop to 1,030, since the majority of economic data points would continue to show improvement. Since institutional money managers believe the economy is on its way to a sustainable recovery, the stock market is unlikely to experience a meaningful decline, until the confidence institutional money managers have in the sustainable recovery story is challenged. If they are right about the recovery, the market will follow the pattern of 2004, and only experience modest declines of 4% to 7%, and trend modestly higher by the end of 2010. This is the consensus view. I do not believe the economy will make a smooth transition to a self sustainable recovery. The road is likely to get a bit bumpy after the Fed removes its various support measures by the end of the first quarter. If the economy hits a soft patch, the stock market will be vulnerable to larger correction, as investors fret about the potential of a double dip recession. However, the market would be vulnerable to an even larger decline if another phase in the financial crisis develops overseas, as I expect. We may know that the sun will rise tomorrow in the east, but there will be plenty of surprises in 2010.

Coming into December, we were long the short Russell 2000 ETF TWM from an average of $28.67, and covered half when the Russell moved above 606.00 and half as instructed in the Special Update on December 10, at an average price of $27.27. We also bought the short S&P ETF SDS when the S&P moved above 1,105.37 and 1,115, at an average price of $35.60. This was sold at $35.89 per the December 10 Update. At the same time, the long S&P ETFF SSO was purchased on December 10 at $37.47, but was stopped out at $36.95, after I raised the stop from 1,090 to 1,095 on December 18 and the S&P dipped to 1,093.88. Ah, the joys of a choppy 2.5% trading range that lasts for more than a month. Bah Humbug! If you are still long, raise the stop to 1,105.00.

BONDS

The 10-year Treasury yield broke out above 3.6%, and looks ready to make a run to 4.0%. A close above 4.07% would be a longer term negative, especially for mortgage yields, housing, and the economy.

E. James Welsh

What's been said:

Discussions found on the web: