Interesting paper out of the Bank for International Settlements on The future of public debt: Prospects and implications:

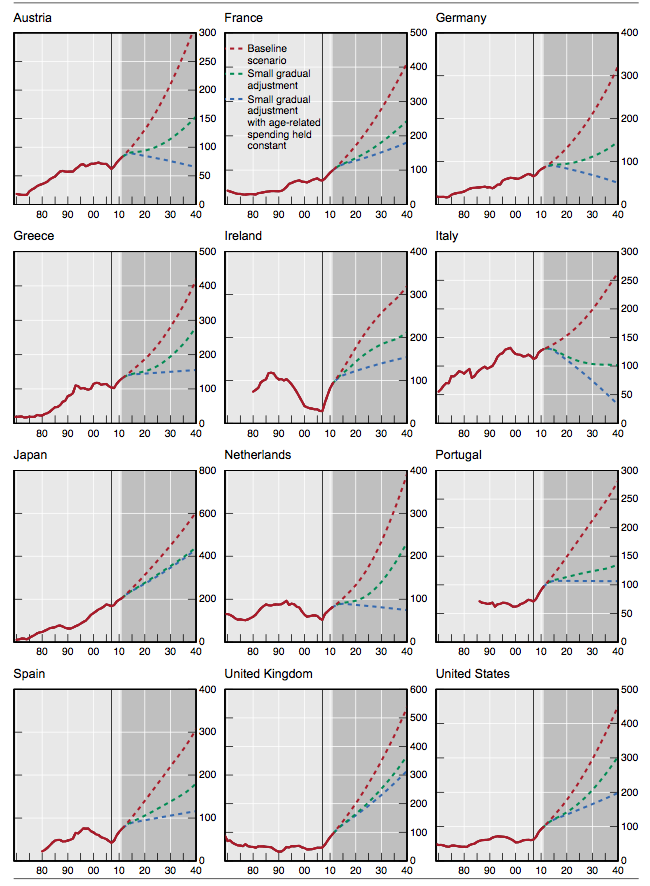

Since the start of the financial crisis, industrial country public debt levels have increased dramatically. And they are set to continue rising for the foreseeable future. A number of countries face the prospect of large and rising future costs related to the ageing of their populations. In this paper, we examine what current fiscal policy and expected future age-related spending imply for the path of debt/GDP ratios over the next several decades. Our projections of public debt ratios lead us to conclude that the path pursued by fiscal authorities in a number of industrial countries is unsustainable. Drastic measures are necessary to check the rapid growth of current and future liabilities of governments and reduce their adverse consequences for long-term growth and monetary stability.

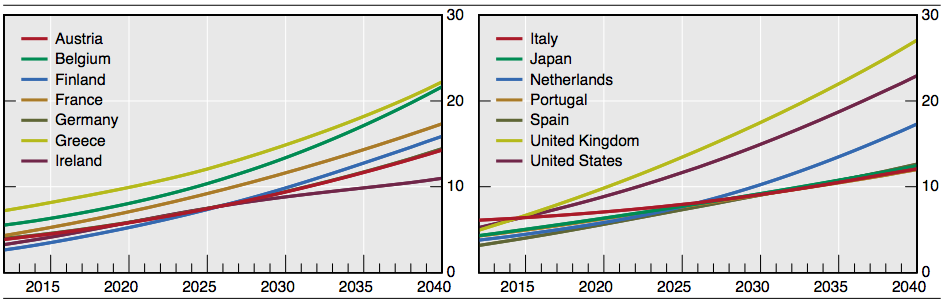

These charts caught my eye (more after the jump):

>

Projected interest payments as a fraction of GDP (%)

Sources: OECD; authors’ projections.

>

Source:

The future of public debt: prospects and implications

Stephen G Cecchetti, M S Mohanty and Fabrizio Zampolli

Bank for International Settlements, March 2010

BIS Working Papers, No 300

http://www.bis.org/publ/othp09.pdf

What's been said:

Discussions found on the web: