Its early in the weekend, but we already have a leading candidate for the article that everyone will be discussing Monday morning: Goldman Fueled AIG Gambles

Excerpt:

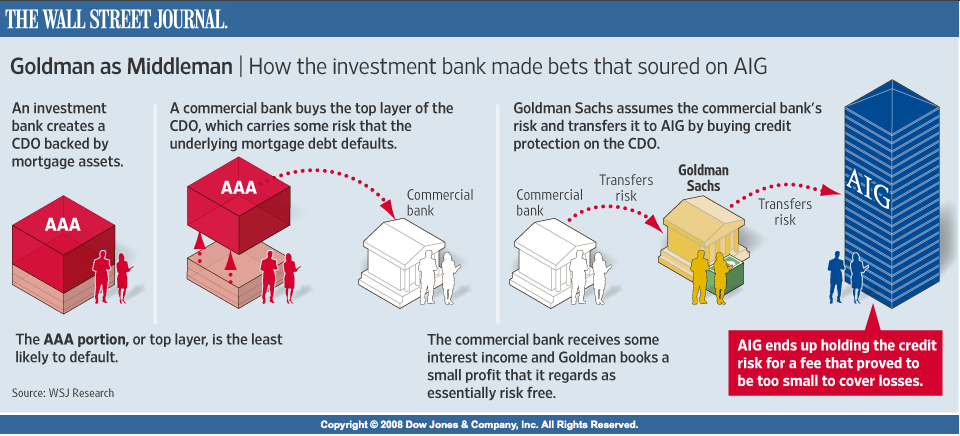

“Goldman Sachs Group (GS) played a bigger role than has been publicly disclosed in fueling the mortgage bets that nearly felled American Insurance Group (AIG).

Goldman was one of 16 banks paid off when the U.S. government last year spent billions closing out soured trades that AIG made with the financial firms. A Wall Street Journal analysis of AIG’s trades, which were on pools of mortgage debt, shows that Goldman was a key player in many of them, even the ones involving other banks.

Goldman originated or bought protection from AIG on about $33 billion of the $80 billion of U.S. mortgage assets that AIG insured during the housing boom. That is roughly twice as much as Société Générale and Merrill Lynch, the banks with the biggest exposure to AIG after Goldman, according an analysis of ratings-firm reports and an internal AIG document that details several financial firms’ roles in the transactions.

In Goldman’s biggest deal, it acted as a middleman between AIG and banks, taking on the risk of as much as $14 billion of mortgage-related investments. Then Goldman insured that risk with one trading partner—AIG, according to the Journal’s analysis and people familiar with the trades.

The trades yielded Goldman less than $50 million in profits, which were mostly booked from 2004 to 2006, according to a person familiar with the matter. But they piled risks onto AIG’s books, which later came to haunt the insurer and Goldman. The trades also gave Goldman a unique window into AIG’s exposure to losses on securities linked to mortgages.

When the federal government bailed out the insurer, Goldman avoided losses on its trades with AIG covering a total of $22 billion in assets.” (emphasis added)

Now, would someone explain to me why Goldman got 100 cents on the dollar as a counter-party to AIG via the Bailouts?

If Ron Paul wants to show he has balls, why not go after GS? The Fed is a soft target, and I believe there is almost no one in Congress with the testicular fortitude to demand repayment, and/or threaten a lawsuit on behalf of taxpayers.

Any Congress people — Bernie Sanders maybe? Perhaps Senators Schumer or Dodd might forget all of the Finance driven campaign contributions they have gotten over the years and come up with a plan. I would imagine Alan Grayson is one of the few Freshman Congresmen who can think of a way to clawback some of the ill gotten booty Goldman grabbed from Treasury.

Ideas . . . ?

>

>

Source:

Goldman Fueled AIG Gambles

SERENA NG and CARRICK MOLLENKAMP

WSJ, DECEMBER 12, 2009

http://online.wsj.com/article/SB10001424052748704201404574590453176996032.html

What's been said:

Discussions found on the web: