Following yesterday’s look at performance by years, Eric Willer in our Dallas office sent me these charts — they are quite instructive as to how markets have performed over various decades:

>

Annualized S&P500 Returns by Decade

>

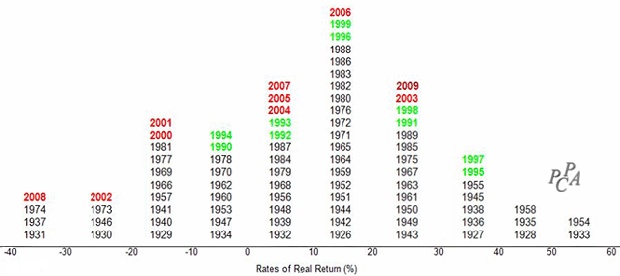

Return History for Common Stocks 1926-2009 (inflation adjusted)

Average Annually Compounded Return = 6.7%

All charts courtesy of PPCA Inc.

>

Good stuff — thanks, Eric!

>

Source:

Perspectives on 2009 and Beyond (PDF)

Ron Surz

Horse’s Mouth, January 4, 2010

http://www.horsesmouth.com/panel/LinkTrack2.asp?http://www.ppca-inc.com/pdf/2009Perspectives.pdf

What's been said:

Discussions found on the web: