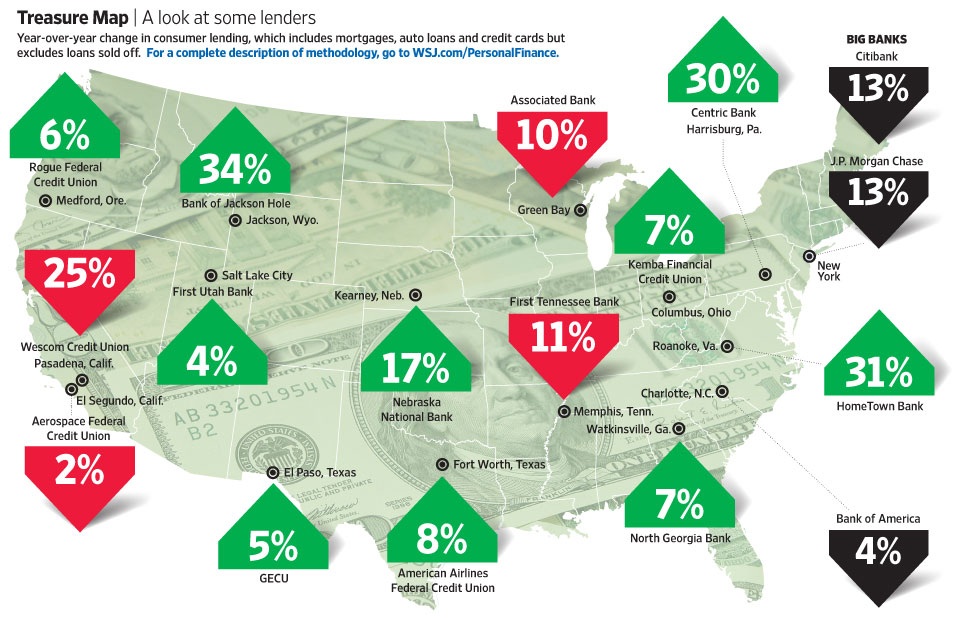

The Journal does yeoman’s job finding banks that have cash to lend:

“U.S. banks posted a 7.5% decline in 2009 in total loans outstanding, the steepest percentage drop since 1942, according to the Federal Deposit Insurance Corp. Consumer lending fell by 3.8% as roughly 7,200 banks and credit unions pulled back on mortgages, credit cards and other loans . . .

Across the country, thousands of other banks and credit unions also are bucking the just-say-no mentality that dominates the headlines. In the wake of the financial crisis that saddled banks with huge losses, the largest 10% of banks by asset size shrank their consumer lending by 4.7% last year, tightening the spigot on loans that aren’t backed by the government.

At many smaller banks and credit unions, though, cash continued to flow. Consumer loans grew nearly 3% at financial institutions that fall in the bottom 50% of the industry in assets, according to the Journal’s analysis of financial-institution data filed with regulators. Some smaller banks and credit unions continued to ramp up their business in mortgages, auto loans and credit cards and gain from the pain of their larger rivals.”

The one thing these lenders all have in common: Their balancde sheets are not festooned with all manner of garbage loans carried at fraudulent levels due to the corrupt rule change Congress foisted on FASB.

These smaller lenders are the only thing standing between a Japan like lost decade or two, and financial health.

>

click for larger map

courtesy of WSJ

>

Source:

Where to Find the Money

RUTH SIMON and MAURICE TAMMAN

WSJ, MARCH 13, 2010

http://online.wsj.com/article/SB10001424052748704869304575110073746360224.html

What's been said:

Discussions found on the web: