I never thought I would see this in my life time but: Apple is now worth more than Mister Softee. About $3 billion more.

Here’s the NYT:

“As of Wednesday, Wall Street valued Apple at $222.12 billion and Microsoft at $219.18 billion. The only American company valued higher is Exxon Mobil, with a market capitalization of $278.64 billion.

The revenue of the two companies are comparable, with Microsoft at $58.4 billion and Apple at $42.9 billion. Microsoft is sitting on more cash and short-term investments, $39.7 billion, to Apple’s $23.1 billion, which makes the value assigned by the market to Apple — essentially a bet on its future prospects — all the more remarkable.”

My first computer was a Mac Classic. I’ve had Quadras, PowerPCs, G3s, G4s,G5s, iMacs (blue) iMac (flat white) iMacs (Aluminum), Powerbooks, Mac Book Pros.

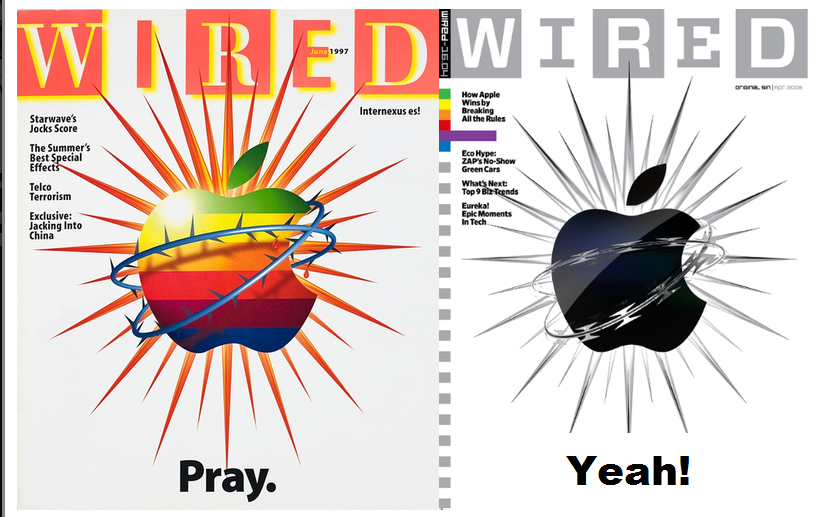

I frequently wrote about Apple, prayed it wasn’t dying, hoped for a recovery. This is truly beyond my wildest imagination.

Links to earlier writings on Apple are below

>

Previously:

Popular or Best? (ATPM January 1998)

Is Disney/Pixar the sequel to Apple/NeXT ? (January 30th, 2004)

Apple morphs into a Consumer Electronics Co (April 25th, 2004)

Analysts Still Underestimate Apple (Real Money, Jan 13, 2005)

Apple to Music Industry: Monetize Your IP (April 28th, 2004)

The Single Company Magazine Cover Indicator (March 20th, 2006)

Microsoft the Innovator to Open Retail Store (October 15th, 2009)

What's been said:

Discussions found on the web: