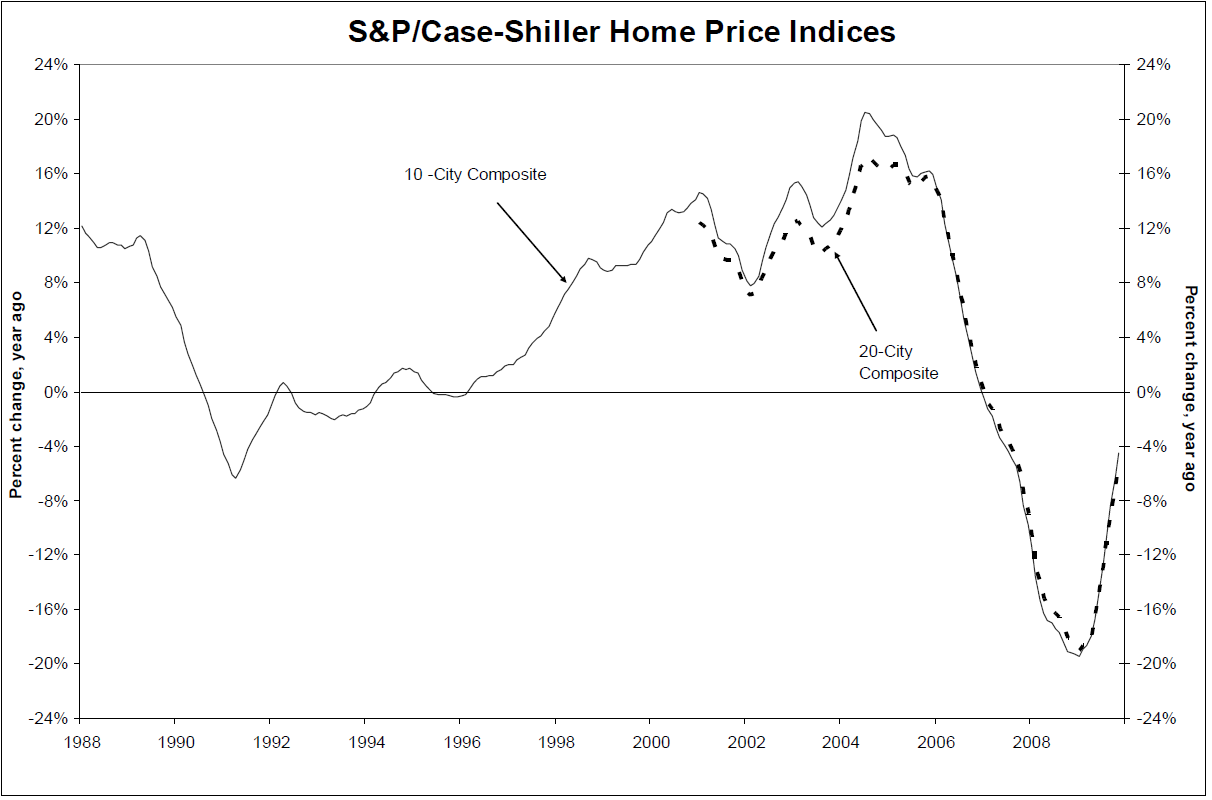

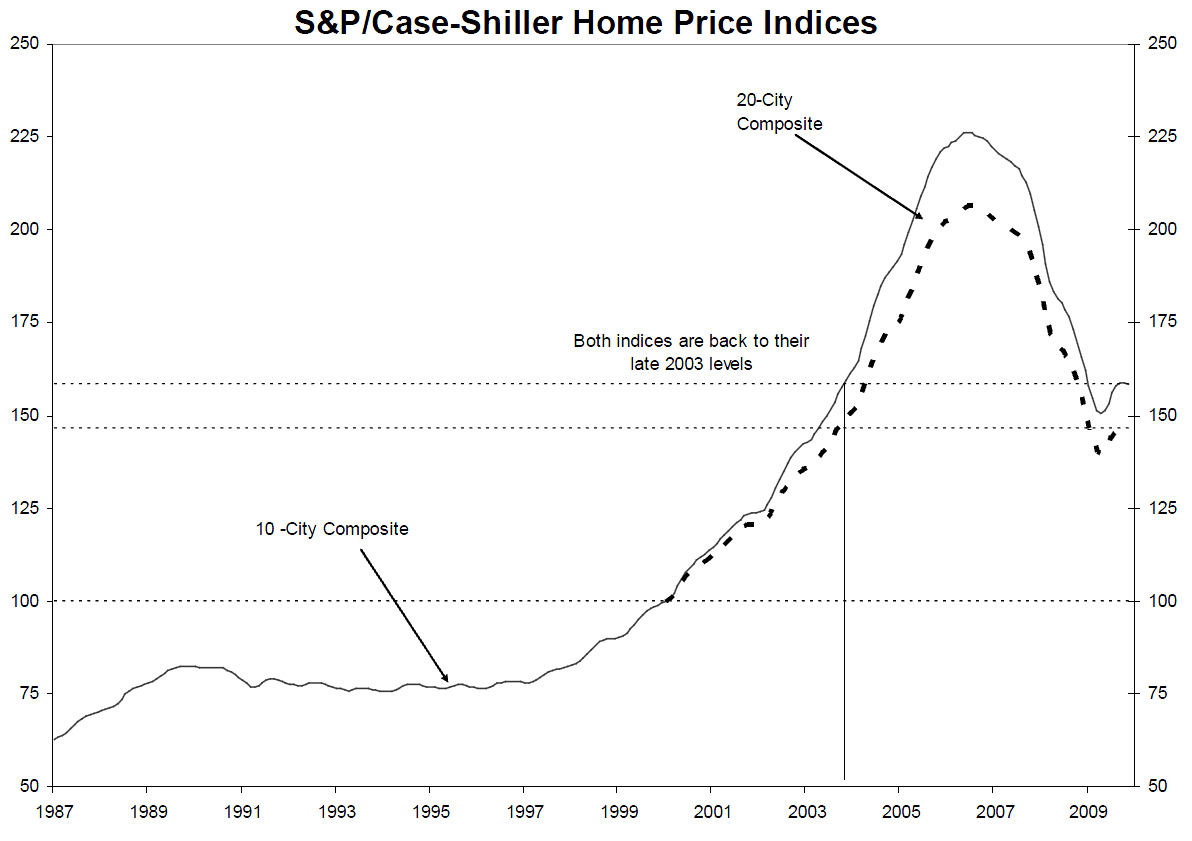

Case-Shiller Home Price Indices data through November 2009 reveal the annual rates of decline of the 10-City and 20-City Composites are improving. There were price declines measured across many markets during November.

This was the 10 month of improved readings — less bad price declines — in the annual statistics. It was also the third consecutive month of “only” single digit drops, following 20 consecutive months of double digit price declines.

>

Source: Standard & Poor’s and Fiserv

The 10-City and 20-City Composite (above) declined 4.5% and 5.3% respectively.

Source: Standard & Poor’s and Fiserv

What's been said:

Discussions found on the web: