Our earlier post noted the regulatory capture of the SEC by Wall Street. Later in the WSJ piece we referenced, SEC Chairman Mary Schapiro hinted that the issue might be even worse. She blamed the agency’s ineffective oversight of Lehman Brothers was partly due to insufficient staffing.

So that set me off looking for how the SEC staff and funding levels have changed over the past few decades relative to their workload .

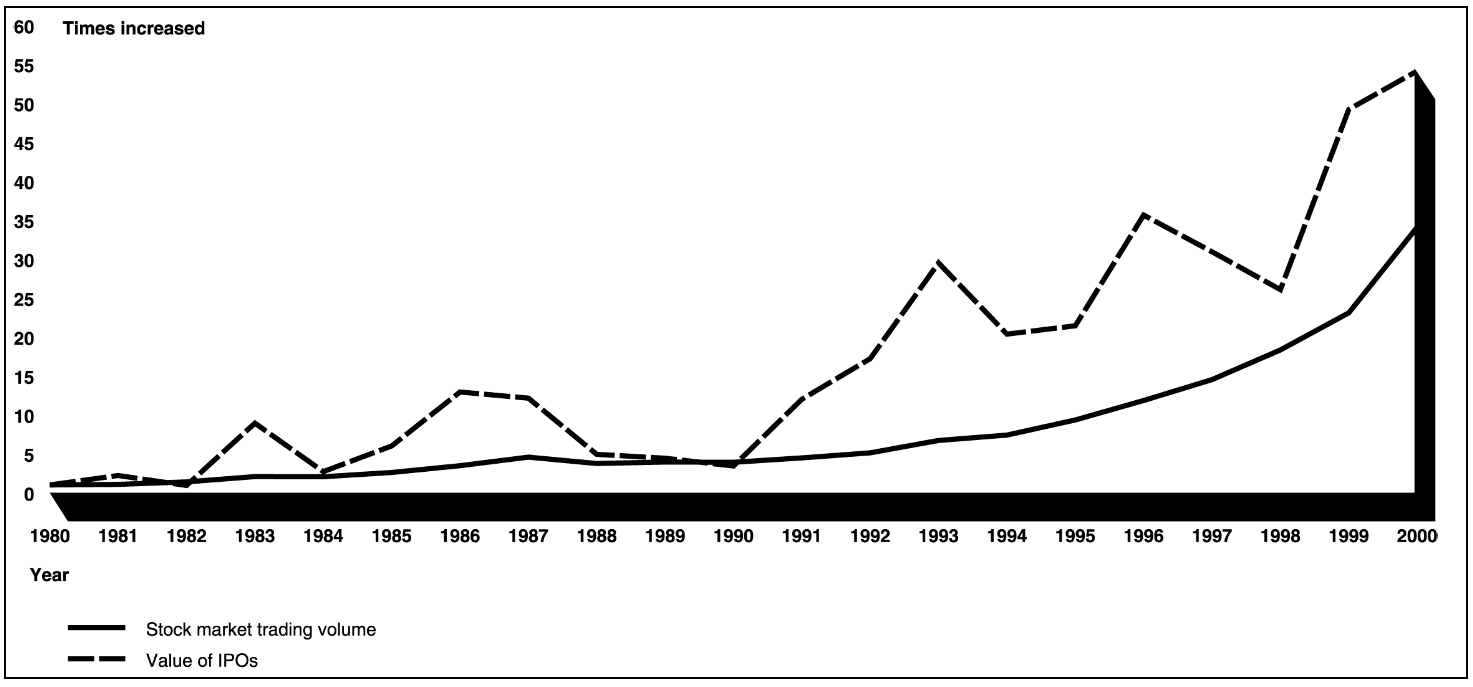

What I found was deeply disturbing: Over the past 30 years, the financial world has grown exponentially in size, breadth and complexity of products, trading volume, and total assets under management. In terms of personnel, assets under management, numbers of trader, managers, sales people, and mathematical PhDs., who work on the street increased dramatically.

The SEC did not.

Indeed, almost by design, the SEC has done a mediocre job keeping up with the finance sector over the past few decades. Their budgeting and salary allowances was far outpaced by Wall Street. The bodies the SEC can throw at any problem are dwarfed by what Wall Street manages. Consider that there are 1,000s of quants working on Wall Street. At the SEC, there are approximately zero.

The SEC appears to have suffered from what can be best described as a benign neglect. However, if you conclude it was malignant congressional intent, you wont get much of a fight out of me. The agency was all but abandoned

Consider this March 2002 GAO report to Congress on the SEC. To summarize their conclusion:

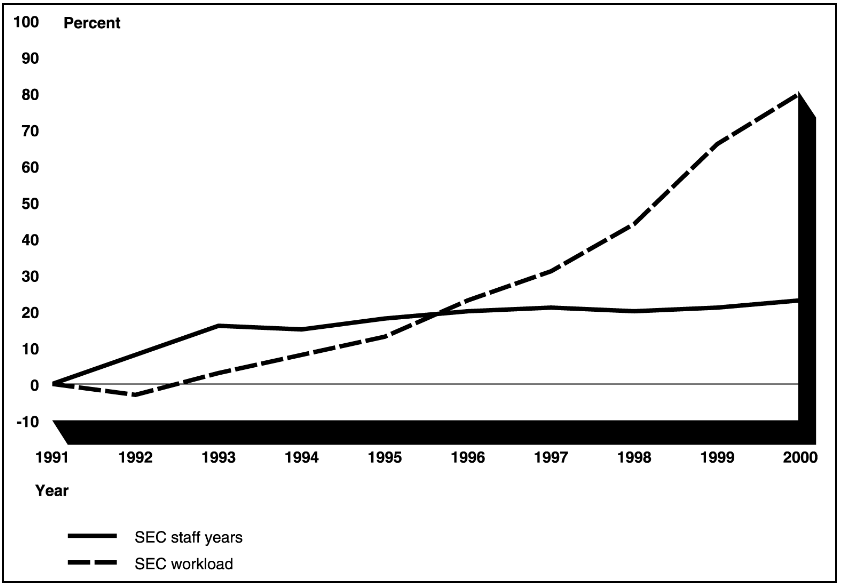

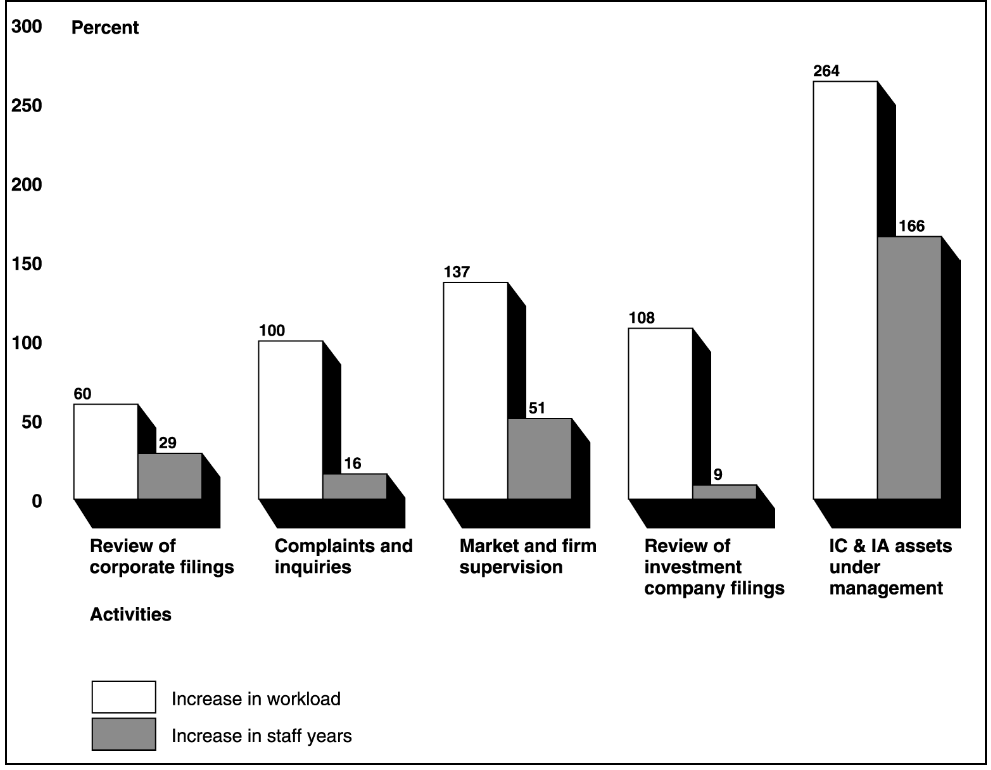

“U. S. securities markets have grown tremendously and become more complex and international. As a result, SEC’s workload has increased in volume and complexity over the past decade. As illustrated below, around 1996, SEC’s workload (e.g., filings, applications, and examinations) started to increase at a much higher rate than SEC staff years devoted to this workload. Although industry officials said that they respect SEC as a regulator, they said that SEC’s limited staff resources have resulted in substantial delays in SEC regulatory and oversight processes, which hampers competition and reduces market efficiencies. In addition, they said information technology issues need additional funding, and SEC needs more expertise to keep pace with rapidly changing financial markets. Finally, the officials said that SEC’s reliance on a small number of seasoned staff to do the majority of the routine work does not allow those staff to adequately deal with emerging issues.

The GAO also identified other budgetary related issues: Low salaries, inexperienced staff, high turnover, outdated equipment, etc.

The charts tell all:

>

Percent Change SEC Staff Workload: 1991 – 2000

All charts sourced via GAO analysis of SEC data

>

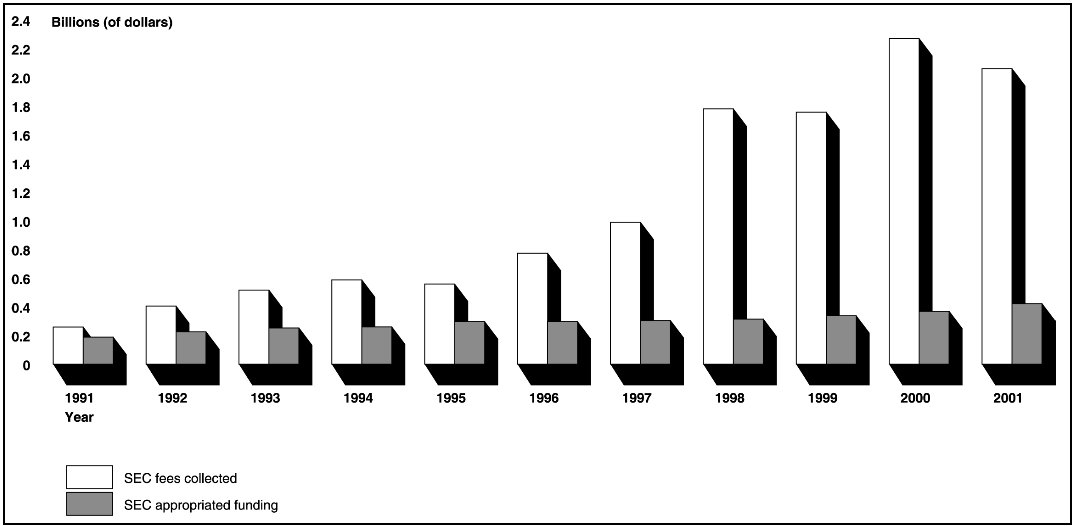

This leads us to asking Congress to accept responsibilty for the ineptness of the SEC. Congress failed to provide adequate funding for the agency. It didn’t require tax dollars, it could have been funded through SEC action, fines and settlements.

Congress did not need to deregulate Wall Street — they only had to defund the SEC –which is what effectively happened. Hence, the chief cop on the Wall Street beat was outgunned, overmatched, undermanned and out-lawyered by the industry they were supposed to be regulating.

How can that possibly have been any good for investors . . . ?

>

More charts after the jump . . .

>

Source:

SEC OPERATIONS Accountability Integrity Reliability Increased Workload Creates (GAO-02-302)

A report to Paul S. Sarbanes, Chairman, Committee on Banking, Housing, and Urban Affairs, U.S. Senate; Christopher J. Dodd, Chairman, Subcommittee of Securities and Investment; and Jon S. Corzine, Member, Committee on Banking, Housing and Urban Affairs, U.S. Senate.

GAO, March 2002

http://www.gao.gov/new.items/d02302.pdf

What's been said:

Discussions found on the web: