I have a few good quotes about secular bear markets in The Bear: Dead or Just Sleeping?:

“And, in fact, many in the bear camp believe the market is destined to meet its maker as soon as the Fed starts to raise interest rates – which could happen late this year.

“When rates go up, it becomes more expensive to borrow, corporate profits slide – all the negative things that take place that make the market less appealing as an investment opportunity,” Mr. Ritholtz says.

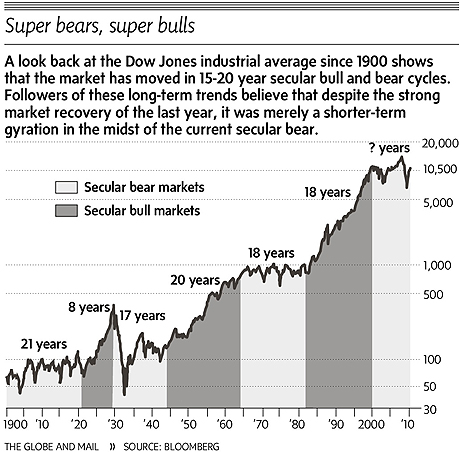

In fact, Mr. Ritholtz is one of several commentators who believe this rally has merely been a temporary cyclical swing in the midst of a longer-term bear market – one that began roughly a decade ago and is far from over. These long-term, or “secular,” market trends tend to last 15 to 20 years.

“This does not have the characteristics of a secular bull market,” Mr. Ritholtz says. Not only would it be starting ahead of schedule, he argues, but even at the market lows of a year ago the stock valuations were never as low as they typically get at turning points in secular market trends.

“In the past, at the start of these big secular bull markets, you have really cheap stocks … I’m not sure we ever got to that point,” he says. “Stocks became reasonable in March [2009] for a month. Now, there are plenty of stocks that are expensive and there are plenty of indexes that are pricey.”

There is a lot more in the article . . .

>

>

Source:

The bear: Dead or just sleeping?

David Parkinson

From Thursday’s Globe and Mail

Published on Thursday, Mar. 11, 2010 XXX http://www.theglobeandmail.com/globe-investor/the-bear-market-dead-or-just-sleeping/article1497020/

What's been said:

Discussions found on the web: