Yesterday’s WSJ had an article about Canada’s Housing market. (Housing Rebound in Canada Spurs Talk of a New Bubble). The article noted that “Average home prices in Canada have risen 23% from their trough in January 2009. Home-sales volumes are up 70% over the same period . . . Canada’s housing recovery has been so rapid that some here are worrying about a bubble.”

But to call it a rebound misses the point. As the Cleveland Fed pointed out, Canada’s housing market never went bust — there was a sales dip, but nothing like the US. And prices have continued to go higher to the point where the Journal is now discussing them in terms of bubbliciousness.

Why is that?

There are a variety of reasons why Canada’s market held up better than that of the US, but I boil it down to the big four:

1) Lending Standards were increasingly non-existent in the US from 2001-07. On the other hand, Canada never had the non-bank lenders that abdicated these standards en masse. There was no “Lend-to-Securitize” business model in Canada.

2) Mortgage Insurance: Mortgages with less than 20% down payment are considered a high LTV ratio (This was 25% previously), and in these purchases, mortgage insurance is required. Over 80% of Canada’s homes have what is commonly known as PMI in the US.

3) Full Recourse Mortgages — you can walk away from the house, but not the mortgage debt. Makes quite a difference in the way borrowers behave.

4) Single Regulator, Lack of Regulatory Capture: The hodge-podge of Federal and State regulators encourages forum shopping; it also masks much of the massive lobbying effort by US banks and investment houses. Lobbying dollars don’t seem to be nearly as pernicious or corrupting North of the border.

The Cleveland Fed also noted that subprime mortgages accounted for a fifth of all US mortgages originated between 2004–2006. In Canada, the subprime market share was roughly 5% percent in 2006—compared to 22% percent in the U.S. And the Canadians never expanded significantly into the wackier exotic mortgage products — IOs, Neg Ams, Piggy Backs, etc. (interest-only and negative-amortizations grew rapidly in the U.S. from 2003 to 2006).

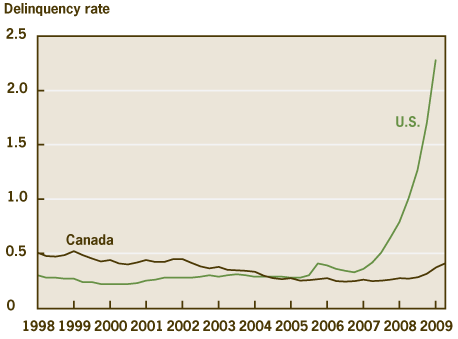

Hence, with a subprime market less than a quarter the size of the US (percentage wise), and homeowners who were on the hook for their own bad purchases, its no surprise that Canada’s housing market is far less boom & bust prone than the US RE market has been.

>

US vs Canada Delinquency Rates

US vs Canada Home Prices

>

Sources:

Housing Rebound in Canada Spurs Talk of a New Bubble

PHRED DVORAK

WSJ, Feb 8, 2010

http://online.wsj.com/article/SB10001424052748703808904575025100730017666.html

Why Didn’t Canada’s Housing Market Go Bust?

James MacGee

The Federal Reserve Bank of Cleveland 12.02.09

http://www.clevelandfed.org/research/commentary/2009/0909.cfm

What Toronto can teach New York and London

Chrystia Freeland

FT, January 29 2010

http://www.ft.com/cms/s/2/db2b340a-0a1b-11df-8b23-00144feabdc0.html

Additional Sources:

Banks urge Ottawa to tighten mortgage rules

Boyd Erman and Tara PerkinsFrom Globe and Mail Feb. 06, 2010

http://www.theglobeandmail.com/report-on-business/banks-urge-ottawa-to-tighten-mortgage-rules/article1458585/

Nobody’s saviour

TARA PERKINS

The Globe and Mail, Apr. 20, 2009

http://www.theglobeandmail.com/report-on-business/article1138040.ece

Homeownership Rate Falls Back to Pre-Boom Level (Economix)

http://economix.blogs.nytimes.com/2010/02/02/homeownership-rate-falls-back-to-pre-boom-level/

Jumbo Mortgage ‘Serious Delinquencies’ Rise to 9.6%

Jody Shenn

Bloomberg, Feb. 8 2010

http://www.bloomberg.com/apps/news?pid=20601110&sid=at0fpRHaUHhE

What's been said:

Discussions found on the web: