Speaking of bailouts: I have a funny little story that relates indirectly to TARP and government bailouts.

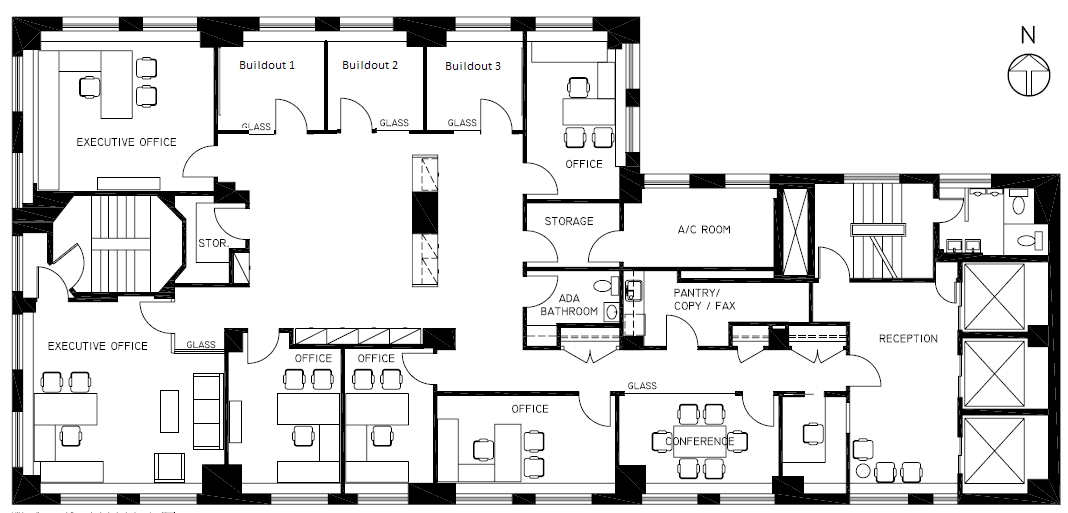

Last week, we moved into new offices — same building, up 20 floors from the old office. The building “wedding cakes” as you go up, so the higher floors are much smaller (5-10k sq ft) than the lower ones, which are the better portion of a city block.

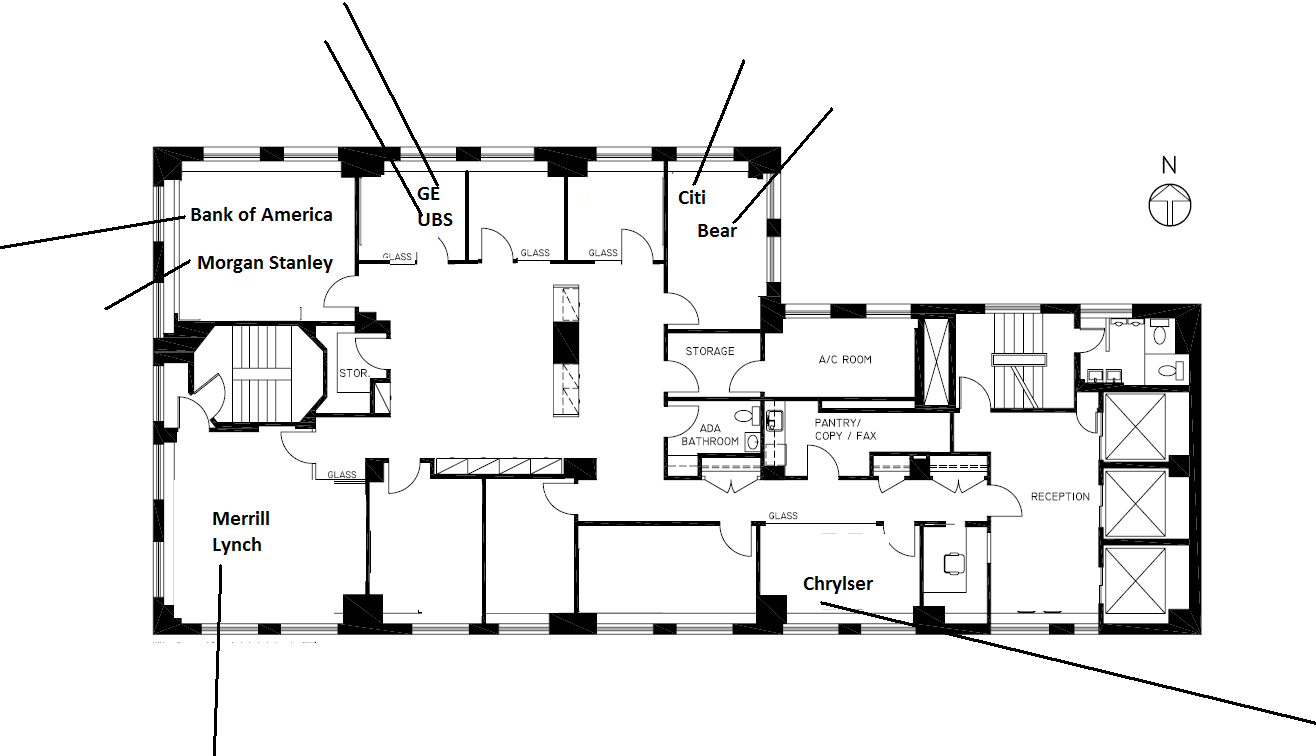

Have a look at the architectural floor plans; We almost have full 360 ° views — the elevator banks on the East side of the floor block that view, but we can still see East from one office (NE corner). So we don’t quite have views in every direction — lets call it ~320 ° views:

>

Over the past few weeks, I have walked through the space with real estate people, contractors, building reps, etc., and noticed something rather amusing: Out of every single office, I could see the offices of at least one major bailout recipient — some offices, I could see four !

If we start at the elevators, walk into the conference room (facing South), and work our way clockwise (South to West to North to East), these are the various bailouts I can see:

Chrysler, Merrill Lynch, Morgan Stanley, Bank of America, General Electric, UBS, Bear Stearns and CitiGroup !

A full run of actual photos I took last week in the new office are after the jump:

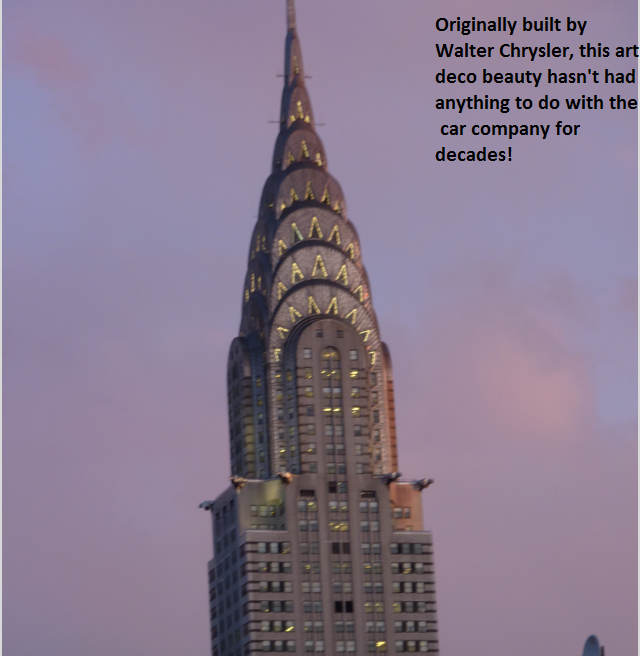

Chrysler & GM

(GM building is ~15 blocks up 5th Avenue from us, on the same side of the street. We can’t see it from any of our windows, and I believe they sold the building some years ago).

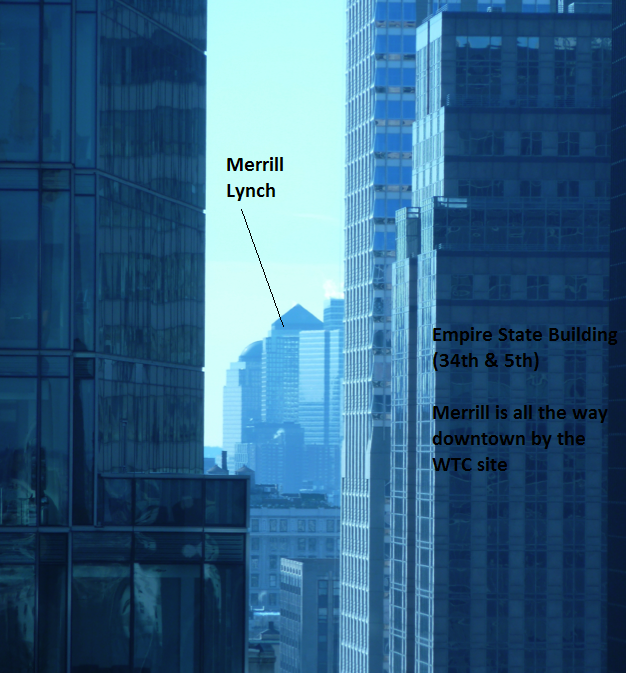

Merrill Lynch& American Express

Amex is right behind Merrill in the close up, above.

This will give you a sense of how far downtown Merrill is from midtown

A few blocks South and a bit East is Goldman Sachs (but we can’t see that from here).

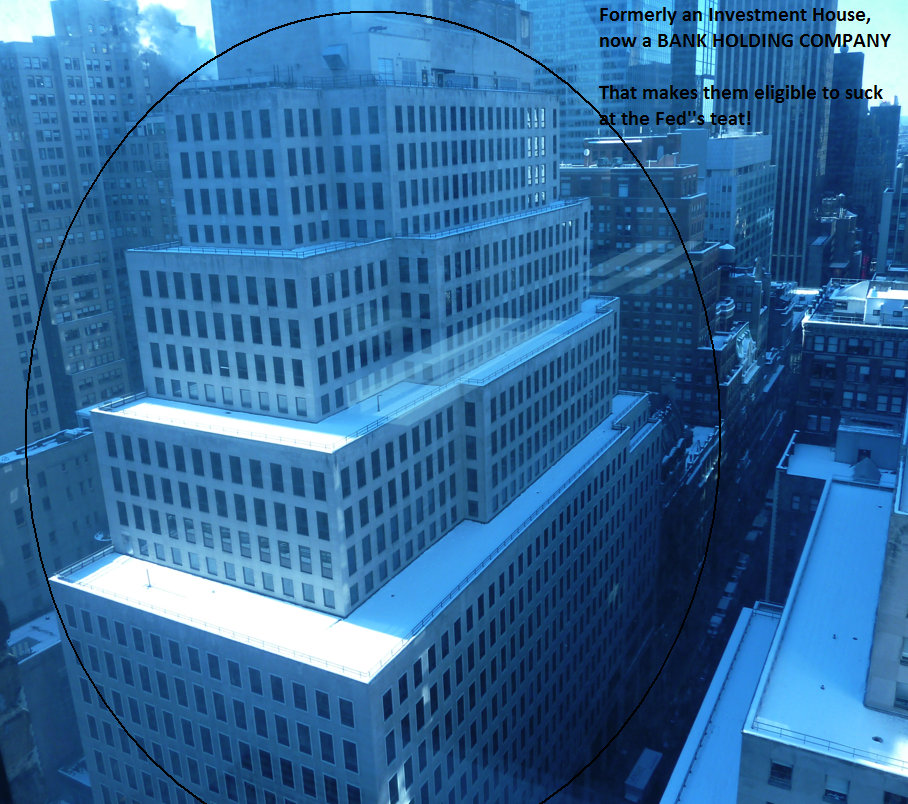

Morgan Stanley

Bank of America

I can’t quite see the old Lehman Brothers building (formerly Morgan Stanley, now Barclays), which is is 3 blocks north (to the right in this picture) from BofA.

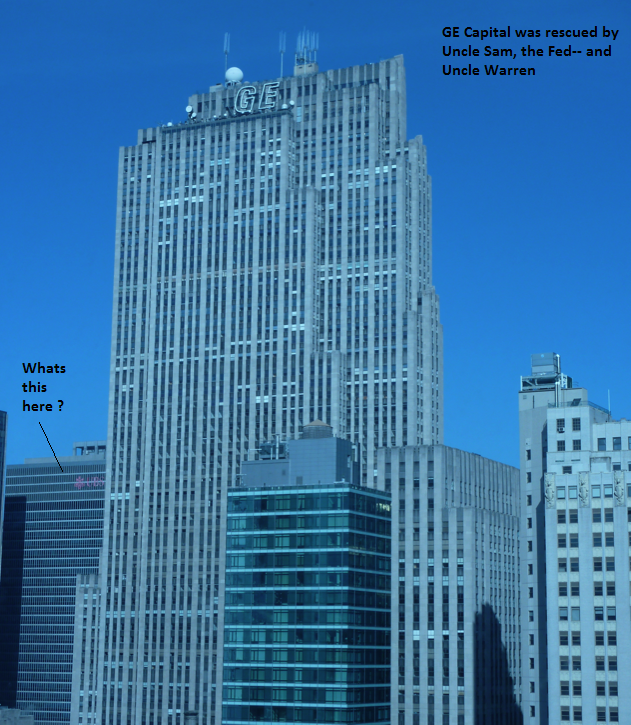

GE

UBS

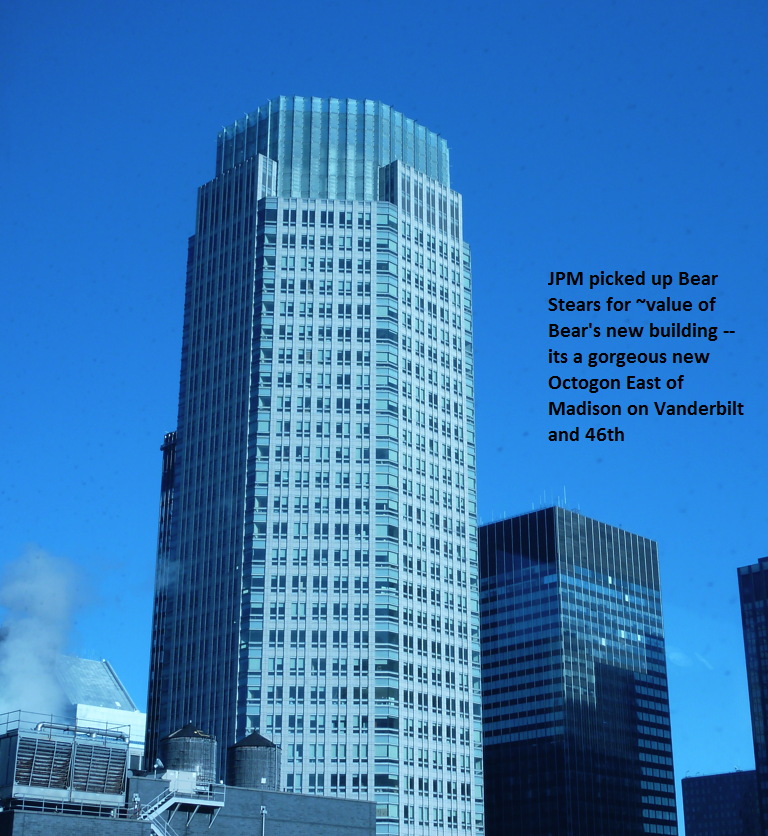

Bear Stearns

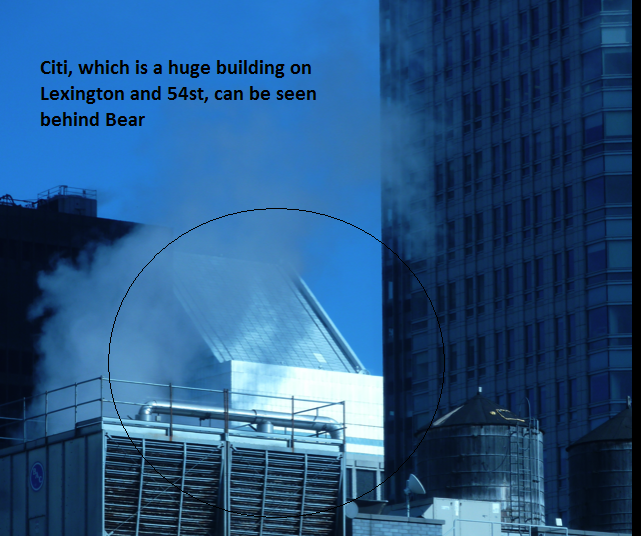

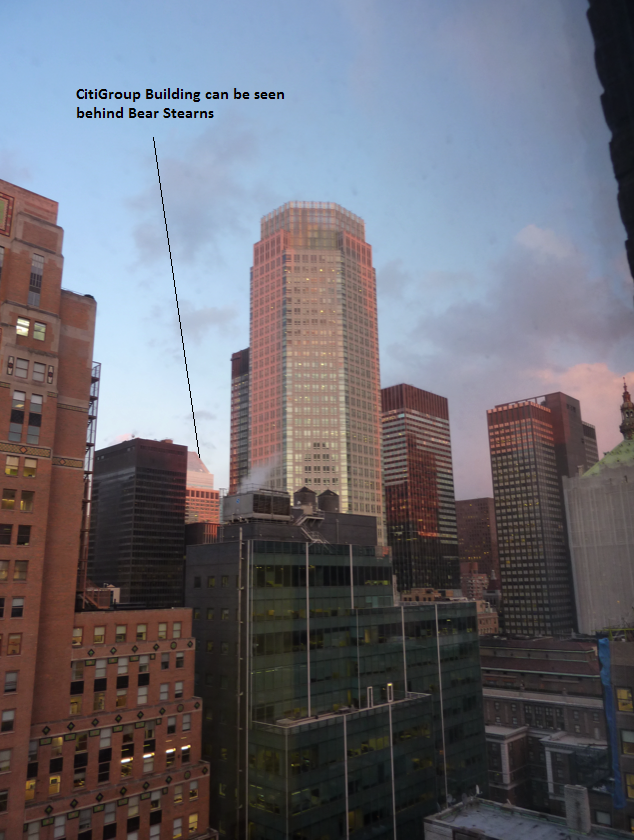

CitiGroup

This gives you a sense of how far away Citi is — its actually a MUCH bigger skyscraper than Bear.

And that, dear readers, is our Bailout Skyline!

~~~

UPDATE:

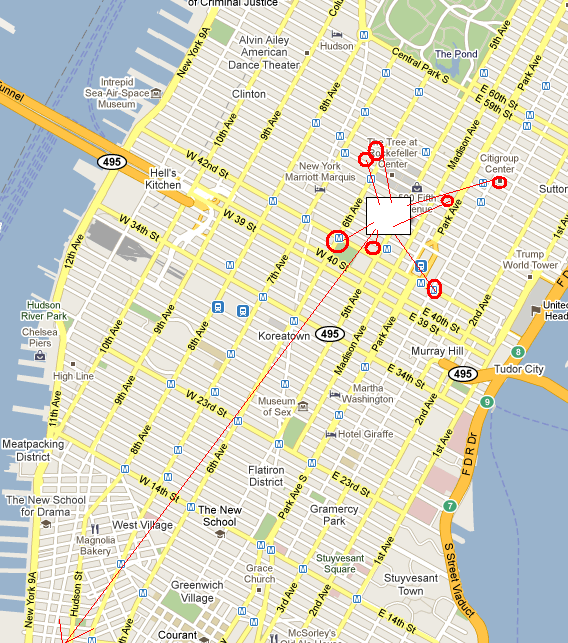

Here are where the views are:

click for larger graphics

What's been said:

Discussions found on the web: