For several months, I had been getting increasingly curious about the fact that the St. Louis Fed’s FRED data and economic research service was no longer indicating a vertical “recession bar” from the period starting around mid-year 2009. Finally, today, curiousity got the best of me and I called my St. Louis Fed contact. This was his response (confirming what I’d already inferred):

Apparently the two staff economists that review the FRED charts believe July 2009 is the date they believe the NBER will announce as the end of the recession. From what I understand a similar “call” was made toward the end of the 1990-91 recession.

If I was to highlight one source they used it would be Jeremy Piger’s (University of Oregon), recession probabilities. He was a staff economist until about 4-5 years ago.

I’m not entirely sure I agree with their assessment, but do think it noteworthy that one of our Federal Reserve banks has apparently “called” a July 2009 end to the recession. I should have inquired on this point sooner, but life got in the way.

FWIW. Carry on.

>

Industrial Production Index (Series: INDPRO)

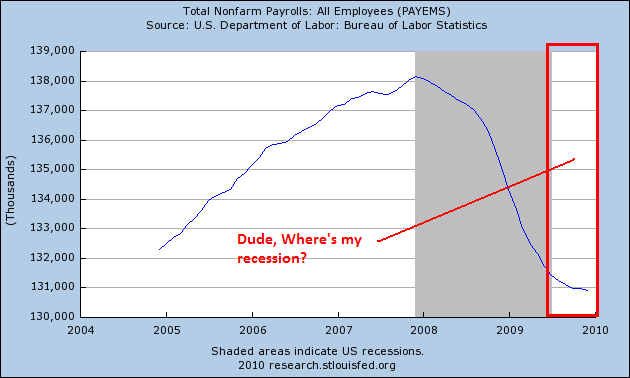

Total Nonfarm Payrolls: All Employees (Series: PAYEMS)

What's been said:

Discussions found on the web: