I stumbled across a fascinating pierce of research (via a reader) regarding misaligned pay incentives Bear Stearns and Lehman Brothers:

“The standard narrative of the meltdown of Bear Stearns and Lehman Brothers assumes that the wealth of the top executives of these firms was largely wiped out along with their firms. In the ongoing debate about regulatory responses to the financial crisis, commentators have used this assumed fact as a basis for dismissing both the role of compensation structures in inducing risk-taking and the potential value of reforming such structures. This paper provides a case study of compensation at Bear Stearns and Lehman during 2000-2008 and concludes that this assumed fact is incorrect.

We find that the top-five executive teams of these firms cashed out large amounts of

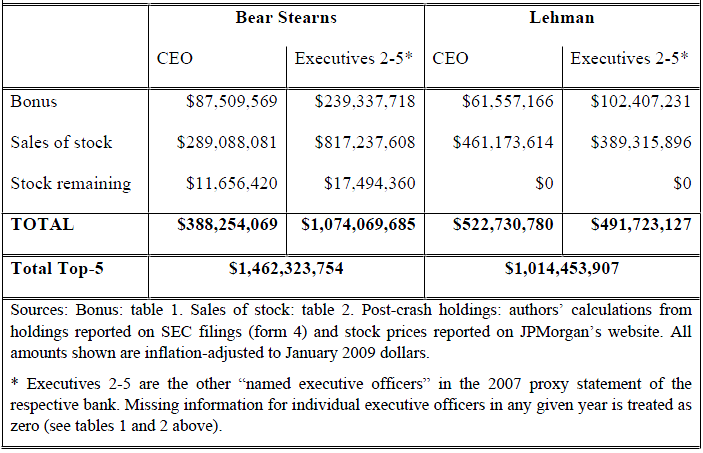

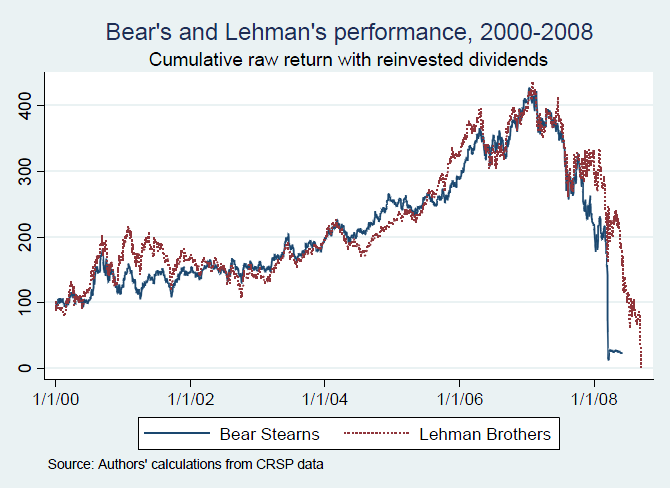

performance-based compensation during the 2000-2008 period. During this period, they were able to cash out large amounts of bonus compensation that was not clawed back when the firms collapsed, as well as to pocket large amounts from selling shares. Overall, we estimate that the top executive teams of Bear Stearns and Lehman Brothers derived cash flows of about $1.4 billion and $1 billion respectively from cash bonuses and equity sales during 2000-2008. These cash flows substantially exceeded the value of the executives’ initial holdings in the beginning of the period, and the executives’ net payoffs for the period were thus decidedly positive.The divergence between how the top executives and their shareholders fared implies that it is not possible to rule out, as standard narratives suggest, that the executives’ pay arrangements provided them with excessive risk-taking incentives. We discuss the implications of our analysis for understanding the possible role that pay arrangements have played in the run-up to the financial crisis and how they should be reformed going forward.”

And to drive the point home, the authors include this lovely matching table and chart set:

Total Cash Flows from Bonuses and Equity Sales 2000-2008

2000-2008 Performance

>

It wasn’t just BSC & LEH, it was most of the publicly traded financial firms.

I always found it an amazing coincidence that none of the private partnerships got into any trouble. Coincidence? Perhaps not — from page 136, Bailout Nation:

More importantly, banks started adopting the “eat what you kill” compensation systems. The bonus structure, replete with short-term financial incentives, began to dominate banks. Throw in monthly performance fees and annual stock option incentives, and you end up with a skewed business model suddenly embracing quicker trading profits.

“This had an enormous impact upon the ways investment banks approached business generation and risk management. Like many public companies, they became increasingly short-term focused. “Making the quarter,” in Street parlance, meant pulling out all the stops to hit your quarterly profit figures, by any means necessary. Incentives became misaligned with shareholders’ interests, as risky short-term performance was rewarded with huge bonuses. Not surprisingly, this worked to the detriment of long-term sustainability.

But short-termism was only part of the equation. Of greater concern was how these firms’ internal risk management changed. Unlike in public corporations, partners are personally liable for the acts of any of the members of the partnership. If any one of a firm’s partners or employees loses a trillion dollars, every last partner is on the hook for that money.

As you would imagine, this creates enormous incentives to make sure that risk is managed very, very carefully. Nothing focuses the mind like the real possibility that any partner could bankrupt all the rest. It’s no coincidence that partnerships like Lazard Freres and Kohlberg Kravis Roberts did not suffer the same kind of risk management failures as Bear Stearns and Lehman Brothers, among others. (Lazard went public in 2005, but too late in the credit cycle for it to get into much trouble.)”

The entire Yale Journal on Regulation is worth a browse . . .

>

Sources:

Cashing in Before the Music Stopped

Lucian Bebchuk, Alma Cohen, and Holger Spamann, Harvard Law School on Monday Harvard Law School Program on Corporate Governance, December 7, 2009

http://blogs.law.harvard.edu/corpgov/2009/12/07/cashing-in-before-the-music-stopped

Bankers had cashed in before the music stopped

Lucian Bebchuk, Alma Cohen and Holger Spamann

FT, December 6 2009

http://www.ft.com/cms/s/0/5c7cd070-e29b-11de-b028-00144feab49a.html

The Wages of Failure: Executive Compensation at Bear Stearns and Lehman 2000-2008

Yale Journal on Regulation, Forthcoming

Lucian A. Bebchuk, Harvard University – Harvard Law School; National Bureau of Economic Research (NBER); European Corporate Governance Institute (ECGI)

Alma Cohen, Tel Aviv University – Eitan Berglas School of Economics; Harvard Law School; National Bureau of Economic Research (NBER)

Holger Spamann, Harvard University – Harvard Law School

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1513522

What's been said:

Discussions found on the web: