Gee, what a shocker:

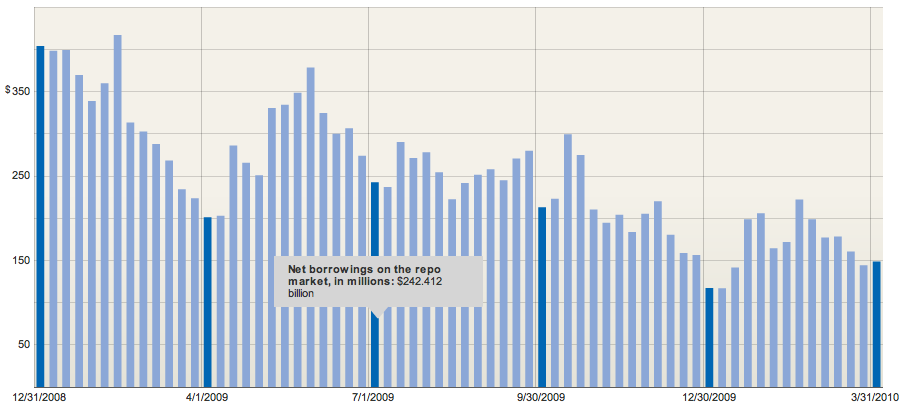

“Major banks have masked their risk levels in the past five quarters by temporarily lowering their debt just before reporting it to the public, according to data from the Federal Reserve Bank of New York.

A group of 18 banks—which includes Goldman Sachs Group Inc., Morgan Stanley, J.P. Morgan Chase & Co., Bank of America Corp. and Citigroup Inc.—understated the debt levels used to fund securities trades by lowering them an average of 42% at the end of each of the past five quarterly periods, the data show. The banks, which publicly release debt data each quarter, then boosted the debt levels in the middle of successive quarters.”

Not quite Repo 105, but close . . .

>

click for interactive graphic

courtesy of WSJ

>

Source:

Big Banks Mask Risk Levels

Quarter-End Loan Figures Sit 42% Below Peak, Then Rise as New Period Progresses; SEC Review

WSJ, April 8, 2010

http://online.wsj.com/article/SB10001424052702304830104575172280848939898.html

What's been said:

Discussions found on the web: