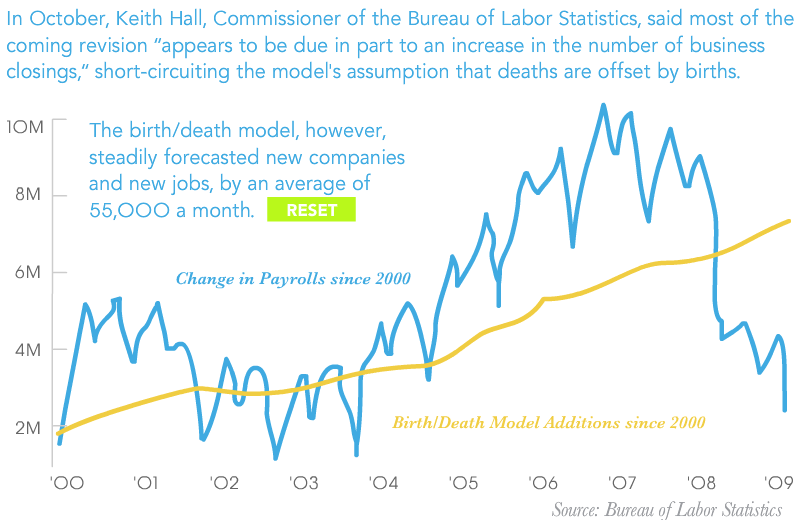

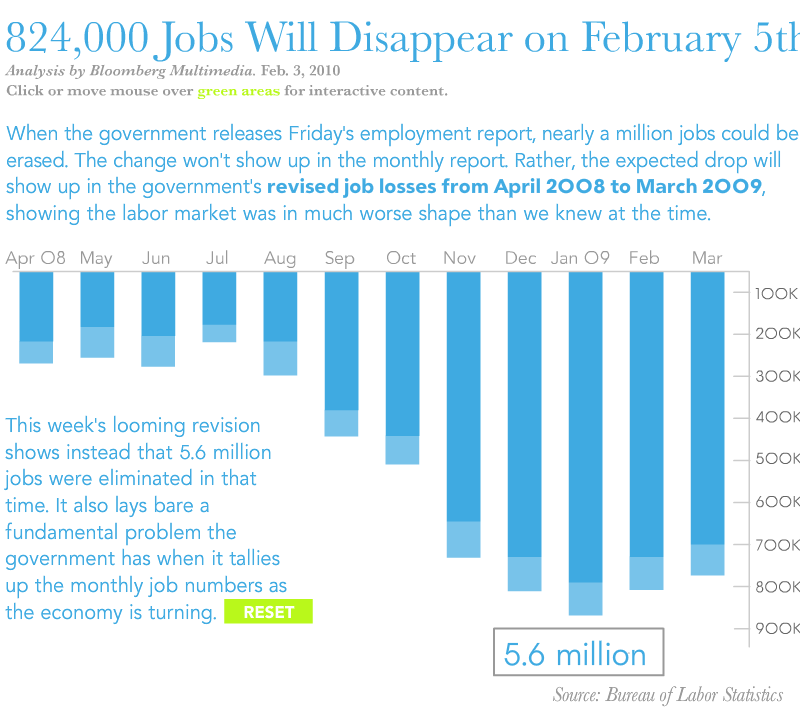

With the NFP payroll report out tomorrow morning, Bloomberg.com put together a timely infographic on one of our favorite pet peeves: the Birth Death Adjustment.

Overall, the piece is good (see charts below). One small quibble: They should have mentioned that int he beginning of the cycle, the B/D catches job creation that the usual methods miss; problem is that at the end of the business cycle, it misses job losses the usual methods catches.

Click for interactive charting:

~

~

As in so much of life, improvements in one part of the model cause problems in another . . .

What's been said:

Discussions found on the web: