One of the oddest things to come out of the entire credit crisis, recession and muddling recovery has been the sudden re-emergence of deficit hawks.

While a few honest deficit hawks are out there — the Peterson Institute is a good example of a group looking at long term structural issues, not immediate fiscal concerns — the vast majority of born again fiscal hawks are political hypocrites. They voted for all manner of budget busting programs — unfunded tax cuts, new entitlement programs (i.e., prescription drugs), an expensive war of choice (Iraq).

How is it that they only learned of the evils of deficits after they lose power? How very convenient.

The current group of anti-deficit spenders are pro-cyclical, rather than counter-cyclical. This means that during an expansion, they have no problem with expanding deficits, running big spending programs, giving generous tax cuts. During a recession is where they suddenly rediscover fiscal prudence.

This is ass backwards. During an economic expansion, with employment gaining and GDP growing is when you should be thinking about saving for the next rainy day. Counter-cyclical spending means that governments should watch the budget carefully during the good times, but spend spend more freely during the downturns. What we are hearing from this crowd is the exact opposite of what should be.

Many people believe the government’s early withdrawal of depression stimulus after the early 1930s is what caused another downturn circa 1938-39. But few people realize that Japan made the exact same mistakes in 1997 and 2001.

That is the lesson SocGen’s Albert Edwards points to in Richard Koo’s book about Japan’s balance sheet recession, The Holy Grail of Macroeconomics: Lessons from Japan’s Great Recession:

The crux of his analysis is that governments have no option but to stimulate

aggressively all the while the private sector is de-leveraging. ANY attempt at fiscal cuts simply results in renewed recession and a further loss of confidence, thus making it even harder and more costly to sustain any subsequent recovery and hence the budget deficit ends up bigger than before (e.g. see chart below). This is exactly the outcome I expect.

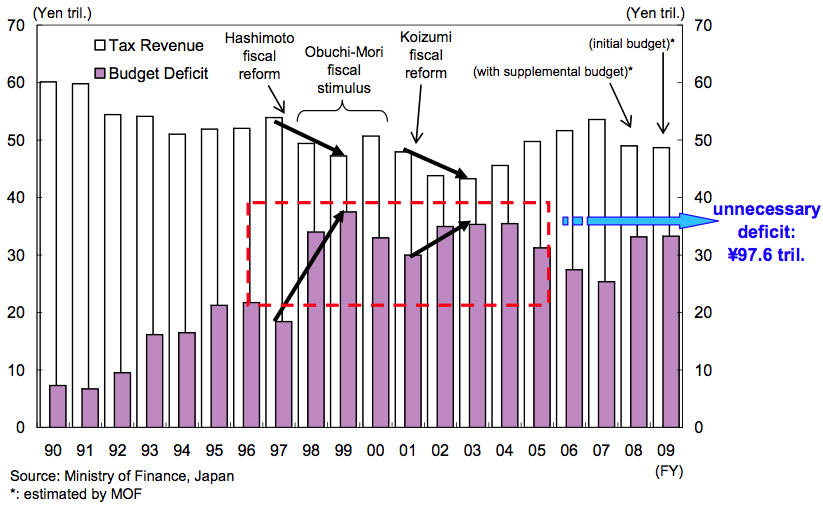

Koo argues that the premature fiscal tightening by Japan 1997 and 2001 weakened the economy, reduced tax revenue and ultimately made the fiscal deficit even bigger:

Premature Fiscal Reforms in 1997 and 2001 Weakened Economy, Reduced Tax Revenue and Increased Deficit

Source: Nomura Securities

>

There are few things more annoying the a drinker who just discovered sobriety: Hence, those who have spent the past decade getting drunk on government spending are now suddenly proselytizing a belated sobriety. These calls are occurring exactly when government largesse would do the most good.

I can’t tell what motivates these new deficit hawks — are they merely ignorant, unaware of the historical analogs? Or are they hoping for another recession as part of a debased power grab? (I don’t know).

What I am sure of is that calling for fiscal temperance RIGHT NOW is essentially calling for another recession . . .

>

Sources:

The Age of Balance Sheet Recessions: What Post-2008 U.S., Europe and China Can Learn from Japan 1990-2005

Richard C. Koo, Chief Economist

Nomura Research Institute

Tokyo, March 2009

KOO’s “Good News”

Welling, September 11, 2009

http://welling.weedenco.com/newsletterdownload.aspx?newsletterpictureid=1803 (PDF)

Richard Koo books:

The Holy Grail of Macroeconomics: Lessons from Japan’s Great Recession

Wiley 2009

Balance Sheet Recession: Japan’s Struggle with Uncharted Economics and its Global Implications

Wiley, 2003

See also:

Caving to Congress Creeps Into Market Views on Obama

Rich Miller and Mike Dorning

Bloomberg, Feb. 16 2010

http://www.bloomberg.com/apps/news?pid=20601109&sid=aDAeDq0lg0Rw&

Judging a Stimulus by the Job Data Reveals Success

DAVID LEONHARDT

NYT, February 16, 2010

http://www.nytimes.com/2010/02/17/business/economy/17leonhardt.html

What's been said:

Discussions found on the web: