The NY Fed has a curious research piece out, looking at areas of Upstate New York that were “insulated” from housing price volatility.

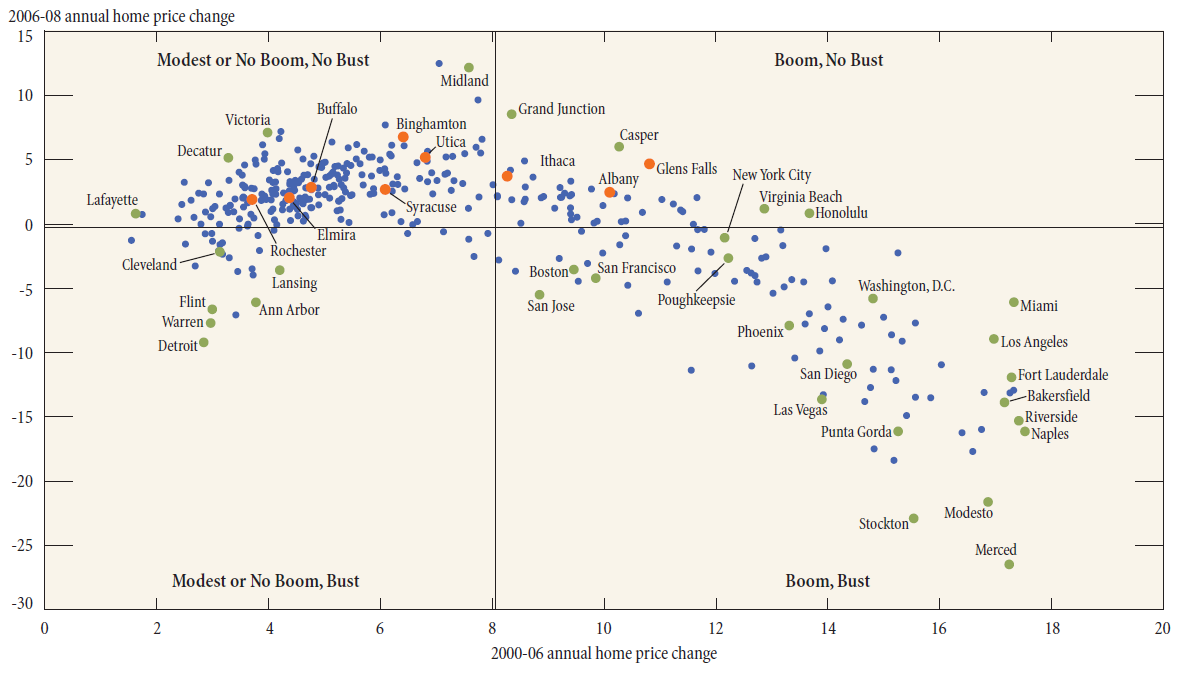

They note that many parts of the country have not experienced dramatic declines in housing prices, and upstate metropolitan areas of Buffalo, Rochester, and Syracuse even enjoyed price increases during the recession.

The NY Fed suggests the reason why is fairly simple: “The region’s relatively low incidence of nonprime mortgages.”

>

Metro Area Home Price Appreciation, 2000-08

>

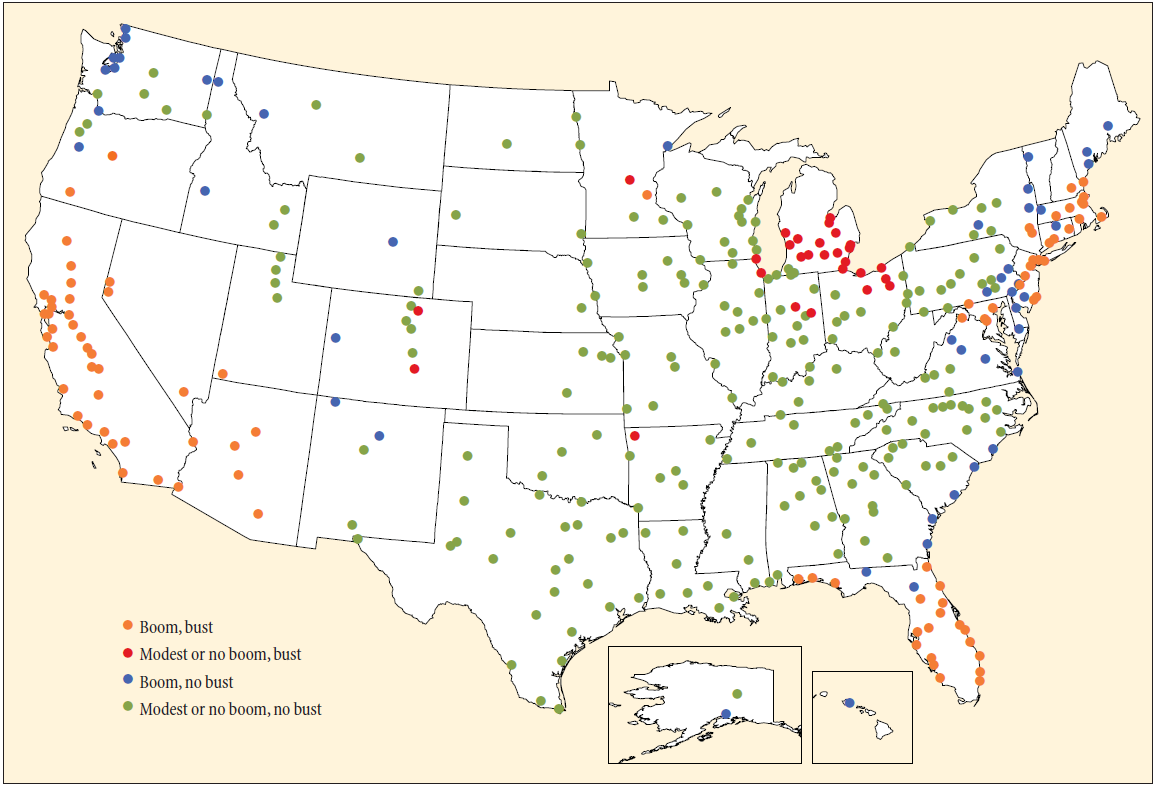

Geographic Distribution of Boom/Bust Metropolitan Areas

Sources: Federal Housing Finance Agency, All Transactions index; Moody’s Economy.com

>

The one caveat I would add is that the coastal populations are far larger, and have a greater density (i.e, on less land), than the non coastal Western areas and Southeast. See this cartogram for a graph of what this looks like.

Hat tip Real Time Economics

>

Source:

Bypassing the Bust: The Stability of Upstate New York’s Housing Markets during the Recession

Jaison R. Abel and Richard Deitz

FEDERAL RESERVE BANK OF NEW YORK Second District, March 2010

Volume 16, Number 3

http://www.newyorkfed.org/research/current_issues/ci16-3.pdf

What's been said:

Discussions found on the web: