This will be the last mention of media bias for the foreseeable future: The NYT wades into the market action last week, and spots numerous factors contributing to the volatility:

“Worries about the strength of the global recovery and proposals from Washington to clamp down on banks have sent fresh jitters through financial markets, prompting chatter among traders that stocks could be poised for that rare but alarming phenomenon: a correction…

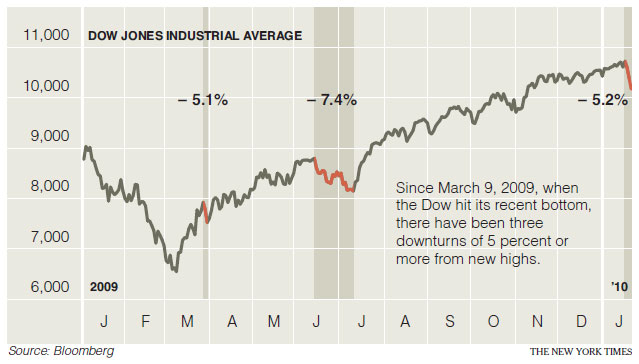

Over three tense days last week, stocks tumbled nearly 5 percent; the Dow posted triple-digit losses on Wednesday, Thursday and Friday, ending the week at its lowest level since November.Some analysts believe the downward momentum may continue. They say the ingredients are there: a spike in volatility (up 55 percent in the three-day period last week, according to one gauge); activism from Washington (the Obama administration’s crusade against risky banks and uncertainty over the future of the Federal Reserve chairman, Ben S. Bernanke); and concerns over the slow pace of a global recovery (worries of a default in Greece and inflation in China).”

One cannot help but point out this is what balanced market reporting — as opposed to the front page laugher we saw in the WSJ last week — looks like.

>

click for larger graphic

courtesy of NYT

>

Previously:

WSJ Jumps the Shark (January 22, 2010)

http://www.ritholtz.com/blog/2010/01/wsj-jumps-the-shark

The WSJ Responds (January 22, 2010)

http://www.ritholtz.com/blog/2010/01/wsj-another-view/

What Balanced Market Reporting Looks Like (January 23, 2010)

http://www.ritholtz.com/blog/2010/01/what-balanced-market-reporting-looks-like-ft/

Source:

Volatility and Politics Are Feeding Fears of a Market Correction

JAVIER C. HERNANDEZ

NYT, January 24, 2010

http://www.nytimes.com/2010/01/25/business/25markets.html

What's been said:

Discussions found on the web: