The single most common emailed question I’ve gotten — from readers, from clients, from the media — is “Do you buy BP? If so, when, where and how?”

Before we proceed, please understand what my thought process is: I want us to consider, weigh and try to determine what the possible risks are versus the potential reward is in this stock.

I suggest those of you who are considering buying or selling BP think about the following ten issues:

>

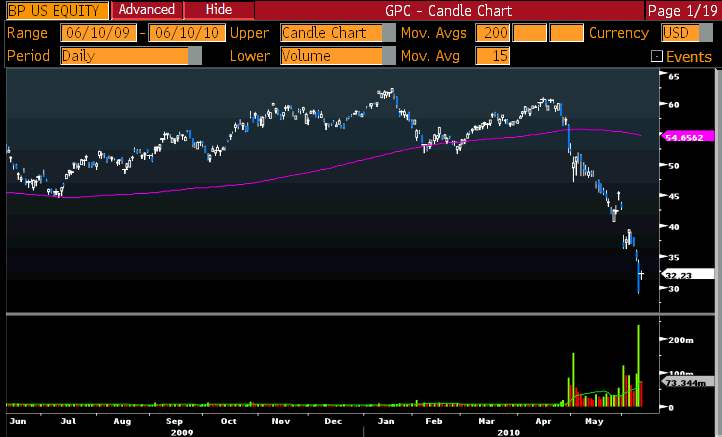

1) BP’s Stock is in Freefall: As the nearby chart shows, BP is down more than 50% from recent highs. Its 200 day moving average is up ~45% from current prices — near ~55. (click for larger chart)

1) BP’s Stock is in Freefall: As the nearby chart shows, BP is down more than 50% from recent highs. Its 200 day moving average is up ~45% from current prices — near ~55. (click for larger chart)

The current market cap is about $100B, almost 40% below its Enterprise Value of $141.65B.

When making a trade in a stock like this, you want to do more than merely hope for a binary outcome — i.e., Make money or Lose money. The goal is to understand what the risks and rewards are, predetermine the losses/downside, and put ion the best risk/reward you can.

There is intelligent speculation and outright gambling. If this trade fits your profile, aim to do the former and avoid the latter.

Research project: In distressed companies, at what levels have we seen ideal entries — in terms of price off of highs, below enterprise value, percentages below 50 and 200 day MA, dividend yields, and P/E ?

~~~

2) Is this a Trade, or an Investment? : There are different rules for Trading than Investing. Before you step into a name in distress, be sure to understand exactly what your goals are, your risk tolerances, and your time horizon.

My guess is the vast majority of the huge volume spike in BP are stat arbitrage (between the common stock and bonds, there are apparently no convertibles) and a mix of day traders and hedgies. If you plan on making BP a long term investment, then you should be thinking in terms of a longer holding period — years, not months.

A universal rule: Never allow a trade to become an investment.

~~~

3) Beware the Value Trap: There can be no doubt that BP, at a 5 P/E and 10%+ dividend yield looks cheap. The question is, how much cheaper might it get? Cheap stocks can and do get cheaper, just as dear stocks can (and do) get pricier.

Indeed, the early investors in the door after BP first fell — and quite a few people publicly announced their buys at 45, 40 and 35 — are now enormously underwater.

Suggestion: Investors should not try to bottom tick the stock. Plan on scaling the initial investment in over days or weeks.

Rather than catch the falling knife, plan on adding a good chunk of the position after the stock breaks the 20 and 50 day moving averages to the upside. That way, you are averaging UP rather than DOWN.

~~~

4) Predetermine Your Losses: I told a client today that rather than buy the $100M of the common stock, i would figure out how much you were willing to lose on the trade.

Lets assume its 10%.

Rather than purchase the common, I would consider buying $10-15 million in LEAPs and Calls. A mix of in the money and out of the money strikes and dates a year in advance allows you to match the upside, with far less capital at risk, and a similar loss.

Alternatively, you could buy half of any long position with common stock, filling out the rest of the position with options.

If you go common stock, figure out what your stop loss is, and then stick tot hat discipline.

Advice: Never make a trade or investment where the losses are open ended (ie, 100% or greater).

~~~

5) Take Over Target? We have heard repeated rumors of potential buyers for BP — Sinook China, Exxon Mobil, Shell Sunoco.

Buying a name and then hoping for a takeover is usually a suckers game. In the case of an energy or minerals firm with proven reserves, however, at a certain price a takeover becomes all but inevitable. The trick is determining what that price might be.

Look at past takeovers in the sector — Exxon Mobil, BP Amoco, Conoco Phillips, Chevron Texaco, etc., to estimate what is a fair purchase price based on reserves and/or earnings versus future liabilities.

Admonition: Make sure your purchase reasons are data driven, rather than merely based upon blind hope.

~~~

6) Will BP Declare Bankruptcy?

I have no idea — but looking at their cash flow, its certainly not a mandatory requirement.If they do a prepackaged bankruptcy, it will be a strategic decision they elect to make — not a mandatory one forced on them by their creditors.

Currently, BP generates global sales of ~$30 billion per year, and profits of about $17 billion. Note that any payments, penalties and settlements all come off the top — pre-profit.

BP could probably payout $250-500 million dollars per month for 20 years, and still be profitable.

~~~

7) Is Declaring Bankruptcy Fatal to Shareholders?

If history is any guide, a prepackaged strategic bankruptcy it might not be fatal to shareholders.

If memory serves me, various other proactive bankruptcies worked to shareholders’ advantages: — AH Robbins issues with their purchase of Dalkon Shield led to billions in settlements, an eventual bankruptcy, and a huge sale to Wyeth (formerly AHP). Texaco did something similar after the Pennzoil litigation, as did many of the various Asbestos exposures. And Merck, which did not go chapter 11, seemed to come out OK of the Vioxx problem (if you bought the stock at the right time).

A strategic bankruptcy can “ringfence” losses from the income earning portions of a company. It creates a fixed, known amount, rather than some unknown future sum. Getting rid of that sword of Damocles allows the rest of the company, to (in theory) prosper.

Surprise!: Bankruptcy can actually work too shareholders’ advantages . . .

~~~

8) Will BP CEO Tony Hayward Get Fired?

Of course!

He is a dead man walking. The bottom line is the accident happened on his watch, as did a huge amount of prior violations and fines. Hayward is also responsible for the firm’s immediate responses, which have for the most part been disastrous.

Advise: But here is some good advise (UK spelling) for BP’s Board of Directors: Never fire your CEO right away. He is a sacrificial lamb whom you can eventually throw to the wolves. But don’t make the mistake of doing so too early!

Sure, he is a one man gaffe machine — but save his execution until it will do the most good. Wait until the political pressure is unbearable — and your succession plan is in place — before you depose your chief executive.

~~~

9) The Politics of BP Are Fluid: There will be significant political pressure on management: To eliminate the Dividend, for heads to roll, to “make good on all losses” (whethr reasonably proven or not);

Be aware of the impact chatter could have on day-to-day price. However, politics should not have too great an impact on the firm’s actual value.

My best guess is that BP is large enough, protected by the UK, and has enough free cash flow that it will not be too damaged by US political pressure.

Caveat: Unless this thing gets much, much worse. Then all bets are off, and BP may become a teenager.

~~~

10) Why Were You Still Long?

Last, those of you who are long standing BP shareholders should be asking yourselves “Why?”. You should not still be long BP from years or even months ago.

Any long term position must have built into it some form of risk management and capital preservation. I cringe every time I hear someone say “There is nothing that can make me sell this stock.” That is a recipe for disaster.

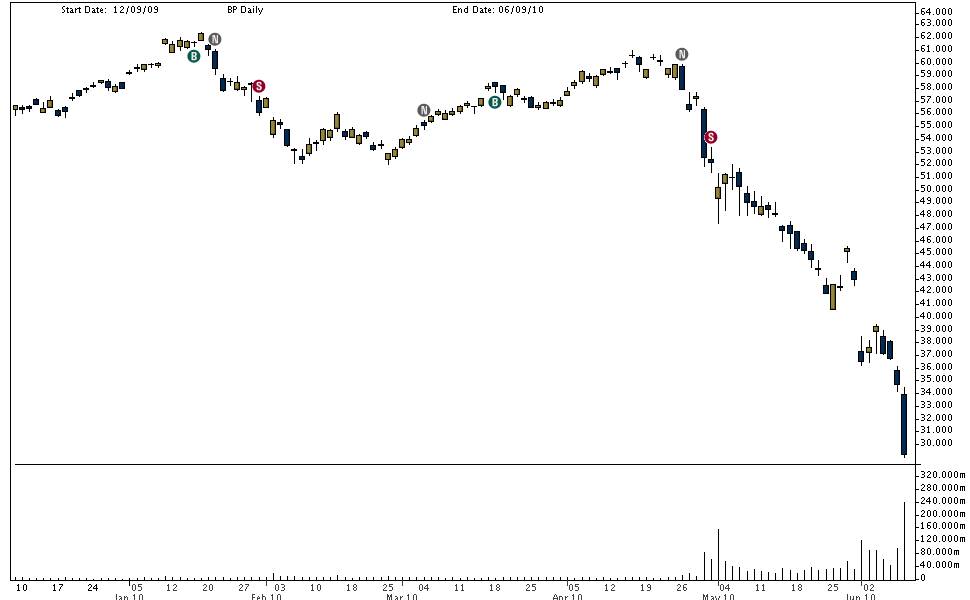

I obviously am partial to our own model. Fusion IQ went to a neutral around 60, and a sell in the low to mid 50s. The stock broke 30 yesterday. Our system worked well to get shareholders out of BP before the damage was horrific (Same last few years for AIG, C, BSC, FNM LEH, etc.).

But regardless of the tool you use, make sure you have SOME way to prevent any holding from becoming a portfolio destroyer.

>

What's been said:

Discussions found on the web: