Laurie Goodman is a well regarded expert on securitization and MBS. She is the former UBS mortgage analyst — Institutional Investor #1 ranked — and is now at Amherst Securities (Bloomberg video here). In a 17 page report released Tuesday, Goodman tried to estimate the total losses that the now-government-owned GSEs will accrue.

This is not an abstract question: Since the Christmas Eve massacre when the Treasury department removed all government caps on aid to Fannie/Freddie, Uncle Sam aka the taxpayers are on the hook for unknown amounts. Given the GSE’s hold $5.5 trillion dollars in mortgages, the potential losses are $100s of billions, if not trillions of dollars.

Not to get too wonky, but Goodman’s methodology was to cross-reference loan performance from the First American CoreLogic’s LoanPerformance Prime Servicing Database (LPSS) against other known mortgage databases. The goal was to develop parallel models that looked for similarities between conventional loans the GSEs held, comparing them with similar non GSE mortgages. Doing so would create a basis for estimating future delinquencies and foreclosures. The LPPS database contains information on 29 million active loans and 92 million closed loans, considered to be “prime” by the servicers. From this source, Goodman looked at variables such as payment history and re-default trends. The GSE and bank portfolio loans turned out to be strongly correlated, suggesting the GSE book would see defaults similar to defaults in prime, private label securitizations. Based upon the above data, a likely loss number was calculated.

And what are those estimated losses Goodman projects for the GSEs ?

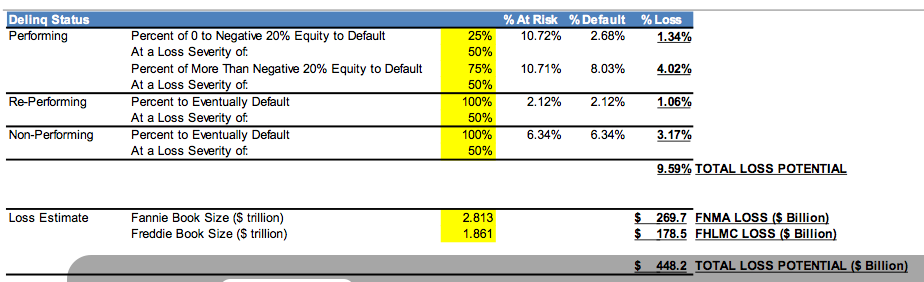

Freddie will likely lose around $178 billion of its $1.86 trillion credit guarantee book, and Fannie will likely lose $270 billion of its $2.81 trillion book. Combine the credit guarantee books of the two firms, and you reach a $4.67 trillion book, with estimated losses at just under ~10%, or $448 billion.

Goodman notes that “overall losses on loans in the Fannie and Freddie credit guarantee books will be ~9.6%, very close to that for the 1983-84 origination in the 4 most severely hit states during the oil bust in the 1980s.”

Ever since the US government took over the GSEs in September 2008 under Bush/Paulson, and the expansion of that policy under Obama/Geithner, the Government has injected ~$112 billion into these two entities. If Goodman is correct — and her guess is about as good as anyone’s — the budget deficit is about to get $336 billion larger.

To put that into context, from September 5, 2008 forward (the day the the GSEs were put into conservatorship) the U.S. Government is likely to spend more money bailing out Fannie/Freddie than they have on the Iraq and Afghanistan Wars — combined.

Over the next few days, we will consider what this means for the Credit and Housing markets, as well as for policy makers. Meanwhile, today’s TBTF tax is gonna need to be a whole lot bigger as the whole in the deficit expands.

>

Charts and tables after the jump.

click for larger graphics

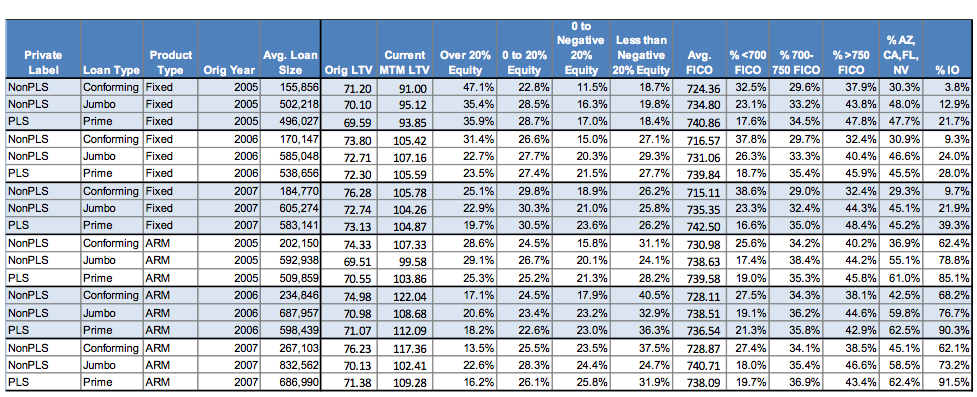

Loan Characteristics

Source: Loan Performance, Amherst Securities

>

Exhibit 3 (above) the characteristics of the loans. We have shown average loan size, average original LTV, distribution of LTVs, average original FICO, FICO distribution, average current LTV, and the distribution of current LTVs. We also included data on the % IO and the % of loans from the sand states (i.e., CA, AZ, NV, FL—the 4 states that experienced the greatest home price depreciation). We excluded CLTV data, which was very spotty. We excluded documentation type (full/other), as we believe the definition of “full doc” is ambiguous for Agencymortgages in which some of the documentation is waived.

Annualized Default Rates – 2005-2007

Source: Loan Performance, Amherst Securities

>

Estimating Losses on GSE Credit Guarantee Books

Source: Fannie Mae, Freddie Mac, LoanPerformance , Amherst Securities

>

Sources:

In-Depth Look – Crash In US Home Prices May Resume (Video)

Conventional GSE and Portfolio Loans Behave Like Prime PLS

MBS Strategy Group: Laurie Goodman, Roger Ashworth, Brian Landy, Ke Yin

Amherst Securities Group, January 12, 2010

GSEs Could Lose $448bn of MBS Guarantee Business, Says Amherst

DIANA GOLOBAY

Housing Wire, January 13th, 2010, 3:21 pm

http://www.housingwire.com/2010/01/13/gses-could-lose-448bn-of-mbs-guarantee-business-says-amherst/

What's been said:

Discussions found on the web: