The latest bad meme to develop legs is the idea that strategic mortgage defaults are goosing retail sales. We looked at this last week in Are Defaults Really Driving Retail Spending? as an idea driven mostly by anecdote (some quite ugly), but unsupported by any hard data.

To those pushing this idea, I ask this: Are these mortgage mod requests from egregiously irresponsible spendthrifts the exception, or the rule? And, if they are more than an exception, would you please produce actual data supporting this thesis?

After my post on this, I got dozens of emails with anecdotal stories of defaulting homeowners going on spending sprees. Many were so similar that I presumed they were email forwards from the same source. Also, Bill Gates wants to send me to Disneyland.

I started hunting for more info on this. I came across three items that are worth discussing. (if you know of any other data sources in this, feel free to mention in comments)

The first item was a quote from Mark Zandi in Monday’s WSJ:

How much can the world count on the U.S. consumer?

U.S. consumers remain the single largest source of global demand, even if their clout isn’t what it once was. J.P. Morgan estimates U.S. consumer spending will account for one-fourth of the global total in 2010, down from about 35% in 2003. Still, the global recession spread to Latin America and Asia when U.S. buyers put away their credit cards.

In recent months, U.S. consumer spending has turned upward and may continue that way for some time, says Economy.com economist Mark Zandi, who figures pent up demand will boost car and home sales. But the long-term outlook is hardly solid. Part of the reason for Mr. Zandi’s short-term bullishness is that he figures about five million households aren’t making payments on their mortgages, giving them as much as $60 billion to spend—for now. -WSJ

Zandi appears to have come up with his $60 billion figure (as far as I can tell) by taking 5 million delinquent home owners X a ballpark $1000 per month mortgage X 12 months = $60B.

Let’s take a closer look at Zandi’s analysis to see if it holds water.

– The March 2010 NFP report data had 15.0 million unemployed persons; the number of “long-term unemployed” rose to 6.5 million — 44.1% of total unemployed. An additional 9.1 million people working part time because full time work was unavailable.

Its reasonable to surmise that there is a huge overlap between the 24 million people either unemployed or under employed, and the 5 million foreclosures, and 6 million+ late mortgage payers. We can reasonably make a connection between a fall in income and foreclosures and defaults.

–Confusing cause and effect. Most people don’t default to get more money; they default because they have run out of money.

When your income plummets — in 15 million case above, by 100% — you stop spending except for necessities. The majority of hard working Americans who are unemployed (or under employed) and who are delinquent on their mortgages because they have run out of money. Merely failing to pay that liability, does not men you therefore have lots of extra cash burning a hole in your pocket.

– Therefore, Liabilities — what is owed by defaulting homeowners — are not the same as Disposable Income. Not paying that liability is not a windfall — its a sign of economic distress. That $60 billion is a collective measure of how much homeowners owe, not how much they have.

And this is coming from me, the guy who advocated that the economy needs more foreclosures . . .

The second item was from Minyanville’s James Kostohryz. He blamed the idea on Perma-Bears, stating they are “running out of excuses for why retail sales rose so strongly in March of 2010” (Are Mortgage Deadbeats Juicing Up the Economic Numbers?).

But James takes it a step further, crunching the numbers to determine, if true, how much this could be impacting spending. His conclusion? The most that strategic defaults are helping retail sales is about $228 million per month — “~0.026% of monthly Personal Consumption Expenditures (PCE) which are averaging about $863 billion per month.” Hardly enough to explain the significant uptick in retail sales.

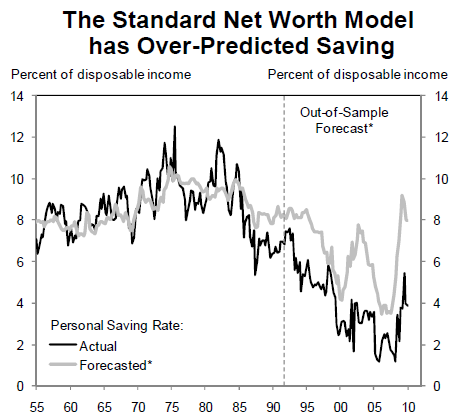

The last item to discuss is a somewhat odd Goldman Sachs economic piece from Ed McKelvey. Their argument seems to be that since “The Standard Net Worth Model has Over-Predicted Savings” — meaning, its forecast was wrong — then something therefore is wrong with the retail data. Never mind that the standard savings model has been wrong for over 20 years (really). If you have access to the GS piece, it might be worth perusing — but just barely.

~~~

Note that my original post on this was a response to this Housing Wire discussion by Paul Jackson For Consumers, Time to Shop (Until the Mortgage Drops). Jackson has answered my post here: Retail Sales and Mortgage Defaults, Oh My! For the record, I’ve always liked Housing Wire and found the original piece lacking in both data and sharp analysis. Like the meme under discussion, it was the exception, not the rule . . .

>

Previously:

Stopping Counter-Productive Mortgage Mods and Foreclosure Abatements (January 5th, 2010) http://www.ritholtz.com/blog/2010/01/stop-counter-productive-mods-abatements/

Sources:

IMF to Ponder China, Jobs and the U.S.’s Wallet

BOB DAVIS

WSJ, APRIL 19, 2010

http://online.wsj.com/article/SB20001424052702304180804575188162863998840.html

Are Mortgage Deadbeats Juicing Up the Economic Numbers?

James Kostohryz

Minayanville, April 15, 2010

http://www.minyanville.com/businessmarkets/articles/mortgages-deadbeat-mortgage-holders-economic-growth/4/15/2010/id/27791

Housing Holds the Key to the Consumer Conundrum Ed McKelvey, US Economics Analyst

Goldman Sachs Global ECS Research, April 9, 2010

Issue No: 10/14

https://360.gs.com

See also:

Extra Tax Refunds Giving Consumers A Short-Term Boost

Jed Graham

Mon., April 19, 2010

http://blogs.investors.com/capitalhill/index.php/home/35-politicsinvesting/1682-extra-tax-refunds-giving-consumers-a-short-term-boost

What's been said:

Discussions found on the web: