Sundays are a good time to look at some of the academic literature out there. Reader Mike R. sends along this study from Q1 2009 — revised January 29, 2010 — that looked at the “asset-backed commercial paper conduits” a/k/a securitized paper.

Recall the basic idea behind securitization structured finance: It is supposed to distribute risk by aggregating various debt instruments into a large pool, which is then sliced and diced into various tranches of different risk quality (and yield). Risk is supposed to be spread amongst investors, who purchase the tranches they desire based on the degree of risk (relative to return) they want to undertake.

This assumes, however, that there is an honest attempt to structure these securities in order to spread the risk. It is quite possible to create a structure that willfully aims at more nefarious goals.

But that is precisely what occurred during the run up to the financial collapse: Securitization was used to accomplish the opposite goal — namely, to concentrate (rather than disperse) risk. These structures did so by lowering capital requirements.

That is the conclusion of several NYU and Federal Reserve Board researchers who studied the issue. According to Viral V. Acharya, Philipp Schnabl and Gustavo Suarez, that is precisely what occurred:

We analyze asset-backed commercial paper conduits which played a central role in the early phase of the financial crisis of 2007-09. We document that commercial banks set up conduits to securitize assets while insuring the newly securitized assets using credit guarantees. The credit guarantees were structured to reduce bank capital requirements, while providing recourse to bank balance sheets for outside investors.

Consistent with such recourse, we find that banks with more exposure to conduits had lower stock returns at the start of the financial crisis; that during the first year of the crisis, asset-backed commercial paper spreads increased and issuance fell, especially for conduits with weaker credit guarantees and riskier banks; and that losses from conduits mostly remained with banks rather than outside investors.

These results suggest that banks used this form of securitization to concentrate, rather than disperse, financial risks in the banking sector while reducing their capital requirements.

A few interesting charts in the paper are worth exploring:

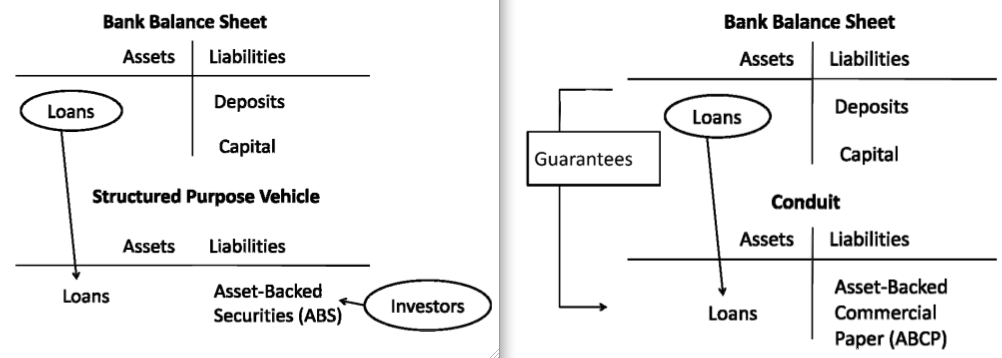

The first is a comparison of Modern Banking – with and without risk transfer during Securitization:

Modern Banking – Securitization with/without risk transfer

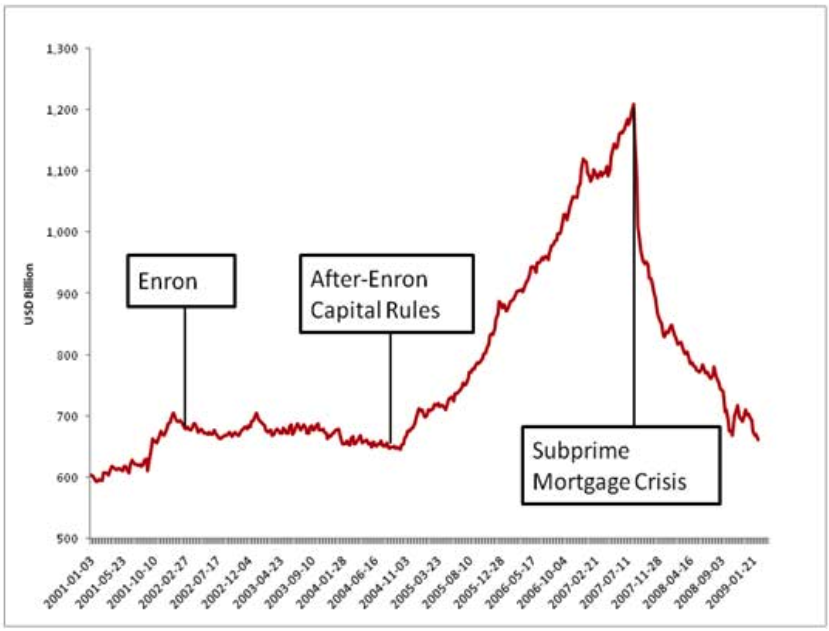

The second looks at what happened to Commercial Paper after new accounting rules (The Enron Capital Rule) for “liquidity enhancement provided to conduits” went into effect April 2004.

Total Asset-backed Commercial Paper Oustanding

Quite fascinating.

You can download the full paper here.

>

Source:

Securitization Without Risk Transfer

Viral V. Acharya (London Business School – Institute of Finance and Accounting; Stern School of Business; Centre for Economic Policy Research (CEPR))

Philipp Schnabl (New York University, Stern School of Business)

Gustavo Suarez (Federal Reserve Board)

Date originally posted: March 22, 2009

AFA 2010 Atlanta Meetings Paper

http://ssrn.com/abstract=1364525

http://ideas.repec.org/p/nbr/nberwo/15730.html

See also:

Recent Policy Issues Regarding Credit Risk Transfer

Federal Reserve Bank of San Francisco

Number 2005-34, December 2, 2005

http://www.frbsf.org/publications/economics/letter/2005/el2005-34.html

What's been said:

Discussions found on the web: