There seems to be growing consensus that the recession ended some time in mid-2009 (June or July), and we recently pointed out that regional St. Louis Fed economists have placed their bets on a July 2009 trough. Now it’s up to the NBER.

We know that they weigh a variety of economic indicators, including Employment, Industrial Production, Real Income, and Real Retail Sales (tracked here at the St. Louis Fed). Business Cycle Dating Committee member Jeffrey Frankel likes to look at aggregate hours, too. In the real world, all of this is mostly an academic exercise in any event — Americans, like Associate Justice Potter Stewart once famously said on a different topic altogether, know a recession when they see one, and they also generally have a pretty good idea when it’s ended. (I take pride in having nailed the NBER’s call that the recession began in December 2007 while blogging elsewhere.)

But what about GDP? How does it figure into the equation? We’ve had two consecutive quarters of growth, including the 5.9 percent of Q4 2009. How will that play?

Well, it’s a interesting question, as the NBER has very contradictory and conflicting information at its own website about how it weighs the evidence:

In announcing the 2001 recession, the NBER said (emphasis mine):

Because a recession influences the economy broadly and is not confined to one sector, the committee emphasizes economy-wide measures of economic activity. The traditional role of the committee is to maintain a monthly chronology, so the committee refers almost exclusively to monthly indicators. The committee gives relatively little weight to real GDP because it is only measured quarterly and it is subject to continuing, large revisions.

Got that? Okay, let’s move on.

October 21, 2003 Memo from the Committee (not coinciding with a peak or trough announcement; emphasis mine):

The committee views real GDP as the single best measure of aggregate economic activity. In determining whether a recession has occurred and in identifying the approximate dates of the peak and the trough, the committee therefore places considerable weight on the estimates of real GDP issued by the Bureau of Economic Analysis of the U.S. Department of Commerce. The traditional role of the committee is to maintain a monthly chronology, however, and the BEA’s real GDP estimates are only available quarterly. For this reason, the committee refers to a variety of monthly indicators to determine the months of peaks and troughs.

Although the Committee qualifies its October 2003 remarks by mentioning the need to maintain a monthly chronology, the two comments nonetheless seem contradictory to me, and flip-flop the importance of what is to be considered.

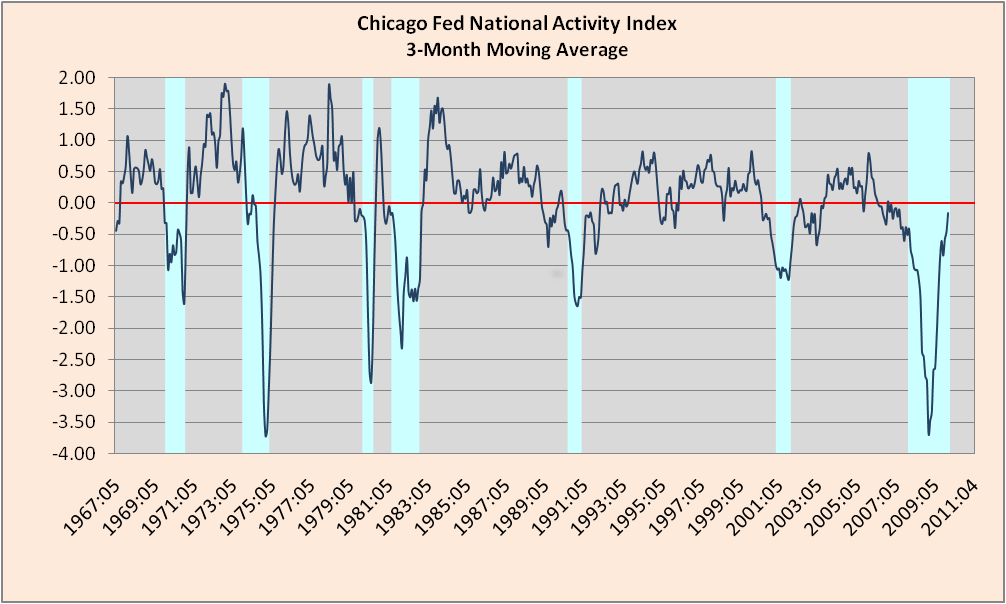

Whichever way they eventually call it, the NBER will have a document to which it can point to support its decision. Is it time — or long past — to formalize what it means to be in, or out of, recession? If so, my vote might easily go to the Chicago Fed’s National Activity Index.

>

>

The Chicago Fed provides the following bogeys: “A CFNAI-MA3 value below –0.70 following a period of economic expansion indicates an increasing likelihood that a recession has begun. A CFNAI-MA3 value above –0.70 following a period of economic contraction indicates an increasing likelihood that a recession has ended. A CFNAI-MA3 value above +0.20 following a period of economic contraction indicates a significant likelihood that a recession has ended.” It is an excellent indicator.

What's been said:

Discussions found on the web: