>

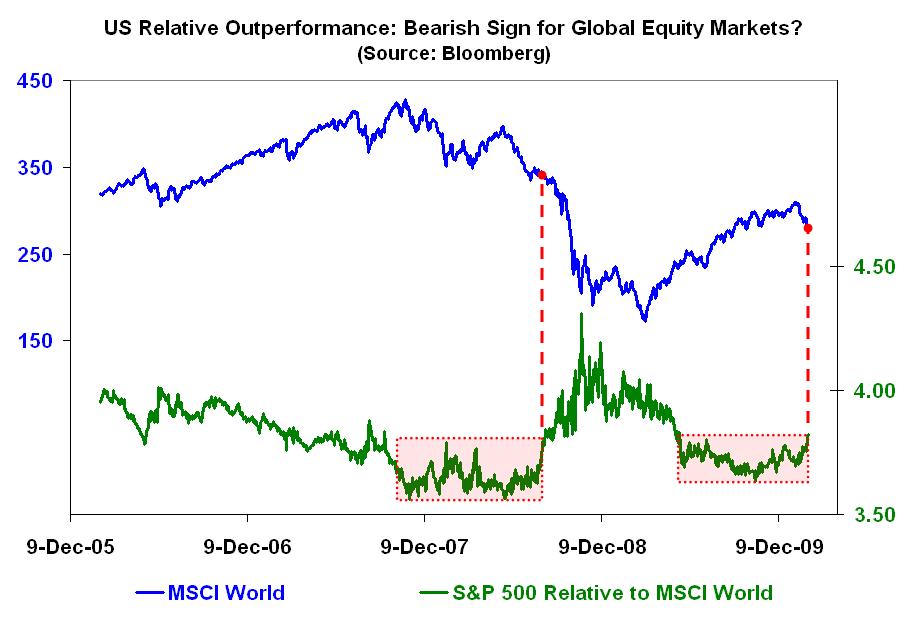

The last time the ratio of the S&P 500 to the MSCI World index staged a bullish breakout was in the summer of 2008 — just before global equity markets fell off a cliff.

On it’s face, that doesn’t seem to make sense. For one thing, it contradicts anecdotal and other evidence that the U.S. tends to lead the way as far as equity markets are concerned.

In addition, the fact that America has been ground zero in terms of the financial crisis would seem to indicate that our markets should bear the brunt when investors run scared.

That has not been the case, however. As paradoxical as it sounds, there are two reasons why U.S. markets can outperform at a time of widespread de-risking — or, if you prefer, panic selling.

First, the U.S. has traditionally been seen as a global safehaven. So, while investors here and elsewhere might be cashing in some of their chips, those international fund managers who must remain invested in equities tend to shift funds towards more defensive locales — like the U.S.

What’s more, over the past ten months and in the period preceding the bursting of the credit bubble in 2007, data on mutual fund and other investment flows revealed that U.S. investors sent a lot of money overseas in a quest for higher returns.

But when return of capital suddenly becomes more a lot more important than return on capital, the direction of those cross-border flows can quickly change course.

In sum, things are not always what they seem.

What's been said:

Discussions found on the web: