Alcoa reported a Q4 2009 loss of $277 million loss, on lower sales and higher costs. Losses narrowed from a year ago when they were $1.2 billion dollars.

Pro forma operating profits were 1 cent, missing analysts estimates of a 6 cent profit, and begging the question of HTF can you report a per share profit on a quarter billion dollar loss? The analyst and accounting industries should hang their head in shame, and reach for a wakizashi to perform Seppuku, being the only honorable thing to do after the great shame brought upon their houses.

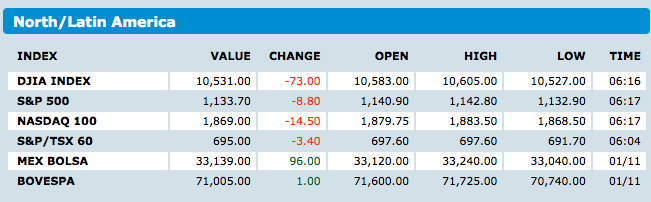

US futures dropped after the miss, and have weakened this morning:

>

Source:

Alcoa Drops After Quarterly Earnings Trail Estimates

Edmond Lococo

Bloomberg, Jan. 12 2010

http://www.bloomberg.com/apps/news?pid=newsarchive&sid=aYU0EdBl.FLI

What's been said:

Discussions found on the web: