Legislation currently under consideration in the Senate would not have prevented the crisis we just had. As such, it is unlikely to prevent a future crisis.

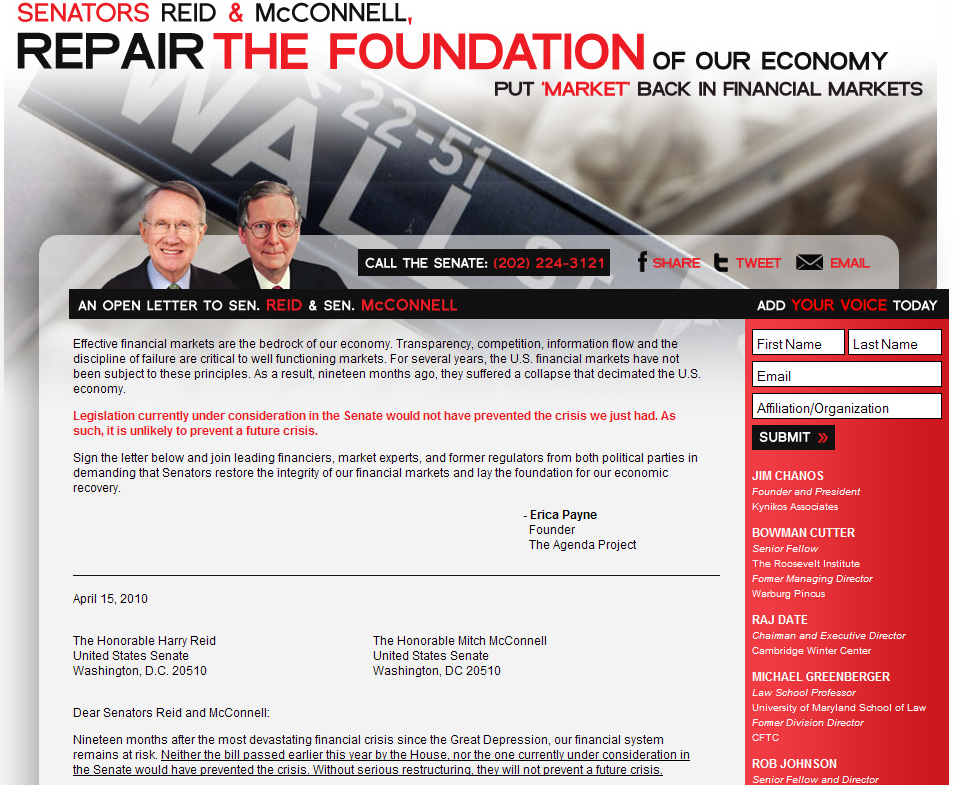

Sign the letter below and join leading financiers, market experts, and former regulators from both political parties in demanding that Senators restore the integrity of our financial markets and lay the foundation for our economic recovery.

You can sign the letter by clicking anywhere below:

>

What's been said:

Discussions found on the web: