In yesterday’s reads, I mentioned a The New Yorker article on Paul Krugman. One line in the piece jumped out at me:

“Let’s put it this way. I can have fairly high confidence—it’s a personality thing—that a market is overvalued. Somehow I never have the same confidence in saying that it’s undervalued.”

Hey Paul, the reason for that has nothing to do with your personality — rather, it has to do with who was running the Fed for most of your adult life: Some guy named Alan Greenspan.

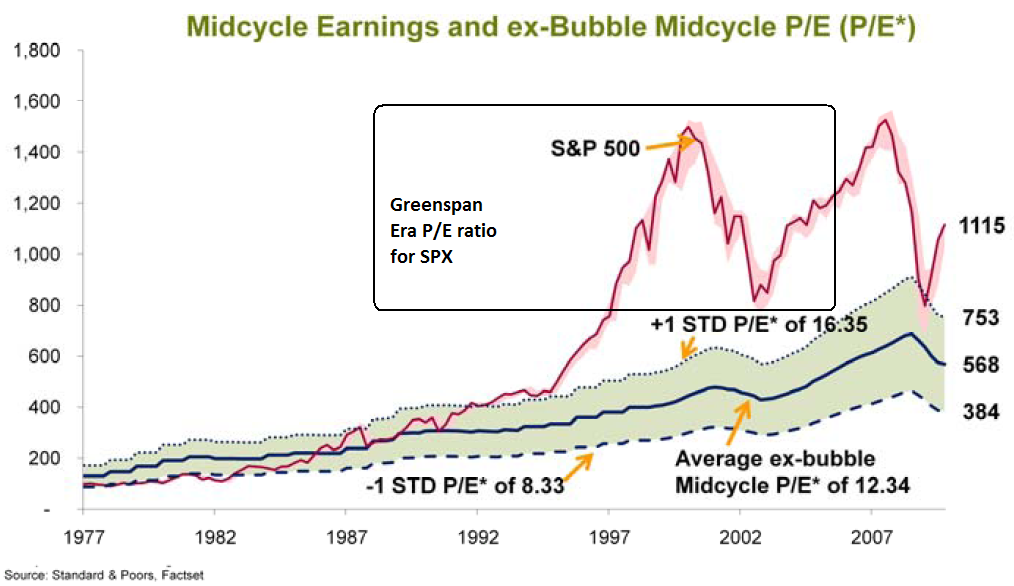

Consider the following two charts: The first chart shows the 1977-2007 period P/E ratio for the S&P500, highlighting the band of where stock prices would have been if the P/E ratio had stayed within one standard deviation of their long term average.

As you can see, for most of Greenspan’s tenure, as well as Bernanke’s (excepting the March ’09 lows), stocks have been mostly-to-extremely overvalued:

>

Source: S&P, Factset

>

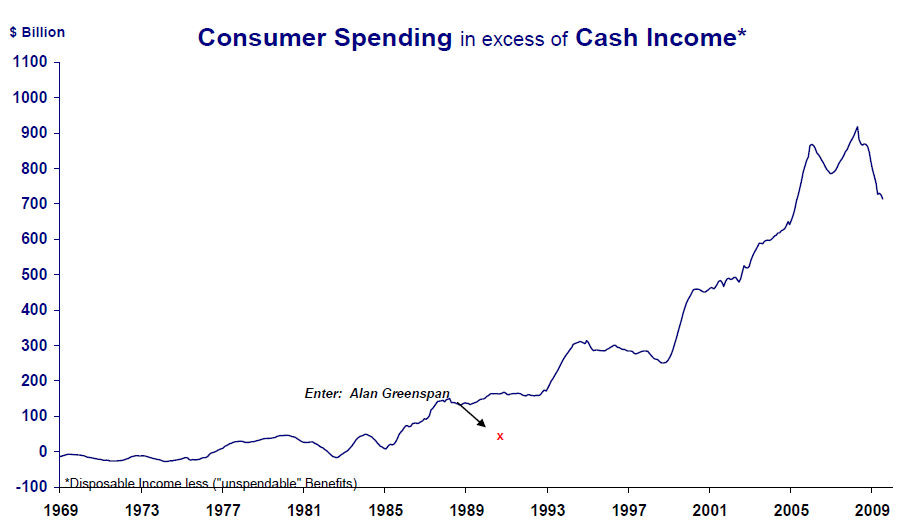

The second chart is a chart of how much the consumer leveraged themselves up during Greenspan’s tenure: What they purchased in excess of their cash income:

>

It appears that a leveraged consumer and a pricey stock market were the most likely culprits — not your personality.

Perhaps a better title for this post might be “When Were Stocks Last Fairly Valued ?”

>

See also:

Are Earnings Normalizing? At What Level? (February 22nd, 2010)

http://www.ritholtz.com/blog/2010/02/are-earnings-normalizing/

What's been said:

Discussions found on the web: