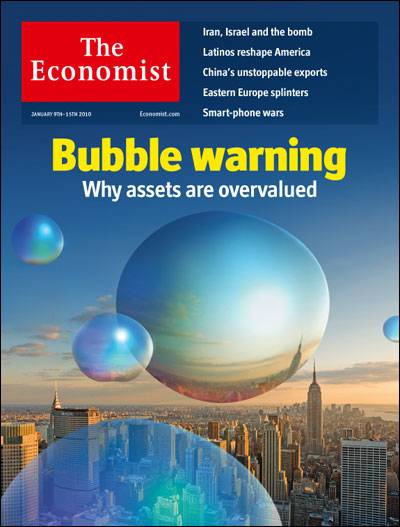

Great cover — and cover story — this week in the Economist:

“The effect of free money is remarkable. A year ago investors were panicking and there was talk of another Depression. Now the MSCI world index of global share prices is more than 70% higher than its low in March 2009. That’s largely thanks to interest rates of 1% or less in America, Japan, Britain and the euro zone, which have persuaded investors to take their money out of cash and to buy risky assets.

For all the panic last year, asset values never quite reached the lows that marked other bear-market bottoms, and now the rally has made several markets look pricey again. In the American housing market, where the crisis started, homes are priced at around fair value on the basis of rental yields, but they are overvalued by almost 30% in Britain and by 50% in Australia, Hong Kong and Spain.

Stockmarkets are still shy of their record peaks in most countries. The American market is around 25% below the level it reached in 2007. But it is still nearly 50% overvalued on the best long-term measure, which adjusts profits to allow for the economic cycle, and is on a par with two of the four great valuation peaks in the 20th century, in 1901 and 1966.”

Is this a contrarian signal?

>

>

I doubt it. This is a valuation discussion in a business mag; I’m not certain it has the appropriate mass appeal to qualify. I certainly would not suggest that the public is part of a bubble zeitgeist, and this cover represents the climax of that.

Based upon that, it does not seem to be the sort of contrarian magazine cover indicator

>

Hat tip Dan B!

Source:

Bubble warning

The Economist print edition, Jan 7th 2010

http://www.economist.com/opinion/displaystory.cfm?story_id=15213157

What's been said:

Discussions found on the web: