With the Dow off over 200 points today, the psychology of the moment is to once again blame the Europeans for the market’s woes.

The latest rumors comes supposedly from Dick Bove — Instant messages across NY trading desks are repeating rumors of a potential downgrade of France. Bove was supposedly saying that chatter about France’s Debt downgrade could be a huge negative (if it comes true). IMs such as this one: IF THIS HAPPENS, WATCH OUT! IT WOULD BE A HUGE NEGATIVE WORLD WIDE!!

Now, I have no idea if there is there is slightest truth to this. I am merely explaining what trading desks are up to. These rumors run rampant during dislocations.

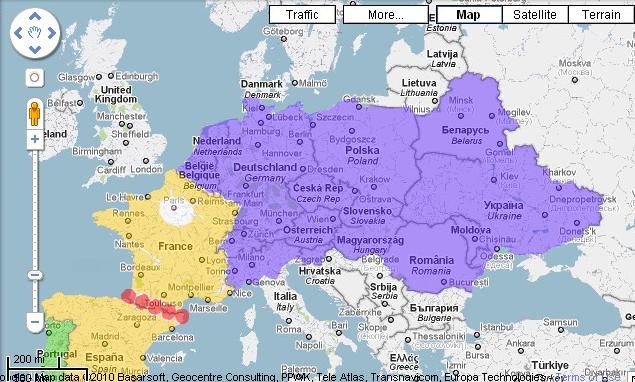

However, I came across a different theory that I put much more stock in: The reason for all the problems in Europe has nothing to do with France, and everything to do with a subtle problem that goes beyond the PIIGs. It turns out that Europe, is in fact, Marge Simpson:

But then again, here maiden name was Marjorie Bouvier — so perhaps there is a French connection after all!

>

~~~

Here are the map details by specific nation:

>

Hat tip Flowing Data, via Strange Maps

What's been said:

Discussions found on the web: