Of all the various economic indicators and data points out there, is there one that has any special ability to forecast future economic activity?

Or defined more broadly, what gives the best insight into future GDP ?

That is the question Dave Livingston of Llinlithgow Associates (he blogs at BizzXceleration) was considering perusing when he noticed one metric in particular stood out: Retail Sales.

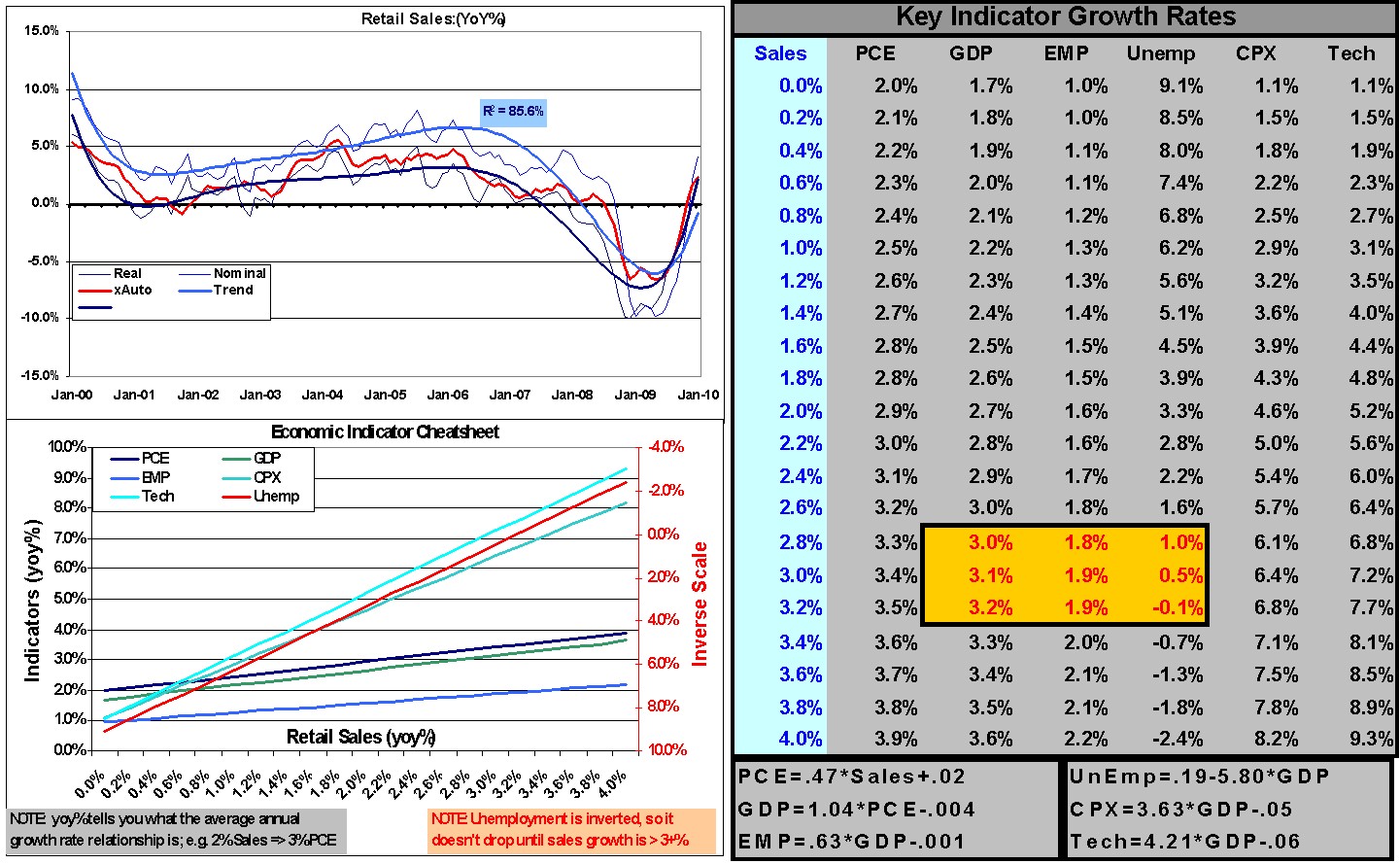

So Dave did what any good econo-geek would do — he a regression analysis between YoY changes in retail sales and other key indicators. (See composite chart of Retail Sales, with

his Cheat Sheet table, below).

Dave acknowledges this “cuts some corners, but it might serve a useful quicklook purpose.” How? Every time there’s a new sales report you can guestimate GDP, Employment, Consumption, Investment changes.

It also operates on another level as a brutal reality check — look at what GDP growth rates are required to get Unemployment down from these levels.

Dave adds that despite all the caveats to this, the table below is a great thing to have in your wallet the next Wonk Dinner Party you attend — just whip it out and read off the economic outlook based on the latest headline!

>

click for larger graph

What's been said:

Discussions found on the web: