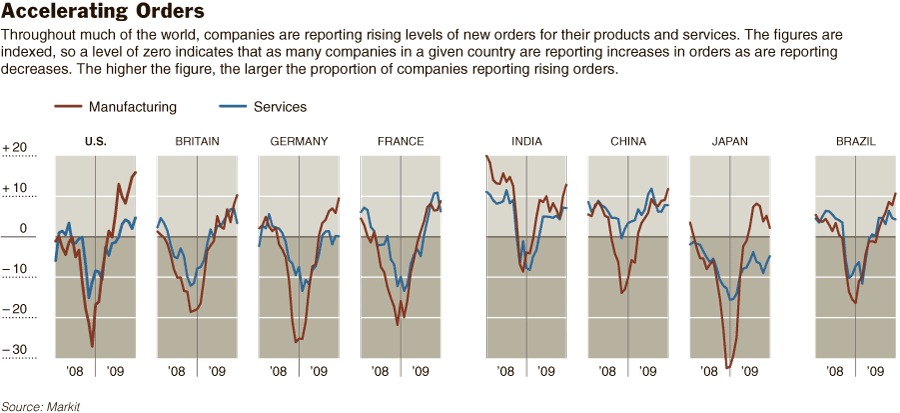

Floyd Norris week continues here at the Big Picture. Today’s offering is a global review of surging new orders for businesses.

In economic recoveries, Manufacturing tends to lead service businesses. But according to the data Norris points to, even service providers are now reporting increases in new business. After 14 consecutive months of declining orders — the longest stretch since the early 1980s — US manufacturers negative streak ended last May. Since then, ISM has been positive all but one month.

Orders for Service companies finally began turning up in September 09. As Norris notes, “But by March, a higher proportion of companies were reporting gains than at any time since 2005.”

The charts below reveal this is not limited to the US, but is a global phenomenon:

>

click for larger graphic

Graphic courtesy of NYT

>

Source:

In Order Books, Signs of Broad Growth

FLOYD NORRIS

NYT, April 9, 2010

http://www.nytimes.com/2010/04/10/business/economy/10charts.html

What's been said:

Discussions found on the web: