Bloomberg News is out with its latest monthly survey of economists’ forecasts and, according to those polled, the U.S. economy “will grow 3 percent this year and next, more than anticipated a month ago.”

Good news, right?

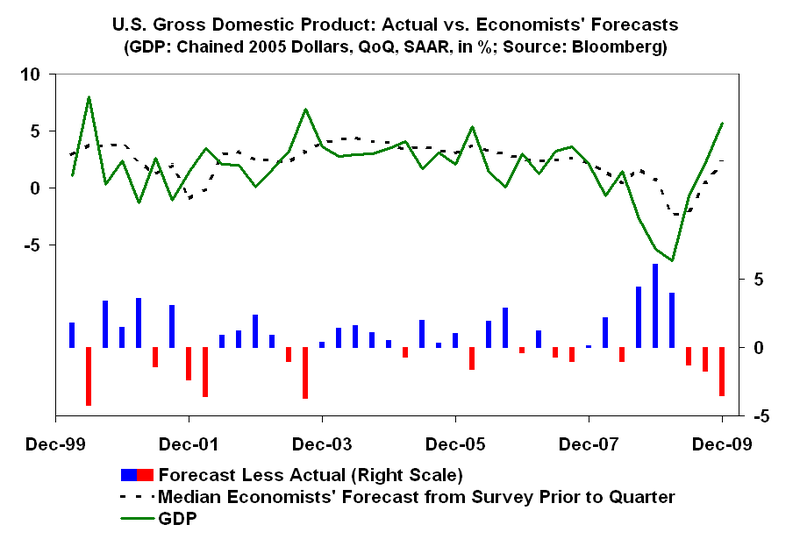

Well, maybe not. If you go back and look at how the experts have fared when forecasting the pace of growth for any given quarter, let alone for the year ahead, their tea leaf reading skills have left a lot to be desired.

Based on an analysis of Bloomberg monthly surveys published just prior to or at the beginning of each quarter over the course of the past decade, the professional prognosticators as a group have rarely been close to the mark.

Except for the last quarter of 2007, when the economists’ prediction (published in September) came within 5 percent of the reported result, the differences in percentage points between their estimates and the actual readings have been in the double digits — at a minimum.

In fact, on three occasions — the first quarter of 2000, the fourth quarter of 2002, and the third quarter of 2006 — the economists overestimated the pace of quarterly GDP by 1,133 percent, 2,400 percent, and 2,900 percent, respectively.

Aside from the fact that many of the so-called experts still haven’t quite figured out that what the economy has been going through is anything but a garden-variety downturn, their history of poor calls on the near-term outlook suggest their longer-term forecasts should be taken with a grain of salt.

~~~

http://www.financialarmageddon.com/2010/02/grain-of-salt-forecasting.html

What's been said:

Discussions found on the web: