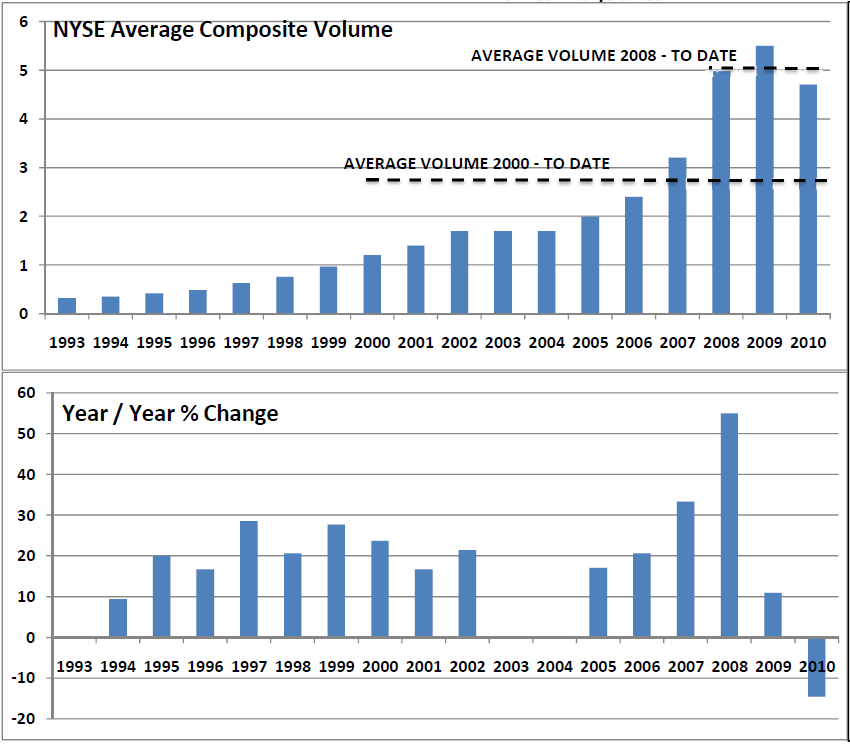

John Roque highlights the changes in NYSE volume:

“Volume has been a curiosity for most and a problem for others. On an absolute basis, 2010 volume is averaging about 4.7 billion shares/day. This is down 15% vs. the 2009 average NYSE volume of 5.5 billion shares/day. Yet 2010’s average volume is only slightly less than the 2008 average of 4.96 billion shares/ day.”

>

What's been said:

Discussions found on the web: