Case-Shiller:

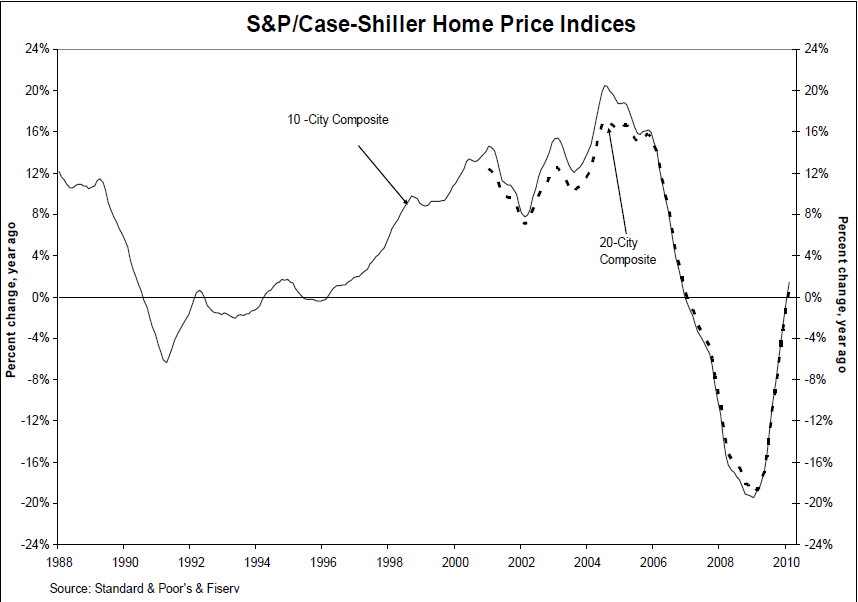

Annual rates of decline of the 10-City and 20-City Composites improved in February compared to January 2010. For the first time since December 2006, the annual rates of change for the two Composites are positive.

The 10-City Composite is up 1.4% from where it was in February 2009, and the 20-City Composite is up 0.6% versus the same time last year. However, 11 of 20 cities saw year-over-year declines.

>

Annual returns of the 10-City and 20-City Composite Home Price Indices gained 1.4% and 0.6% respectively in February 2010 compared to the same month last year. Eighteen of 20 metro areas and both Composites showed an improvement in their annual rates (Dallas and Portland being the exceptions).

>

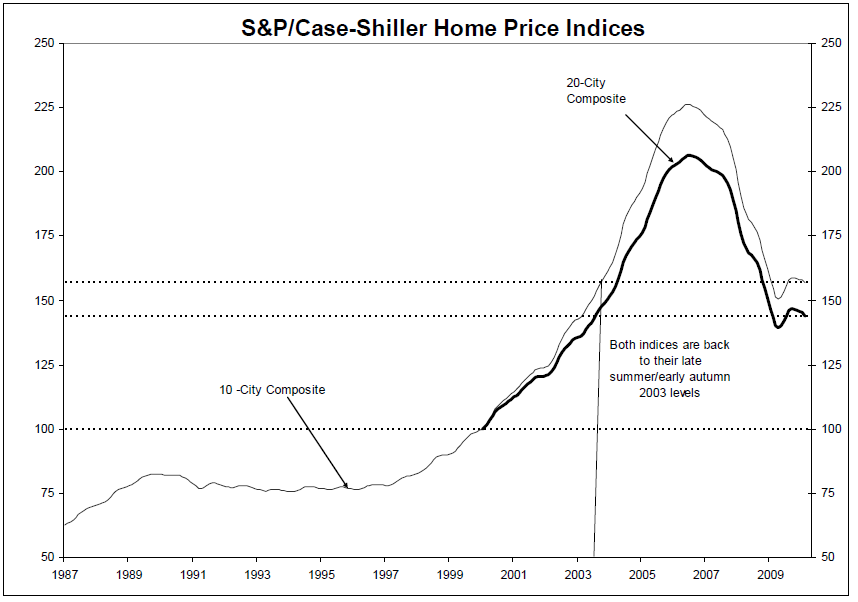

UPDATE: One more chart, via Calculated Risk:

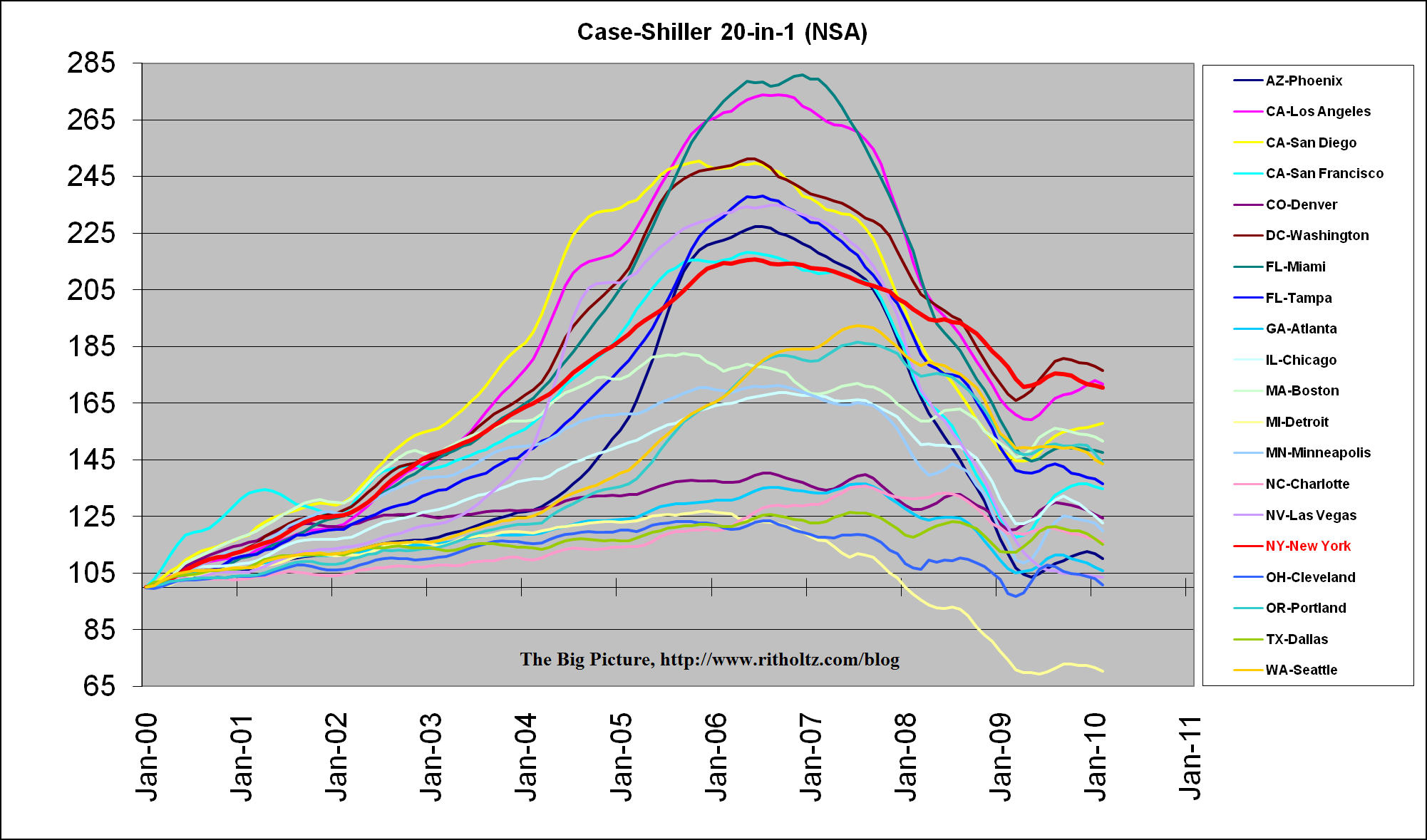

More charts after the jump

Source: Standard & Poor’s and Fiserv

What's been said:

Discussions found on the web: