Several readers expressed surprise that I still believed home prices remain too high, as discussed in the A Closer Look at the Second Leg Down in Housing last week.

Paul Kasriel, in a recent Daily Global Commentary — “The U.S. Housing Market – Post-Tax Credit Give-Back or Something More Fundamental” — argued the exact opposite. In that piece, he wrote:

“Is there any reason to believe that after a couple of months, home sales will pick up again? Yes.

Why? Because with mortgage rates at rock-bottom levels and with house prices very low in relation to household incomes, housing is about as an attractive a purchase as it has been in the past 40 years.

Are we on the eve of a renewed housing boom, given this attractiveness? No. But are we likely to slip back into a full-fledged housing recession? No. Two steps forward, one step backward.”

I always enjoy it when someone whose methodology I respect is on the opposite side of an analytical debate from me. I would much rather argue against a smart mathematical or economic or psychological thesis, than the usual partisan frippery.

So which is it? Are house prices low or high relative to income? What’s the basis of Kasriel’s homes-are-cheap statement?

To find out, I pinged Paul as to the basis of his Housing is cheap thesis. Here is what he wrote back:

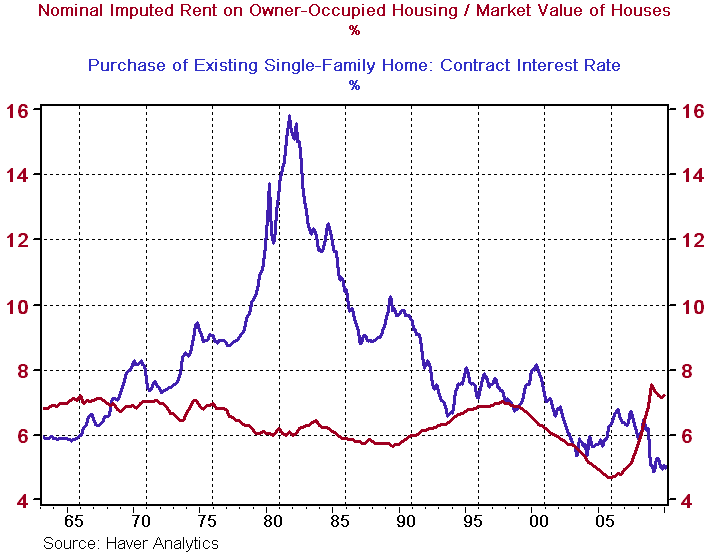

“The chart below illustrates why I think owner-occupied housing on a national basis is cheap. The “yield” on owner-occupied housing continues to be above the cost of financing a home purchase. This is actually a rare occurrence. Of course, if the market value of owner-occupied housing were to fall more, all else the same, the purchase of a house would become even more attractive.”

Nominal Imputed Rent versus Home Purchase Price

>

That is an interesting, data driven analysis. Kasriel’s point is that for any potential home buyer, the cost of buying a home is less than what it would cost to rent the equivalent home. Hence, in his analysis, homes are cheap. Think of it as using dividend yield of a stock to determine if its cheap or dear relative to Treasuries.

Might home sales pick up again in a couple of months? Perhaps, but I doubt it. I simply do not see any compelling reason for the marginal home buyer to make that purchase. By September, we will be fighting seasonal factors. The exception is the key bubble bust regions, where foreclosures are driving prices as much as 50% off the peak prices.

But I am unconvinced about prices in general. My problem with imputed rent is that it is not independent of demand for home purchases; Imputed rents interact with home prices, credit availability, pricing trends, employment, etc.

Indeed, one can easily imagine a scenario where: 1) Home prices are thought of trending lower; 2) Credit is tight; 3) Employment is weak; 4) Wages are flat. This would create an environment of relatively soft demand for home purchases (sending their prices lower) At the same time, this would increase demand for rental units.

There are other factors thyat might also pressure prices lower. As we saw last cycle, even very low mortgage rates are no guarantee of home price appreciation. Home buyers have figured out that as rates rise, it caps RE gains. And the move from 1% in 2004 to 5% in 2006 set up not only the end of price appreciation, but home price collapse as well. Perhaps buyers are aware that with the Fed at zero, there is nowhere for rates to go but up. That means price appreciation will be modest at best, and negative at worst.

What's been said:

Discussions found on the web: