Mike Santoli asks an interesting question this morning in his Barron’s column.

Mike Santoli asks an interesting question this morning in his Barron’s column.

“The important question isn’t whether the market retrenches a bit, but whether that retrenchment would segue into a more definitive and momentous market top.”

This is a worthwhile query for exploration.

Mike calls a market pull back more likely than a top. He challenges da Bears to explain how a new top can form:

– During a broad rally, with “new highs swamping new lows?”

– While the LPL Current Conditions Index is at a post-2008 high?

– When credit spreads are tight and issuance of cheap corporate bonds and convertible securities rampant

– With percolating merger activity, and when Merrill Lynch bond strategists warned last week that “LBO risk” was on the rise?

– Do bull markets end amid public apathy toward equities? The typical investor has mostly shunned stocks, with outflows or weak inflows into stock funds the rule.

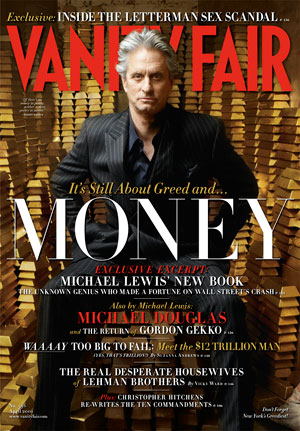

— With Vanity Fair magazine hyping the anti-greed sequel to the film Wall Street?

I will have to take issue with a few of Mike’s bullet points:

• The Current Conditions Index may be near highs, but the ECRI index has turned decisively lower. Further, the Consumer Metrics Institute real time daily economic data of the ‘demand’ side of the economy has been shrinking at an annualized rate of over 1.5% during the trailing quarter.

• Both the AAII survey and the Federal Reserve analysis of household total financial assets now shows they are at historical median equity exposure.

• I am less sure that a Annie Leibovitz cover photo of Michael Douglas in the celebrity obsessed Vanity Fair will qualify as a legitimate contrary indicator reflecting anything about he current market rally.

My own views are that this is a cyclical bull rally within a secular bear market, and that it ends with an approximate 20-30% correction, followed by a broader trading range. As of today, we see no signs that the end is imminent. However, the closer we get to the day when the market believe a Fed removal of accommodation is imminent, the closer we will be to the top. Alternatively, once the current unwind of the armageddon trade encounters the heavier resistance of Dow 11,500k and S&P 1250, the upwards momentum is likely to wane.

Until then, the bias remains to the upside.

>

Previously:

The Most Hated Rally in Wall Street History (October 8th, 2009)

http://www.ritholtz.com/blog/2009/10/the-most-hated-rally-in-wall-street-history/

Source:

Down, But Not Out

MICHAEL SANTOLI

Barron’s March 22, 2010

http://online.barrons.com/article/SB126903945323364875.html

What's been said:

Discussions found on the web: