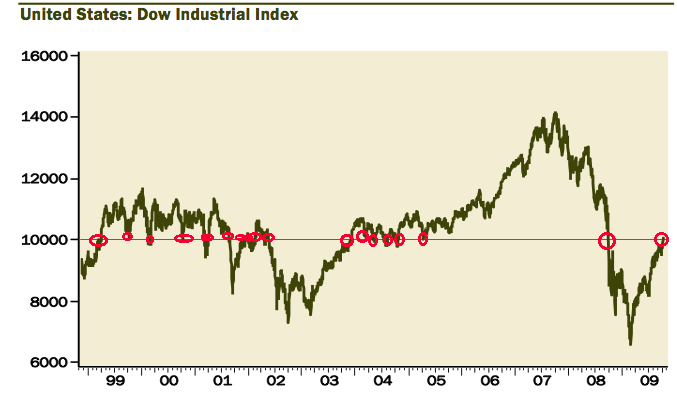

Last October, we noted that Dow 10,000 was “a meaningless number, without any impact technically or quantitatively. Its no surprise that the Dow did not hold over 10k for very long. Its been over 26 times, starting in 1999. And hear it is, 10 years later — zero progress. Why anyone — other than tv producers and silly hat manufacturers — cares about D10k is quite simply beyond my comprehension . . .”

The WSJ’s Carl Bialik comes to the same conclusion:

“Arbitrary milestones pervade economics, finance and everyday matters. Some carry more meaning than others: Foreign-exchange markets can rattle national confidence when one country’s paper money threatens to drop below parity with a rival’s, which is a meaningful threshold because it is felt in the portfolios of those swapping currencies. It’s less clear why double-digit inflation and unemployment should carry more political weight than rates just less than 10%, particularly given the controversies about how the numbers are calculated.

The milestones are the result of our brains’ attempts to impose order and assign categories to numbers that vary continuously . . . Further diminishing their importance, milestones often don’t change when underlying conditions do. For example, it’s a lot harder for an album to sell one million copies than before music was sold and swapped online, but that’s still the criterion for platinum status. In baseball, some Hall of Fame voters treat 500 home runs and 300 wins as thresholds for sluggers and pitchers, respectively, even though homers have gotten easier to come by, and wins harder.”

A bit more eloquent than what I wrote, but the same general prinicple.

Hey, these charts look strangely familiar:

>

TBP, October 2009

>

Remind me to fire my lazyass copyright attorneys next week!

>

Previously:

Dow 10,000, We Hardly Knew Ya! (October 16th, 2009)

http://www.ritholtz.com/blog/2009/10/dow-10000-we-hardly-knew-ya/

Get Those Dow 10,000 Hats Out of Storage (February 5th, 2010)

http://www.ritholtz.com/blog/2010/02/put-those-dow-10000-hats-back-into-storage-for-now/

Source:

Milestone Figures Grab Attention, but Their Impact Is Hazy

CARL BIALIK

WSJ, FEBRUARY 12, 2010

http://online.wsj.com/article/SB10001424052748703382904575059862880464510.html

What's been said:

Discussions found on the web: