Is a replay of the 1987 crash a realistic likelihood?

Well, it depends upon who you ask. And even more important, when you ask them.

Consider these two WSJ articles, one published (online yesterday) in today’s print WSJ, one in 2007. A mere 3 years — and a 7,500, 56% Dow crash — separates the two publications. How do you think that impacted participants’ perspectives of the current environment versus 1987?

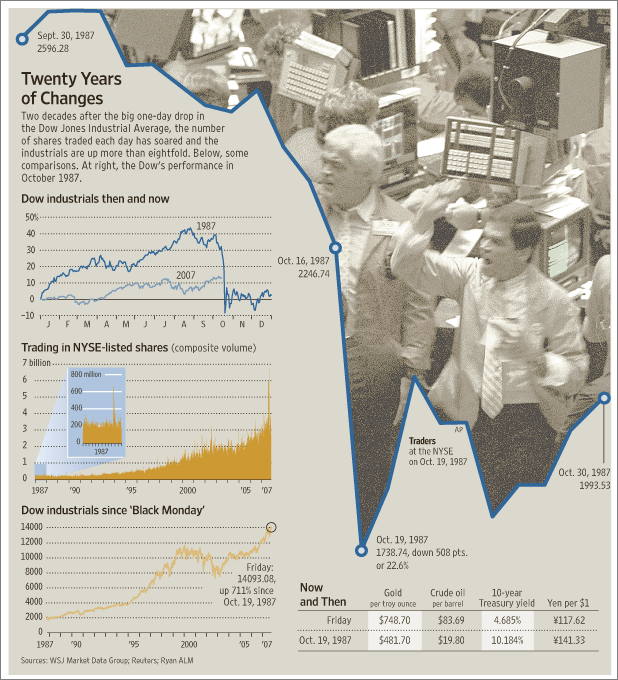

The 2007 article came four years into a cyclical bull market. Housing and credit was shaky, but the impact on the market was — at the time — only modest. The Dow was approaching 14,000. The dominant psychology bullish, the interviewees upbeat — despite plenty of warning signs.

Yet no parallels to 1987, or any other market dislocation, could be discerned. This article was published on October 15, 2007 — 20 years after the ’87 crash, and a few days after the peak of the 2003-07 bull run — just weeks before the onset of one of history’s ugliest bear crashes.

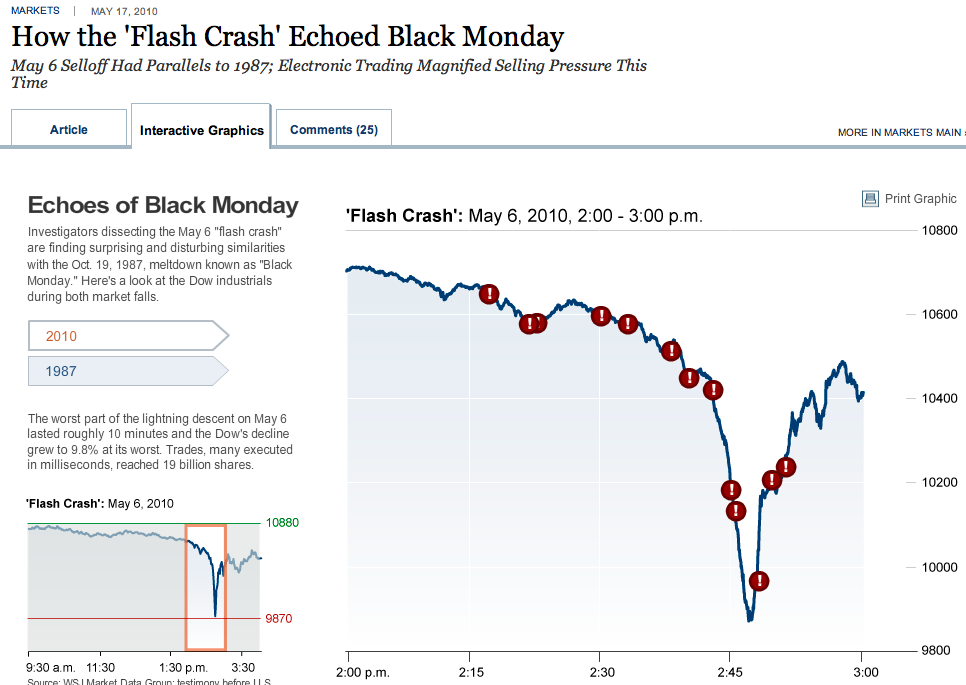

Flash forward 3 years — after a 56% drop in indices. Given what we know if the Recency Effect, would you be surprised to learn that people are now seeing parallels to 1987?

“On May 6, “The velocity of the volatility was stunning, beyond anything I had ever seen, with the exception of October of 1987, when I was on the trading floor,” said Ted Weisberg, president of Seaport Securities in New York.

“There’s a strong parallel between the Black Monday crash and the flash crash,” said Michael Wong, an analyst at Morningstar who tracks stock exchanges.

That is how we are hard wired. We tend to look backwards, not forwards. We over-emphasize the recent, and extrapolate from there.

After the 2008-09 crash, wouldn’t you guess that the similarities to 1987 are easy to spot?

On Oct. 19, 1987, the Dow Jones Industrial Average tumbled more than 20%, and the swoon extended into the following day, before a rebound. Floor traders, working by telephone, dominated the action and computer-generated trading was still in its infancy. Dark pools and high-frequency trading were the stuff of science fiction. Trading reached 600 million shares, according to the SEC.Fast forward to May 6, 2010: The worst part of the lightning descent lasted roughly 10 minutes and the decline hit 9.8% at its worst. Trades, many executed in milliseconds, reached 19 billion shares.

In both cases, troubles first appeared in the stock futures market, which precipitated a decline in the regular “cash” market. The two created a feedback loop, dragging both markets lower.”

A mere three years earlier, when the same technological factors were driving the markets, we get a different perspective from the market pros, who are all too human. Compare the above paragraphs with what the experts said in this 2007 WSJ article, on the 20th anniversary of the ’87 crash. The subhed noted that “Despite the housing slump, Crashes such as 1987 are likely to stay memories.”

Let’s look at parts of that 2007 article:

“With the stock market booming lately, many investors are putting aside worries about the housing slump and the summer’s credit crunch. At the same time, some are thinking about a looming anniversary. . . .

“But some of the root causes of the 1987 crash appear to be missing today. A big problem 20 years ago was that stocks had risen too far, too fast. At their August high, the Dow industrials were up more than 43% for 1987 alone, a stunning short-term gain. They slipped after that, falling especially heavily just before the crash.

This year, the stock gains have been more moderate. At their record close of 14164.53 last Tuesday, the Dow industrials were up 14% for the year. The Dow finished on Friday at 14093.08. Instead of declining as October wears on, stocks have rebounded.

Stocks don’t look as overpriced today as they did in 1987. Today, the companies in the Standard & Poor’s 500-stock index trade only a little above the historical average of 16 times profits for the past 12 months. In 1987, the S&P 500 was at more than 20 times profits. Interest rates are much lower than they were then and inflation, which was causing the Federal Reserve to fret in 1987, appears to be moderating, at least for now.”

The key differences have nothing to do with who was quoted, or the articles authors or their editors. What had changed was the psychology of the moment. And THAT, more than anything, impacts how people perceive the world . . .

>

>

Sources:

How the ‘Flash Crash’ Echoed Black Monday

SCOTT PATTERSON

May 6 Selloff Had Parallels to 1987; Electronic Trading Magnified Selling Pressure This Time

WSJ, MAY 17, 2010

http://online.wsj.com/article/SB10001424052748704314904575250602626326346.html

Exorcising Ghosts of Octobers Past

E.S. BROWNING

Despite Housing Slump, Crashes Such as in 1987 Likely to Stay Memories

WSJ, OCTOBER 15, 2007

http://online.wsj.com/article/SB119239926667758592.html

What's been said:

Discussions found on the web: