The National Federation of Independent Business (NFIB) released its monthly Small Business Economic Trends (SBET) survey, and the outlook for small businesses is still not good. The NFIB counts its membership at about 350,000 small businesses.

The overall Optimism Index declined in the month of March to 86.8, roughly the same level it was at the very tail end of 2008 (87.8 in November ’08, when the world was on the brink of collapse):

>

NFIB Optimism Index

>

NFIB’s economist, William Dunkelberg, commented as follows:

While news about the economy has been positive for two or three quarters, small business owners remain quite pessimistic about the future for the economy. The Optimism Index has been below 90 for 18 consecutive months and below 90 in all but four months since the recession started in January of 2008. […]

Since small firms produce half the private sector GDP, it is hard to envision a sustained recovery without their participation. Once the gains from inventory rebuilding are exhausted, it is hard to see what will fuel growth. Small firm capital spending is at 35 year low levels and plans for future expenditures are equally low. Plus, hiring plans remain “negative” as more firms still plan reductions than increases in their employment).

Unfortunately for small businesses, their larger counterparts enjoy (at least) three distinct benefits that they don’t:

- International sales

- Stronger balance sheets

- Easier access to credit

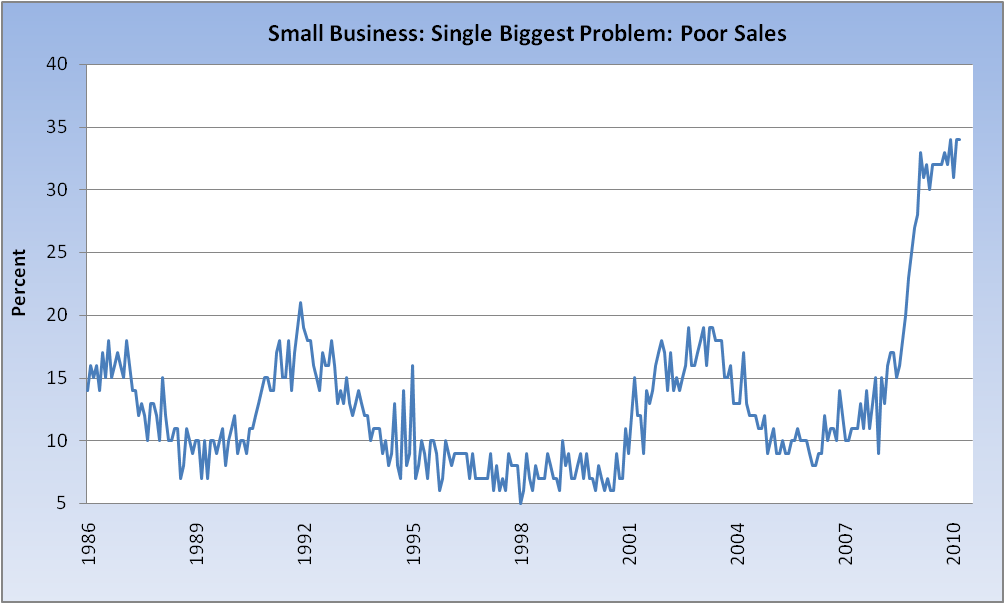

Small businesses overwhelmingly continue to cite “Poor Sales” as their number one problem:

>

Small Business Sales Remain Weak

>

I agree with Dunkelberg: Barring a turnaround for the nation’s small businesses, it’s hard to see how this “recovery” will have much sustainability or make a dent in the ~8.4 million jobs we’ve lost since the recession began. The problem, I believe, is how to stoke final demand (hence the “Poor Sales” problem), without which not much progress can be made.

What's been said:

Discussions found on the web: