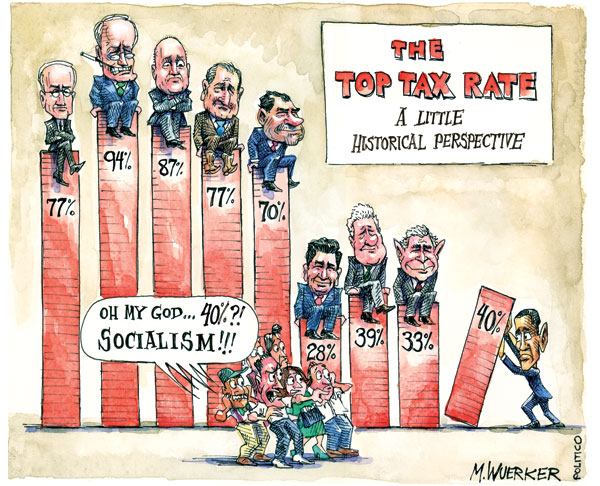

Since when has labeling anything you disagree with “Socialism” a substitute for political discourse? We embarrass ourselves as a nation to the rest of the world when we do this.

Regardless, Wuerker of Politico puts this into better context:

via Politico

Hat tip PBH

~~~

See also:

Bill Gates’s Dad Says the Rich ‘Aren’t Paying Enough’ in Taxes

http://www.bloomberg.com/apps/news?pid=20601109&sid=a4YNFBDAXnKI&

What's been said:

Discussions found on the web: