Yesterday, my buddy Paul showed this Vanguard interactive chart.

Vanguard was trying to show the superiority of Buy & Hold versus “emotional investing.” I have many issues with their argument.

First, I have to challenge the use of that term — emotional investing — to describe what is a fixed mathematical exit and entry strategy. In fact, that is the exact OPPOSITE of emotional investing: Using predetermined risk management system that operates without any human intervention — a quant black box — is not emotional investing.

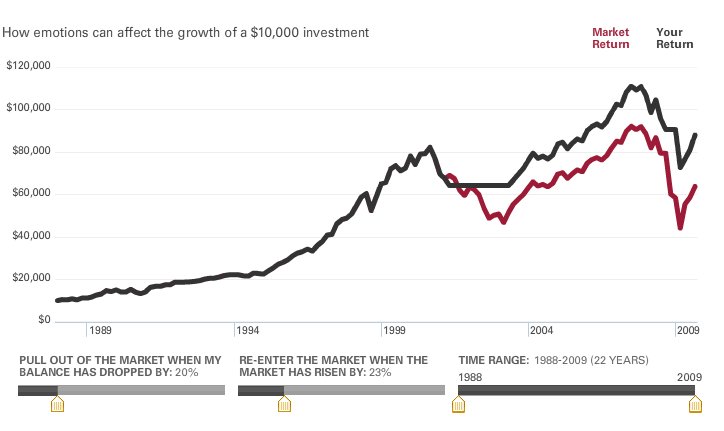

Paul used the default settings — something guaranteed to never beat the market. That approach makes Buy & Hold look like the superior strategy. Vanguard shows B&H performance of $63,791 versus in/out performance of $33,628:

Oh, Mr. Bogle, please tell me more about Buy & Hold!

>

Vanguard did not count on clever market participants engaging in na little clever slide play . . . just a tweak here, down 20% to get you out, up 23% to get you back in — voila! Massive out performance form-fitted to recent history: B&H performance of $63,791 versus risk managed performance of $88,095:

Risk Management vs Buy & Hold

And, you have not only out-performed over the past decade, you are actually up since 10 years ago — versus still negative for Vanguard.

>

Thanks Paul, Bruce, Scott F.

What's been said:

Discussions found on the web: