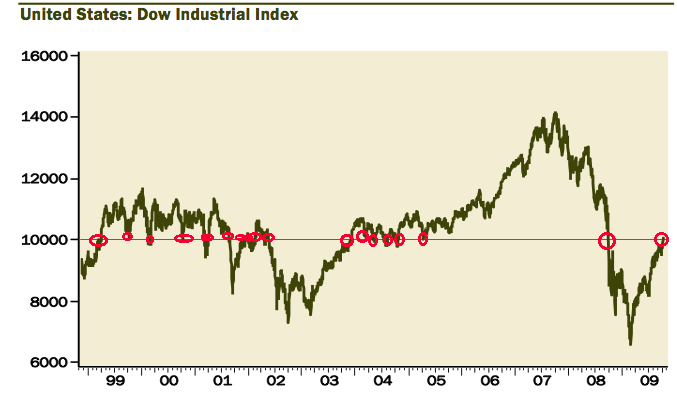

Once again, we see the 10,000 level is not worth much as support — or resistance. Its a tv talking point but little more.

As we noted back in October, we have crossed this line repeatedly — this makes the 27th or so time!

>

>

Save the hat– you’ll get more — probably a lot more — use out of them in the future!

What's been said:

Discussions found on the web: