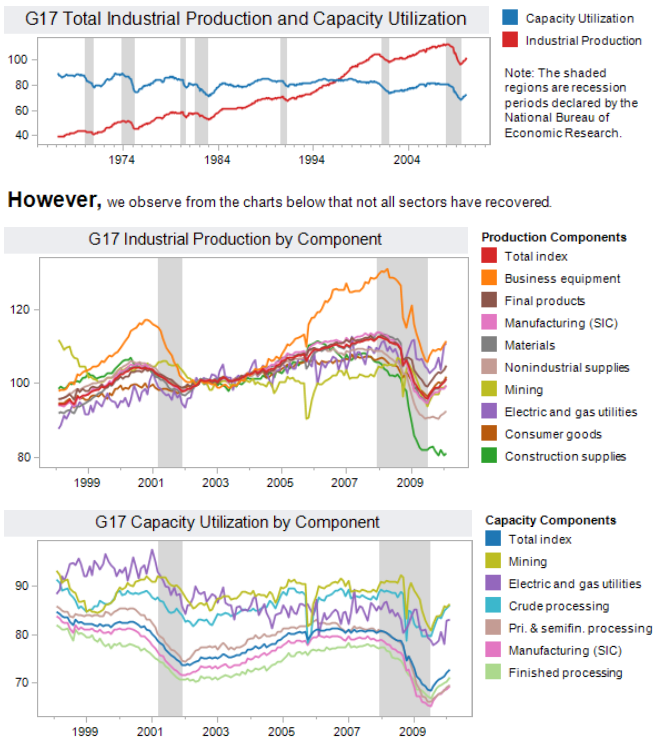

Yesterday, we noted that the Fed seems to have declared the end of the recession based upon Industrial Production (Federal Reserve Declares Recession Over).

The folks over at Tableau Software took another swipe at the data, and found the answer is less clear cut then the Fed suggests. A breakdown by sector is somewhat are far less conclusive than Industrial Production

>

Sector Analysis of Industrial Production

Chart courtesy of Tableau Software

>

Construction is the obvious laggard, with consumer goods 2nd to last . . .

What's been said:

Discussions found on the web: