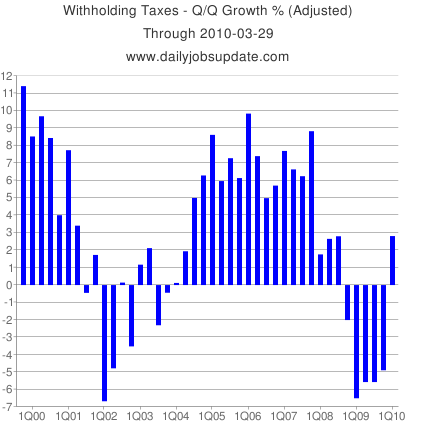

Matt Trivisonno shares with us some of the research he does at Daily Jobs Update regarding payroll withholding taxes.

He notes that in March, there has been a very strong surge in withholding taxes. The amount is roughly equivalent to 300,000 new workers being paid $30,000 salaries. Matt presume many of these jobs are Census hires.

How he arrived at the 300,000 estimate:

In February, the un-adjusted growth in withholding taxes over February 2009 was -2.28%. For the first 21 business days of March, the growth rate is +3.12%. That’s a miraculous 5% jump, the bulk of which is almost certainly the result of Census Bureau hiring. Let’s take a look at how many new jobs would fit this size of a leap:

The dollar amount of March’s gain is $4,764,000,000.

Divide that by 21 days, and we get a daily average of $226,860,000.

Divide that by 5 and we get $45,370,000 per work week.

So, how many new workers would be required for the IRS to rake-off $45,370,000 per week more in taxes this month? A good ballpark figure might be 300,000 new jobs.

If you hired 300,000 workers and paid them an average annual salary of $30,000, your weekly payroll would be $173,076,923 (300,000 * 30,000 / 52).

If you withheld 26.5% in taxes from each paycheck, the total would be $45,865,385 ($173,076,923 * 0.265), which is pretty close to the increase in March’s withholdings so far.

However, the withholding data is not detailed in any way by the Treasury Department, and we only have totals to work with. So, we can only make very, very rough estimates since there is a wide range of salaries, multiple tax brackets, and the fact that many workers will have had their hours increased as opposed to being newly hired.

Nevertheless, the Bureau of Labor Statistics should report a very large number on Friday morning.

The Census Bureau hasn’t published any hiring statistics that I have seen, but the consensus among economists is that they have hired 100,000 workers in March. They could have hired quite a lot more of the planned 1.2 million total, but the army of door-knockers isn’t scheduled to hit the streets until May, though they will likely go on the payroll for training well before then.

The bottom line is that Friday’s jobs report should be very strong, though it could disappoint the market if the Census Bureau was responsible for the bulk of hiring as opposed to the private economy.

All data and charts via Matt Trivisonno Trivisonno.com and Daily Jobs Update

What's been said:

Discussions found on the web: